Table of Contents

What is SYNCB/Google on my credit report?

SYNCB/Google stands for Synchrony Bank/Google. Synchrony Bank is a banking and financial services company, and they’re in partnership with Google as the issuer of their store card.

If you have a Google credit card, it represents your Google Store Financing Account, which you can use to purchase products from the Google Store, such as Fitbits, Pixel phones and cases, and Google Nest products. 1

If you see SYNCB/Google on your credit report, you probably applied for or currently have a Google Store Financing Account.

Synchrony Bank’s other affiliates

As the nation’s largest issuer of private-label credit cards, Synchrony Bank partners with dozens of businesses to provide their store cards. 2 If you see the SYNCB label on your credit report, you probably have an account with one of Synchrony Bank’s other affiliates.

Synchrony Bank Contact Information

If you want to remove SYNCB/Google from your credit report, write to Synchrony Bank's address:

Address: P.O. Box 965035

Orlando, FL 32896-5035

Phone Number: (866) 794-8802 / (866) 419-4096

Website: google.syf.com

Disputing an incorrect entry on your credit report can be stressful and difficult. Consider working with a professional.

Is SYNCB/Google a scam?

No, SYNCB/Google isn’t a scam. Synchrony Bank and Google are legitimate organizations. If they’re on your credit report, it probably indicates that you have an account with them or they checked your credit.

If you’re certain that there’s activity on your credit report under SYNCB/Google that shouldn’t be there, it’s possible you’ve been the victim of identity theft.

We’ll discuss the reasons (both legitimate and fraudulent) that SYNCB/Google might be on your credit report in more detail in the next section.

Why is SYNCB/Google on my credit report?

SYNCB/Google can appear on your credit report for a number of reasons, some negative and some harmless. It’s possible for it to show up even if you don’t have a Google credit account.

Here are some reasons why SYNCB/Google might be on your credit report:

1. Synchrony Bank checked your credit

You’ll see SYNCB/Google on your credit report if Synchrony Bank ran a credit check to determine whether or not to extend credit to you. This type of credit check can appear as a hard inquiry or a soft inquiry.

- Hard inquiries: These generally appear on your credit report when you apply for new credit, such as credit cards, store cards, or installment loans. For example, if you applied for a Google credit card, Synchrony Bank probably triggered a hard inquiry when reviewing your application.

- Soft inquiries: These show up on your credit report when someone checks your credit but you’re not actually in search of new credit. For example, if you received an unsolicited offer letter in the mail for a credit card issued by Synchrony Bank, then they may have triggered a soft inquiry during the prequalification process.

Thankfully, soft inquiries won’t affect your credit score. Hard inquiries usually lower your credit score by several points, but the effect won’t last more than a year, and the inquiry will fall off your credit report entirely after two years. Note that you usually can’t remove a hard inquiry early unless the bureau added it to your report by mistake.

2. You have a Google credit account

SYNCB/Google will appear on your credit report if you currently have or previously had a Google credit account. Even if you closed your account, SYNCB/Google can stay on your credit report for 7 years (if the account was delinquent due to missed payments) to 10 years (if the account was in good standing).

You might find your Google credit account marked as closed even if you never took any active steps to close it. This can happen due to account inactivity—it’s common for lenders to close credit accounts if they haven’t been used for a while.

3. You’re an authorized user on someone else’s Google credit account

SYNCB/Google can show up on your credit report if someone else added you as an authorized user to their own Google credit account.

You might have been named as an authorized user by your:

- Spouse

- Child

- Parent

- Friend

- Business partner

If someone designated you as an authorized user on their Google credit account, their activities on the account could affect your credit score.

If the primary cardholder is a responsible person and a reliable borrower, being an authorized user on their account will probably improve your credit score by helping you build a positive payment history. On the other hand, you might notice a drop in your credit score if the primary cardholder neglects their payments or cancels their account with unpaid debt.

Similarly, your use of someone else’s credit will affect their credit score, so take care when acting as an authorized user.

4. You’re a victim of identity theft

If you see a SYNCB/Google hard inquiry on your credit report but you’re sure you didn’t apply for a Google credit account, it could be a sign of identity theft.

If you think that SYNCB/Google is on your credit report because someone’s trying to fraudulently open accounts in your name, take these steps:

- Contact the company that made the hard inquiry (which will be Synchrony Bank, unless they hired another company to perform the inquiry for them). Tell them you didn’t authorize the inquiry. Ask them for details (i.e., when and under what circumstances their records show the inquiry was authorized).

- Report the identity theft to the Federal Trade Commission (FTC). Go to www.identitytheft.gov and answer the questions to generate an identity theft report and recovery plan.

- Contact any of the three main credit bureaus (Equifax, Experian, or TransUnion) and have a fraud alert placed on your credit report. You only need to contact one of the bureaus; they’ll coordinate with the others, and your fraud alert will be acknowledged by all three.

You may also want to freeze your credit (or get a credit lock, which is very similar).

Carefully monitor your credit reports over the next few months for further signs of fraudulent activity.

How does SYNCB/Google affect my credit score?

There are several ways that SYNCB/Google can affect your credit score, depending on whether they triggered an inquiry or manage one of your accounts.

Hard inquiries

As mentioned, a single hard inquiry will have a small, short-term effect on your credit, usually lowering your FICO score by up to five points and your VantageScore credit score by 5–10 points.

This effect is usually cumulative, so too many hard inquiries can really hurt your score. However, a single inquiry isn’t something to worry about—your credit score ranges from 300 to 850, which means 5 points in either direction isn’t significant.

Open and closed accounts

If you have an open or closed SYNCB/Google account on your credit report, then it’s contributing to your credit score by influencing the following factors:

If the account is open, then it’s also contributing to your credit utilization rate (also known as your debt-to-credit ratio).

To learn how your SYNCB/Google account will affect your credit score, familiarize yourself with the factors that make up your FICO score and VantageScore.

Don’t rush to close your account

Closing an account can hurt your credit score by reducing your available credit (which will increase your credit utilization rate). Use the account occasionally to prevent your creditor from closing it due to inactivity, and only close it if keeping it open will jeopardize your finances.

How to remove SYNCB/Google from my credit report

If you want to delete SYNCB/Google from your credit report, then try one of the following approaches.

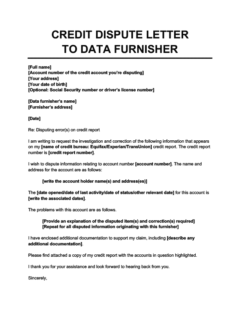

1. Send a dispute letter

If you see an item listed under SYNCB/Google on your credit report that you suspect is a mistake, then you can dispute it by writing something known as a credit dispute letter.

You should send your letter to whoever you think the error originated with. You can send it to:

- Synchrony Bank: Send your letter directly to them if you believe they made the original mistake (e.g., they reported a credit check to the bureaus that you never actually authorized).

- The credit bureaus: Write to the credit bureaus if you believe the error originated witih them (e.g., they confused you with someone with a similar name or Social Security number).

Either way, it’s usually a good idea to send copies of the letter to both parties, the bureaus and your card issuer (Synchrony Bank). They may contact each other as they investigate the matter, and it’s important to make sure everybody has received the relevant information.

If you think one of the credit bureaus added SYNCB/Google to your credit report by mistake, use this credit dispute letter template to file a dispute directly with them. Send your letter to all of the bureaus that are reporting the mistaken hard inquiry or credit account. Use this letter if you think SYNCB/Google is on your credit report because Synchrony Bank mistakenly reported a credit check or account to the bureaus. Address and send your letter to Synchrony Bank, not Google.

Credit Dispute Letter to a Credit Bureau

Credit Dispute Letter to Synchrony Bank

Once you’ve filed your credit dispute, the credit bureau will be required to investigate and correct any inaccurate information on your report, usually within 30–45 days.

2. Use a credit repair company

A credit repair company will act as a middleman between yourself and your card issuer (and the credit bureaus). They might be able to get a hard inquiry or another SYNCB/Google item off your credit report by helping you gather evidence and handling all the required communication.

However, be wary of scammers. There are restrictions on the cost of credit repair—by law, credit repair companies are not allowed to charge you before they’ve helped you. If they ask for payment upfront, hire a different company.

Although hiring a credit repair company can save you some time and hassle in disputing items on your credit report, bear in mind that they can’t do anything for you that you can’t do yourself.

They also won’t necessarily be able to erase valid negative information or turn a bad credit score into a good credit score overnight. Think carefully before hiring a third-party company to get SYNCB/Google off your credit report.

Takeaway: SYNCB/Google can appear on your credit report for several reasons

- SYNCB/Google can appear on your credit report as a hard inquiry or as an open or closed credit account, either belonging to you or someone who has authorized you to use it.

- How SYNCB/Google will affect your credit score depends on your credit history and the status of the account.

- You can get SYNCB/Google off your credit report by sending a dispute letter to the credit bureaus and Synchrony Bank. Alternately, you can hire a credit repair company.