Although student loans aren’t always a bad thing for your credit, there are some circumstances in which you’ll want to get rid of them.

For instance, you should always remove student loans from your credit report if they’re being reported in error (e.g., if they’re being listed as current debts but you actually paid them a long time ago). Moreover, if you’re one of the many Americans feeling overwhelmed with student debt, you might not just be looking for a way to get them off your credit report—you might also be looking to wipe away your student debt once and for all.

Whatever your situation is, there are ways you can get student loans off your credit report and get a handle on your payments if you’re behind.

Table of Contents

- Can you remove student loans from your credit report?

- Option 1: File a credit dispute to remove student loan errors

- Option 2: Remove a student loan default

- How long do student loans normally stay on your credit report?

- How to deal with student loans and avoid negative marks in the future

- How student loans can help you build credit

Can you remove student loans from your credit report?

Yes, you can remove student loans from your credit report, but only if they’re invalid or they were added to your credit report by mistake.

However, even though you can’t get valid student loans deleted from your credit report, you may be able to erase derogatory marks that are associated with them, such as delinquencies or defaults showing that you’ve fallen behind on your loan payments.

You have two main options for how to proceed.

Option 1: File a credit dispute to remove student loan errors

This is an approach that you can take to remove genuine student loan errors on your credit report, such as:

- Loans being reported as “delinquent” that you actually paid on time

- Loans that never belonged to you in the first place (e.g., that actually belong to someone else with a similar name)

You can get any and all errors like this removed by disputing the item on your credit report. All you need to do is send a credit dispute letter to the relevant credit bureau (Equifax, TransUnion, or Experian).

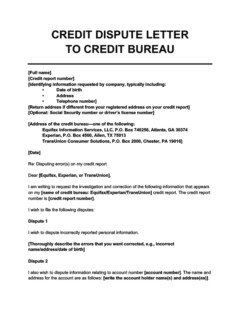

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute about one of your student loans with the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

Provide the following information and supporting documents along with your letter:

- Your loan account number or reference number

- A clear description of what the error is

- A copy of your credit report with the error highlighted

- Evidence proving that the information is incorrect (e.g., a document proving your enrollment status, proof of payment, or loan statements)

- A clear description of how you want the credit bureau to fix the error

Once you’ve got all your documents in order, use the table below to find out where to send your dispute letter. It’s also a good idea to send a separate letter to your student loan servicer.

| Experian | Equifax | TransUnion | |

|---|---|---|---|

| Where to send your dispute letter | Experian P.O. Box 4500 Allen, TX 75013 | Equifax P.O. Box 740256 Atlanta, GA 30374-0256 | TransUnion Consumer Solutions P.O. Box 2000 Chester, PA 19016-2000 |

| What you’ll need to send | |||

| Dispute online | Experian's online dispute form | Equifax’s online dispute form | TransUnion’s online dispute form |

Once you’ve filed a credit dispute, keep an eye on your credit reports over the next month or two to ensure that the error has been corrected. You’re entitled to free copies of your credit reports from each major credit bureau, which you can get at AnnualCreditReport.com.

When should you dispute student loans on your credit report?

Credit reporting errors happen for various reasons, and whether filing a credit dispute is the right move depends on your circumstances.

Below are some examples of when you should try to remove negative information related to your student loans from your credit report:

You’re still in school and have federal student loans

Your federal student loan payments should be deferred until after you graduate. You may also have a grace period after graduation before your repayment period starts. 1

If you have private student loans, then your repayment terms may be different and your loan might show up on your credit report sooner. However, if you’re still a full-time student and you believe you shouldn’t need to make payments yet, then you should dispute any missed payments that your loan provider has reported to the credit reporting agencies.

When you send your student loan dispute letter, attach supporting documents proving your enrollment status.

You were approved for deferment or forbearance

If you submitted a deferment or forbearance request that your student loan servicer approved, then they shouldn’t be reporting any missed payments. If they are, then you should send them a dispute letter asking them to correct your records and update your credit reports.

Your student loan payments aren’t being accurately reported

As with any other loan or credit account, it’s important to make sure that your payments toward your student loans are being reported correctly.

If your student loan is marked as delinquent or in default when you’ve been making at least the minimum payment each month, immediately dispute the relevant marks in your payment history. Provide receipts, confirmation emails, or bank statements as proof of payment.

The student loan doesn’t belong to you

You should always dispute accounts on your credit report that don’t belong to you. As mentioned, it’s not uncommon for the credit bureaus to mix up one person with someone else who has a similar name or Social Security number.

On the other hand, if all of your personal information matches up with the account but you’re sure you didn’t take out any student loans, then it’s possible that you’ve been the victim of identity theft.

If you suspect that your identity has been stolen, have a fraud alert placed on your credit reports. Just contact one of the credit bureaus (Experian, Equifax, or TransUnion), and they’ll notify the other two. You should also file an identity theft report at IdentityTheft.gov.

Option 2: Remove a student loan default

The methods above can remove errors related to student loans from your credit report. If the student loan wasn’t reported in error, then your options are more limited, but you can still delete negative marks related to a student loan default.

When you default on a student loan (stop paying it completely), it can have serious negative consequences, like a drop in your credit score and student loan acceleration (where your full balance becomes immediately due).

If the defaulted debt is sent to a debt collection agency, student loan collections may appear on your credit report, damaging your credit score even further. You may also face debt collector harassment as the agency pursues you for the overdue debt.

Thankfully, there are ways to get out of default and even remove defaulted student loans from your credit report entirely. The options you have and the steps you’ll need to take depend on the type of student loan you have.

When do student loans go into default?

Federal student loans generally go into delinquency when your payments are 90 days overdue and go into default when your payments are 270+ days overdue. 2 The exact time when private student loans will go into default depends on the lender. Oftentimes, your account will be considered in default after you’re 90 days late making a payment. 3

Removing defaulted federal student loans

One of the ways that federal student loans are unique is that you can get defaulted loans completely removed from your credit report through a process known as student loan rehabilitation.

How to rehabilitate federal student loans

Here’s how student loan rehabilitation works:

- You log in to the Federal Student Aid website to find out who your loan servicer is.

- You contact your loan servicer and ask to enter student loan rehabilitation.

- You and your loan holder decide on a reasonable and affordable monthly payment amount.

- You make at least nine on-time monthly payments over a 10-month period. 2

- Your loan servicer stops all collection efforts and has the “default” status removed from your student loans.

Removing defaulted private student loans

Removing default or late payment marks from private student loans is much more difficult, but it’s not necessarily impossible. You may be able to convince your student loan provider to agree to a goodwill deletion, which is where they delete a negative entry in your credit file as an act of compassion.

This approach is more likely to work if you had a good reason for missing your student loan payments, such as a serious medical emergency that drained your finances. Your lender is under no obligation to agree to your request, but there’s no harm in trying. To get started, use the goodwill letter template below:

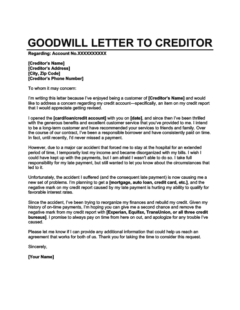

Goodwill Letter to Creditor

Use this goodwill letter template to ask for a goodwill deletion from one of your creditors. Remember to customize it to your circumstances for the best possible chance of success.

How long do student loans normally stay on your credit report?

Student loans will remain on your credit report as long as you’re still paying them off. If you don’t take extra steps (as described above) to have them removed, then once the account is closed, they will stay on your credit history for a further 7 years (if delinquent) or 10 years (if in good standing). 4 5

Some federal loans that have been charged off can stay on your credit report for even longer than 7 years. 4 Specifically, Perkins loans can stay on your credit report until you’ve fully paid them off. 6

How to deal with student loans and avoid negative marks in the future

You may be able to remove student loans from your credit report with the methods above. However, it’s obviously better if you can avoid incurring negative marks related to student loans in the first place.

Below are some options you can explore to keep your loans out of default and protect your credit:

Alternative repayment plans for federal student loans

One of the major advantages that federal student loans have over private student loans is their flexible repayment options.

When you enter your repayment period, you’ll automatically be enrolled in a standard payment plan. However, you can easily switch over to one of the following alternative repayment plans, which may better suit your budget and financial goals:

- Income-driven repayment plans: These plans include the Income-Based Repayment Plan (IBR), Income-Contingent Repayment Plan (ICR), Pay As You Earn Repayment Plan, and Revised Pay As You Earn Repayment Plan. Your monthly student loan payment is set at a fixed and affordable amount based on your income.

- Graduated repayment plan: This plan is designed to allow you to pay off your full loan amount within 10 years, but unlike the standard repayment plan, your payments start out low and increase every 2 years. This is a good option if you expect to be earning more money down the line.

- Extended repayment plan: If you owe over $30,000, then you can opt for a longer repayment term of up to 25 years. Your payments can be fixed or graduated. However, you’ll probably pay more in interest overall than you would with a standard repayment plan.

Student loan consolidation

If you have multiple student loans, then consolidating them may simplify your finances and help you manage your payments. Like the case with any other type of debt consolidation, your student loans will be merged into a single loan with one interest rate and repayment period.

For federal student loans, applying for a direct consolidation loan can get you out of student loan default and allow you to regain certain benefits, such as eligibility for deferment and forbearance. 7

Bear in mind that even though refinancing your student loans can make it easier to make your payments in the short term, it won’t necessarily save you money in the long run. That entirely depends on the interest rate and repayment term of your consolidated loan. If your consolidation loan has a longer term, you could end up paying more in interest overall. 8

Student loan forgiveness, cancellation, and discharge

Having your student loans forgiven won’t immediately wipe them off your credit report. However, it’ll close the credit account, meaning that it’ll begin the 7-year or 10-year countdown to when your student loans will be automatically removed from your credit report.

Below are the main options you have for student loan forgiveness or discharge:

- Public Service Loan Forgiveness (PSLF): Once you complete this 10-year public service loan forgiveness program, your remaining student loan balance will be forgiven.

- Teacher loan forgiveness: You can have up to $17,500 forgiven from your student loans if you’ve spent at least 5 years teaching at a qualifying low-income school.

- Disability discharge: If you’re permanently disabled, you may be able to have your student loan debt discharged.

- Discharge through bankruptcy: It’s a widespread myth that student loans can’t be discharged through bankruptcy. It is possible to do so, although you’ll have to prove that your student loans are causing you “undue hardship.”

Federal student loans have no statute of limitations

Unlike most other types of loans, there’s no statute of limitations on debt collection for federal student loans, meaning that once the debt is charged off and sent to a debt collection agency, debt collectors can continue pursuing payments as long as you still owe money. Debt collectors can also garnish your wages or paychecks without taking you to court first.

How student loans can help you build credit

The strategies in this article will help you delete student loans that are damaging your credit score. Before you get started, though, make sure you understand the exact effect that your loans are having on your credit.

Even though student loans are a type of debt, they don’t automatically hurt your credit. In fact, as long as you manage your account well, student loans can actually improve your credit score.

This is because student loans contribute to the following factors involved in the calculation of your credit score:

- Payment history: Although late payments will hurt your credit score, on-time student loan payments will allow you to establish your reliability as a borrower, which benefits your score.

- Length of credit history: Student loans will contribute to your credit age as long as they’re on your credit report. Having a longer credit history is good for your credit score because it shows lenders that you can handle debt obligations over long periods.

- Amounts owed: Both FICO scores and VantageScores take into account your current loan balance as compared with the original amount you borrowed. They’ll reward you for having a high percentage of your loan paid off.

- Credit mix: Having a student loan on your credit report will enrich your credit file by contributing an installment loan to the different types of credit accounts you have. Your credit score will go up if you have a diverse blend of credit accounts on your report.

Even if you have derogatory marks associated with your student loans, rest assured that your score will eventually recover as long as you take steps to manage your debt responsibly, such as adjusting your payment plan, budgeting, and setting payment reminders.

Takeaway: To remove student loans or related items from your credit report, dispute them or negotiate with your lender.

- You can only remove student loans from your credit report completely if they shouldn’t be there (e.g., they don’t belong to you or they’re past the credit-reporting limit).

- To remove student loan errors, send a student loan dispute letter to your creditor and the credit bureau that provided your credit report.

- To remove student loan default marks from your credit report, enroll in student loan rehabilitation (for federal loans) or request a goodwill deletion (for private loans).

- If you’re struggling to pay your student loans, explore options like alternative repayment plans, student loan consolidation, or student loan forgiveness.

- Student loans stay on your credit report while you’re paying them off and then another 7 or 10 years after the account is closed, but they can positively contribute to your credit.