Your age isn’t factored into your credit score. However, there are noticeable patterns in how credit scores vary by age group.

Taking a look at your generation’s credit score statistics can help you gauge how you’re doing financially relative to your peers.

Table of Contents

Credit score distribution by age

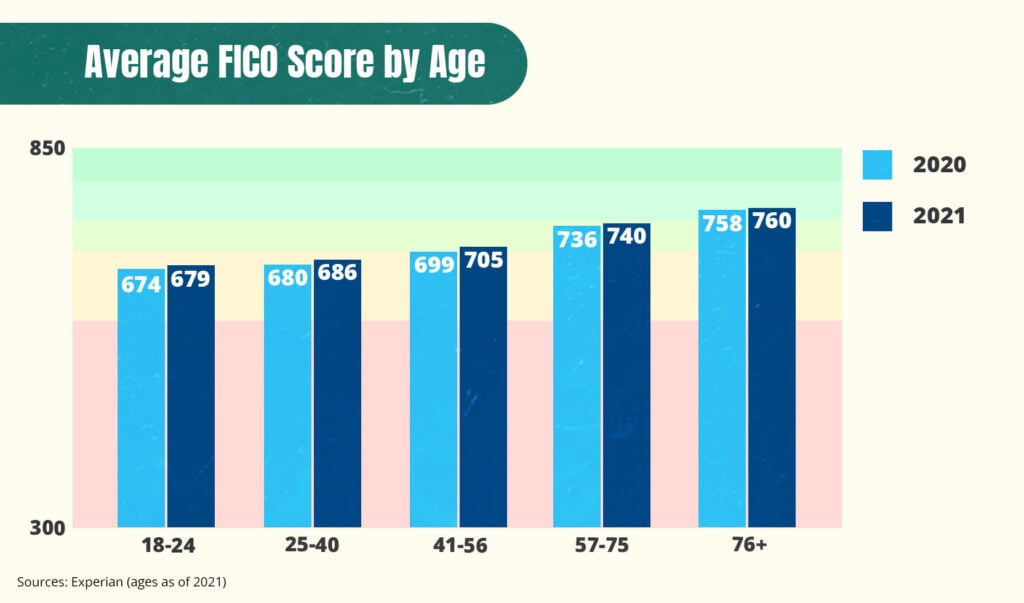

The graph below shows the average credit scores in 2019 and 2020 among people in different age groups. To put these numbers in perspective, credit scores range from 300 to 850, with a higher score being better, and the average US credit score at 716.

As you can see, the older people are, the better their credit scores tend to be.

People aged 75+ years have the highest average credit score (47 points above the average in 2020), whereas those aged 18–23 years have the lowest average credit score (37 points below average).

This equates to a pretty big difference in credit scores (84 points) between the oldest age group and the youngest age group.

Credit score distribution by generation

It can also be helpful to look at the average credit score for each generation:

You may also be surprised to learn that average credit scores don’t only vary by age group. Here are statistics showing how your credit score may be associated with other factors:

What is a good credit score for my age?

What’s considered a good credit score depends on the credit scoring model used. Here’s a look at the differences between FICO and VantageScore (the main credit scoring companies) in terms of their credit score ranges:

FICO Score Ranges

| Poor | Fair | Good | Very Good | Exceptional |

|---|---|---|---|---|

| 300 to 579 | 580 to 669 | 670 to 739 | 740 to 799 | 800 to 850 |

VantageScore Ranges

| Very Poor | Poor | Fair | Good | Excellent |

|---|---|---|---|---|

| 300 to 499 | 500 to 600 | 601 to 660 | 661 to 780 | 781 to 850 |

These ranges are the same for everyone, regardless of age. If your score is classified as “good” (or better) and it’s near or above the average for your generation, you’re in pretty good shape, credit-wise.

Does age affect your credit score?

Your age doesn’t directly affect your credit score. Neither of the two popular credit scoring models (FICO and VantageScore) consider how old you are when they calculate your credit score. They only consider the choices you make when it comes to your credit accounts.

This means you can easily have a high credit score when you’re young if you control your spending and pay all your bills on time. Similarly, you can still have poor credit when you’re older if you run into problems with your credit, like if you stop repaying your debts or file for bankruptcy.

Nonetheless, age does seem to have some influence on the types (and amount) of information in your credit report. This means that, even though the credit scoring models don’t consider it, it has an indirect impact on your score.

Ways your age can indirectly affect your credit score

Older people tend to have better credit scores for the following reasons:

- They’ve been using credit for longer: The scoring models consider the length of your credit history, so it’s no surprise that your credit score seems to improve with age—after all, most people only start building credit at age 18 or older.

- People make more mistakes when they’re starting out: Younger people are more likely to have problems with their payment history and their credit utilization rate (i.e., how much they spend on their credit cards). 1 This can be explained by the fact that as people get older, they gain more knowledge and insight into how credit works and what affects their credit score.

- Older people are more financially established: Because younger people are newer to the credit game, they’re more likely to have a large amount of debt still left to pay off (such as a student loan or a mortgage), and may have lots of new credit 1 Both of these can damage your score.

How to improve your credit score

Whatever age you are, there are steps you can take right now to improve your credit score so that you can start taking advantage of all the benefits that come with having good credit:

- Check your credit reports for errors: Credit monitoring is important in every stage of life, and one simple way of keeping your credit in shape is to regularly check your credit reports and dispute any errors you find to keep them from hurting your score. You can access free copies of your credit reports once per year at AnnualCreditReport.com.

- Always make on-time payments: Since your payment history is the most important factor contributing to your credit score, consistently making on-time payments is the most effective way of improving your credit score. Consider setting up autopay or payment reminders to ensure you pay all your bills on time.

- Lower your credit utilization rate: Another way to give your credit score a boost is to reduce how much of your credit you’re using. You can do this by simply cutting back on your spending, but other options include requesting a credit limit increase or opening a new credit card account.

- Start building credit early: If you’re still young, it’s a good time to open new credit accounts. One of the main reasons older adults tend to have higher scores is because they’ve been using credit for longer, so setting up accounts while you’re young is one of the best advantages you can give yourself.

- Keep your credit accounts open: Closing a credit card account will probably cause a drop in your credit score by reducing the total amount of available credit you have. Keeping your accounts open, on the other hand, will benefit your credit by demonstrating your ability to manage your debts over long periods of time.

If these credit score distribution trends tell us anything, it’s that building credit is a long process. No one starts off with a perfect credit score, and you likely won’t see your score peak until your later years.

Nevertheless, there is an upside—as long as you continue to use credit responsibly, the only way is up.

Takeaway: Statistics show that your credit score improves with age.

- Age itself isn’t a factor that affects your credit score. However, there are noticeable trends in how credit scores differ by age group.

- Older adults tend to have higher credit scores than young adults do, which can be explained by differences in the information in their credit reports.

- Young people tend to be more likely to have missed payments, a short credit history, a less diverse mix of credit accounts, higher credit card spending, and newer accounts.

- Regardless of what age you are, you have the ability to improve your credit score by paying your bills on time and establishing a long and positive credit history.