Table of Contents

How to delete late payments from your credit report

If you think that the late payment mark on your credit report is an error (i.e., it was incorrectly reported), then getting it removed will be relatively straightforward. If you actually were late in paying one of your bills, getting the mark removed will be much harder, but still worth trying.

There are four methods you can try to delete late payments from your credit report:

1. If the late payment is an error: send a dispute letter

Creditors sometimes make mistakes and report late payments on accounts that you actually paid on time, or even accounts that aren’t yours. When this happens, you can send a dispute letter to have the illegitimate late payment removed. Dispute letters don’t cost anything to file.

To dispute a late payment on your credit report, follow these steps:

- If you can, find documentation that you made the payment on time, such as a copy of a verification email or a receipt. (If you believe that you never owed the payment in the first place, skip this step.)

- Send a letter to the bureau that published the error. Clearly indicate which items you believe are incorrect. Attach the documentation that you prepared in step 1. The credit bureau will contact the creditor or lender that filed the initial report.

- Contact that creditor yourself and ask them to check their records. Send the same proof that you sent to the credit bureau.

- If the creditor agrees that you didn’t pay late, send a follow-up letter formally requesting that they update your information with the credit bureau.

How long before my credit report will be updated?

If your dispute is successful, your creditor is legally obligated to update your account information in 30 to 45 days.1 However, they might not report your updated information to the credit bureaus for another 30 days, so it could take up to 2–2.5 months before the late payment is removed from your credit report.2

Dispute letter example

You don’t need to write your own dispute letter from scratch. It’s easy to find free templates for late payment removal letters to creditors and late payment removal letters to the main credit bureaus (Equifax, Experian, and TransUnion).

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

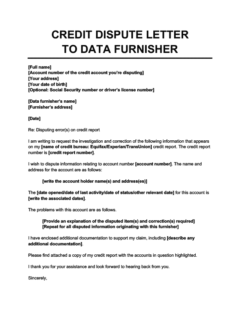

Credit Dispute Letter to a Data Furnisher

Use this credit dispute letter template to file a dispute with a creditor or debt collector. If you recognize a credit account but it's listed with the wrong balance or incorrect status (e.g., if you settled the debt and it's still listed as unpaid), the error may have originated with your data furnisher.

2. If the late payment is legitimate, but you’ve paid it off: send a goodwill letter

If the late payment isn’t an error, then it’ll be difficult to get it deleted from your credit report, but not necessarily impossible.

If you’ve already paid the debt, you might be able to get your creditor to perform something called a “goodwill adjustment” to remove it from your report. To do this, send them a goodwill letter in which you explain why your payment was late and promise it won’t happen again.

When you send a goodwill letter, you’re essentially asking for a favor. Your chances of success are better if you have a good relationship with your creditor, a solid payment history, and a good reason for missing your payment due date, such as:

- Financial hardship due to a natural disaster

- A serious illness or injury

- A recent job loss

- Unexpected medical bills that strained your finances

- Payment processing delays beyond your control

For example, if your bank’s system was undergoing maintenance on the date you paid, your payment might be listed as late. If you can prove that the system downtime made you late, your creditor might be willing to record your payment as on-time.

Even if you have a good excuse, your goodwill letter isn’t guaranteed to work. Creditors aren’t always willing to ask the credit bureaus to delete accurate items because doing so pushes the boundaries of legality under the Fair Credit Reporting Act (FCRA), which stipulates that it is illegal for furnishing companies (like your creditor) to report information that they know is incorrect.3 This means that deleting late payments as an act of goodwill falls into a legal gray area, which can make creditors reluctant to do it.

If your creditor does agree to forgive your late payment, thank them and make sure you get a copy of the agreement in writing.

Goodwill letter example

Writing a goodwill letter is simple and hassle-free. Look for a goodwill letter template that you can download and tailor to your circumstances.

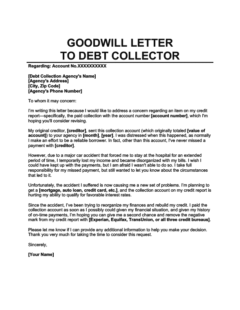

Goodwill Letter to Debt Collector

Use this goodwill letter template to ask for a goodwill deletion from a debt collection agency. Remember to customize it to your circumstances for the best possible chance of success.

3. If you haven’t paid off the debt yet: send a pay-for-delete letter

If you’ve incurred late payments for a debt that’s still outstanding, then you can try sending a pay-for-delete letter. Pay for delete is a negotiation strategy where you promise to repay the debt in exchange for having the corresponding negative item removed from your credit report.

This strategy is most often used with older debts, particularly for removing collection accounts. Pay for delete is less likely to work with late payments, since you have to contact your original creditor before they transfer or sell your debt, which means it probably isn’t that old. However, there’s no harm in trying.

Your letter should specify the total amount you’re willing to pay (for the best chance of success, offer to pay in full) and your conditions (i.e., that they must remove the late payment mark from your credit report). Also say how long your offer will be valid, including the date by which you’d like your creditor to respond.

Pay-for-delete letter example

Your pay-for-delete letter should be polite and professional, but you should be careful not to imply you’ll pay the debt if they don’t agree to your conditions. Again, it can be helpful to use a pay-for-delete letter template, modifying it to fit your circumstances.

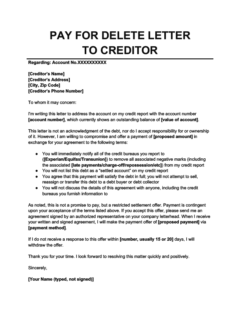

Pay for Delete Letter to Creditor

Use this pay for delete letter template to ask your original creditor to remove another type of negative mark, such as a late payment or a charged-off account that they haven't sold to a debt collector yet. Creditors tend to be less receptive to pay for delete letters than debt collectors.

4. If you’re out of options: Consult a credit counselor

Removing a late payment from your credit report isn’t always possible, but there are other ways you can improve your credit score. A credit repair expert can assess your situation and provide you with possible solutions.

Note while many credit counseling agencies offer free consultations, professional credit repair costs money, so be clear about what kind of company you’re talking to (and whether you’ll have to pay them) before you agree to anything.

How long will late payments stay on my credit report?

Late payments can stay on your credit report for up to 7 years. They increase your perceived risk as a borrower and lower your credit score, which hurts your chances of getting credit with attractive interest rates and terms.

The good news is that the impact that late payment has on your credit score will diminish over time. To bring your score back up, pay your bills consistently from now on so that you look like a reliable borrower. Consider setting up autopay to ensure that you won’t miss any payment due dates in the future.

Repaying your debts doesn’t remove late payments from your credit report

Bringing your accounts current by paying off your debts is usually a good idea, but it won’t make late payment marks disappear from your credit report. However, it can prevent your debts from being charged off and sent to a collection agency, which is even worse for your credit score than a late payment.

How much will my credit score increase if late payments are removed?

How much your credit score will improve when you remove a late payment depends on how much of an impact it had on your score to begin with. Obviously, the more damaging the late payment was, the greater the increase in your score will be when it’s finally deleted.

How much late payments affect your score

Late payments can cost you anywhere from just a few points to 180 points.4 They can be very damaging because your payment history is the most important factor that contributes to your credit score (accounting for 35% of your final score in FICO’s model).

This means it’s well worth trying to get late payments removed from your credit report. In the best-case scenario, if you succeed, you could immediately improve your credit score by 100 points or more.

The factors that determine how much a late payment will damage your score include:

- The number of late payments you have

- The length of your credit history and your total number of credit accounts

- What your credit score was before the late payment (better scores are hit harder)

- How late the payment is (30, 60, or 90+ days)

- Whether the account has been charged-off or sent to a debt collection agency

Takeaway: You can get late payments off your credit report by disputing them or negotiating with your creditor

- You can get a late payment removed from your credit report if it’s a mistake by disputing it with the credit bureaus and/or your creditor.

- There’s no guaranteed way to get valid late payments off your credit report, but you can try asking your creditor for a goodwill deletion (if you’ve paid the debt) or pay for delete (if you haven’t).

- Late payments can stay on your credit report for up to 7 years, but their impact on your credit score will diminish over time.

- How much your credit score will improve after a late payment has been removed from your credit report depends on various factors related to your credit history.