Table of Contents

Once something is removed from my credit report, can it be put back on?

Yes, once something is removed from your credit report, it’s possible for it to be put back on. There are two reasons why a removed item might reappear on your credit report:

You disputed your debt and your lender verified it after 30 days

When you dispute a mistakenly reported debt on your credit report with one of the three nationwide credit bureaus (Equifax, Experian, and TransUnion), they’ll ask your lender to verify that they correctly reported the item.

According to the National Consumer Law Center, if your lender affirms that the item is correct, the credit bureau will usually defer to them and conclude their investigation. 1 On the other hand, if the bureau doesn’t get a response within 30 days, they’ll remove the negative mark from your report. 2

However, if your lender eventually verifies the item after the 30-day deadline, the credit bureau will automatically add the deleted item back onto your credit report. This is known as “reinsertion.”

In accordance with the Fair Credit Reporting Act (FCRA), the credit bureau must inform you within five business days if they reinsert a deleted item onto your report. 3

Your debt collector re-aged an old debt

Under the FCRA, the credit bureaus are legally required to remove negative information, such as foreclosure or repossession, from your report after seven years (or 10 years for certain types of bankruptcies). 3

However, some lenders and debt collectors will intentionally report an old debt as new by changing the date of your first missed payment. They’ll generally do this to prevent a debt from exceeding its statute of limitations, after which point it becomes time-barred debt and they can no longer force you to repay it by filing a lawsuit.

If a debt collection agency re-ages a debt and makes it appear as though it’s less than seven years old, it will reappear on your credit report, even if it’s actually older than that.

You can report a debt collector for re-aging old debt.

If you suspect that a debt collector has intentionally re-aged your debt to pressure you into paying it off, report them to the Federal Trade Commission for bad business practices.

What to do if a disputed item reappears on your credit report

If the credit bureau reinserts a negative item on your credit report, file another dispute and provide additional documentation to support your claim. 4 Make your claim in writing and request a return receipt so that the bureaus can’t claim that they never received it.

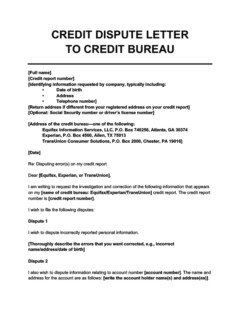

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

You should also file a dispute with the lender that made the error. Sending them a detailed letter before the bureau contacts them will make it harder for them to argue that they didn’t have enough time to investigate your claim.

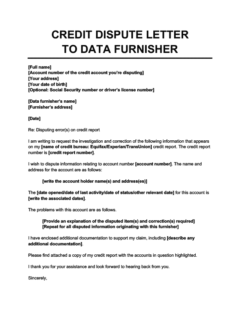

Credit Dispute Letter to a Data Furnisher

Use this credit dispute letter template to file a dispute with a creditor or debt collector. If you recognize a credit account but it's listed with the wrong balance or incorrect status (e.g., if you settled the debt and it's still listed as unpaid), the error may have originated with your data furnisher.

How to seek legal advice if the bureaus don’t remove the error

If the deleted item still appears on your credit report after multiple attempts to get it removed, consider speaking to an attorney. Visit the National Association of Consumer Advocates for a list of lawyers who specialize in defending consumers with inaccuracies on their credit reports.

Where to send your dispute letter

Here are the contact details you’ll need to file a dispute with the three credit bureaus:

| Experian | Equifax | TransUnion | |

|---|---|---|---|

| Where to send your dispute letter | Experian P.O. Box 4500 Allen, TX 75013 | Equifax P.O. Box 740256 Atlanta, GA 30374-0256 | TransUnion Consumer Solutions P.O. Box 2000 Chester, PA 19016-2000 |

| What you’ll need to send | |||

| Dispute online | Experian's online dispute form | Equifax’s online dispute form | TransUnion’s online dispute form |

Takeaway: Seek legal advice if a deleted item reappears on your credit report after multiple disputes

- The credit bureaus will reinsert removed items onto your credit report if your lender verifies them.

- Old debts can also reappear on your report if a collection agency changes the date of delinquency to make your account look newer.

- The bureaus must notify you within five days of reinserting a deleted item on your credit report.

- Always make your disputes in writing and request a return receipt. The credit bureaus refer online disputes to their automated systems, which means they deal with them less effectively.

- You should also file a dispute with the lender that verified the error to speed up the process and increase your chances of getting the item removed from your credit report.