Table of Contents

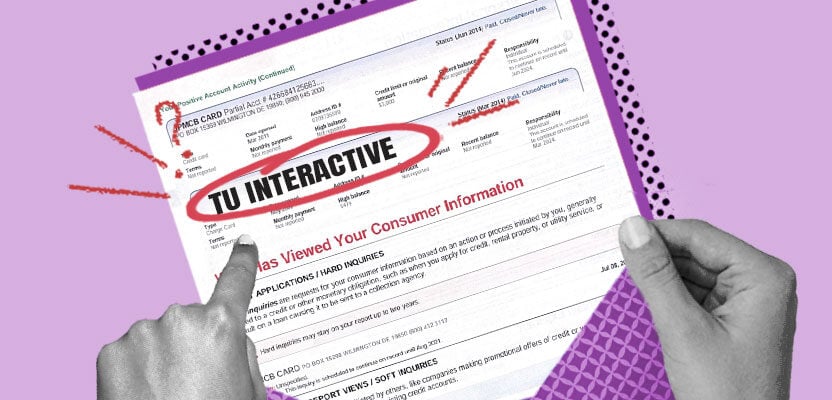

What is TU Interactive on my credit report?

TU Interactive stands for TransUnion Interactive.

TransUnion is one of the three main national credit bureaus. As their consumer-facing subsidiary, TransUnion Interactive provides credit reports and credit monitoring, identity theft protection, and other personal financial services to consumers.

TransUnion Interactive offers these services directly through TrueCredit.com, which they acquired in 2002, and zendough.com, which TransUnion launched in 2010. 1 2

They also offer their services through business affiliates in the healthcare, insurance, retail, and auto lending industries, among others. 3 4

If you see TU Interactive on your credit report, you probably signed up for a credit monitoring service affiliated with TransUnion Interactive. However, since the regular credit checks performed by these services are soft inquiries, a hard pull by TU Interactive is most likely a mistake. (More on what this means below.)

TransUnion Interactive’s other affiliates

You may see TU Interactive on your credit report if you have a credit monitoring subscription with one of TransUnion’s credit monitoring partners.

Here are some of TransUnion Interactive’s affiliates:

- TrueCredit

- zendough

- CreditKarma

- Credit Sesame

- WalletHub

TransUnion Contact Information

If you want to remove TU Interactive from your credit report, write to their address:

Address: P.O. Box 2000

Chester, PA 19016

Phone Number: (855) 681-3196

Website: www.transunion.com

Disputing an incorrect entry on your credit report can be stressful and difficult. Consider working with a professional.

Is TU Interactive a scam?

No, TU Interactive isn’t a scam—TransUnion Interactive is a legitimate organization. As mentioned, if their name is on your credit report, it probably indicates that you used TransUnion Interactive (or one of their affiliates) to check your own credit score.

If you’re certain that there’s activity on your credit report under TU Interactive that shouldn’t be there, it’s possible you’ve been the victim of identity theft.

What to do if you suspect identity theft

If you suspect that the TU Interactive mark on your credit report indicates that someone’s stolen your identity, then there are a few steps you need to take:

- Contact TransUnion Interactive immediately and gather the details of the credit check (e.g., when was it conducted, how was it requested, etc).

- Report the identity theft to the Federal Trade Commission (FTC). Go to www.identitytheft.gov and answer the questions to generate an identity theft report and recovery plan.

- Contact any of the main credit bureaus (Equifax, Experian, and TransUnion) and have a fraud alert placed on your credit reports.

You only need to contact one of the three bureaus and have a fraud alert placed on your credit report. The bureau you contact will coordinate with the other two, and your fraud alert will be acknowledged by all three.

Carefully monitor your credit reports in order to catch identity theft as early as possible. The sooner you report it, the less damage will be done.

Will a TU Interactive inquiry affect my credit score?

No, TU Interactive shouldn’t affect your credit score. That’s because it will only appear on your credit report when you check your own credit. Self-conducted credit checks are considered “soft inquiries,” which never affect your credit score.

Soft inquiries can be contrasted with hard inquiries, which appear on your credit report when you apply for a credit card or loan and your lender runs their own credit check on you. Hard inquiries lower your credit score by around 5 points, although the effect is temporary.

Because TransUnion Interactive doesn’t provide credit checks for lenders (just consumers who want to look up their own credit scores), TU Interactive can’t possibly appear as a hard inquiry, which means it can’t damage your credit score.

What should I do if I think TU Interactive hurt my credit score?

If you think TU Interactive damaged your credit despite being soft inquiry, contact TransUnion Interactive to make sure they didn’t accidentally conduct the credit check as a hard pull. It’s more likely that there’s some other explanation for the drop in your credit score—it’s common for scores to fluctuate slightly on a week-to-week or even day-to-day basis—but there’s no harm in checking.

How long will TU Interactive stay on my credit report?

TU Interactive will stay on your credit report for up to 2 years from the date it first appears.

All inquiries (both hard and soft) remain on your credit report for that long, although hard inquiries only affect your score for a few months to one year. (To reiterate, soft inquiries like TU Interactive don’t affect your credit score at all.)

Will lenders see TU Interactive if they check my credit?

No, lenders can’t see TU Interactive if they run your credit. Not only do soft inquiries like this not affect your credit score, they don’t show up when anyone else looks at your credit report. Only you can see them.

The upshot is that, assuming it’s not a sign of identity theft, TU Interactive appearing on your credit report isn’t anything to worry about. It won’t affect your finances or your life, and it won’t stay on your report for very long.

Takeaway: TU Interactive probably isn't hurting your credit score

- TransUnion Interactive and its affiliates provide credit monitoring and credit check services. If TU Interactive is showing up on your credit report, you're probably subscribed to one of them.

- The other possibility is that you've been the victim of identity theft. If you're sure the TU Interactive mark shouldn't be there, contact the company for more information and file an identity theft report.

- Because TransUnion Interactive conducts soft inquiries, not hard inquiries, even if their mark appears on your credit report, it can't affect your credit score.

- Lenders won't be able to see TU Interactive on your credit report when they conduct credit checks on you.