Establishing a credit history isn’t easy, and neither is raising your credit score. But having a good score is crucial when it comes to securing loans, jobs, and housing.

Fortunately, there’s a relatively simple trick—known as piggybacking—that can help you improve your credit score quickly. Read on to learn how it works and whether it has any downsides you should be aware of.

Table of Contents

What is piggybacking credit?

Piggybacking credit is when you become an authorized user on someone else’s credit card and reap credit score benefits from that person’s credit history.

When a cardholder adds you to their credit card as an authorized user, you’re able to use the credit card as if it was your own. A record of their activity on the card will also usually be added to your own credit report.

If they’ve used their card responsibly (i.e, they have a good payment history), this will have a positive impact on your credit score, hence the term “piggybacking”—essentially, you’re taking advantage of their own credit history to boost your own.

Does piggybacking credit actually work?

Yes, piggybacking on someone else’s credit really works. However, like a lot of things that initially sound too good to be true, it does come with certain risks.

The main downside of piggybacking is that, just as the primary cardholder’s positive credit history will benefit you, any negative items on their card history will also hurt you. For instance, if they make late payments on the credit card they added you to, that will damage your own credit score.

It’s also worth noting that while becoming an authorized user can be beneficial—especially for new borrowers with limited credit histories—piggybacking credit shouldn’t be your only means of building credit. However, it can be a useful practice for jumpstarting your credit-building journey.

Is credit card piggybacking legal?

Yes, piggybacking credit is a legal practice. However, as mentioned, there are risks involved, especially if you piggyback through a for-profit service. Piggybacking should be done carefully and in conjunction with other methods of improving your credit.

How does piggybacking credit work?

As mentioned, piggybacking credit works because when you’re added to an established credit user’s card, your credit report is supplemented with their credit history. You’ll be associated with many of their good borrowing practices, and your credit score can rise as a result.

However, piggybacking isn’t guaranteed to work. As your credit will be tethered to another person’s, your score will also suffer if they borrow irresponsibly (e.g., miss payments).

Also, some card issuers have a policy against reporting “piggybacked” credit activity to the credit bureaus, so make sure to check your issuer will go along with this strategy before you commit to it.

There are two ways to piggyback credit:

1. Person-to-person piggybacking

Perhaps the most common form of piggybacking—and the most advisable method—is becoming an authorized user on a friend or family member’s credit card.

You can ask someone close to you with good credit if they’re willing to add you to their credit account. You can negotiate with the person about whether you’ll actually be allowed to use the line of credit or will simply be added to the account as a way of boosting your credit score.

Common people to consider for piggybacking are:

- Parents

- Spouses

- Partners

- Siblings

- Family members

- Close friends

Just make sure to find someone with a good credit score and consistent borrowing habits so you don’t end up doing more harm than good.

2. For-profit piggybacking

If you don’t have someone close to you that will allow you to piggyback off their credit, it’s also possible to use a for-profit piggybacking service.

These services, often referred to as tradeline services, offer to add you as an authorized user to a credit account that belongs to someone with an excellent credit score.

Downsides of for-profit piggybacking services

However, there are significant cons to using tradeline services to piggyback credit:

- High costs: Tradeline services are expensive (fees can cost upwards of $4,000).

- Risk: Signing up for this service requires providing sensitive personal information. You also have to trust that the person whose card you’re added to will continue to use their credit responsibly, which is a gamble given that you won’t actually know them.

- No guarantees: Tradeline services often practice deceptive advertising. Whatever they say, they can’t actually guarantee how much your credit score will improve (or even that it will improve at all).

- Limited benefits: Services like this can only do so much for your credit score. To achieve significant and long-lasting gains, you’ll still need to practice responsible borrowing over an extended period of time.

- Discouraged by lenders: Lenders and the credit bureaus frown upon paid tradeline services, as they don’t accurately reflect your ability to borrow money responsibly. Some companies even suggest that this practice might be considered fraud, although it’s unlikely you’ll actually face any actual legal consequences for doing it.

In general, if you can, it’s cheaper and safer to find a trusted family member or friend than to hire a credit piggybacking service. However, this is an option if you really can’t find anyone.

How does piggybacking credit affect your credit score?

The point of piggybacking credit is, of course, to improve your credit score. But how exactly does piggybacking boost your credit?

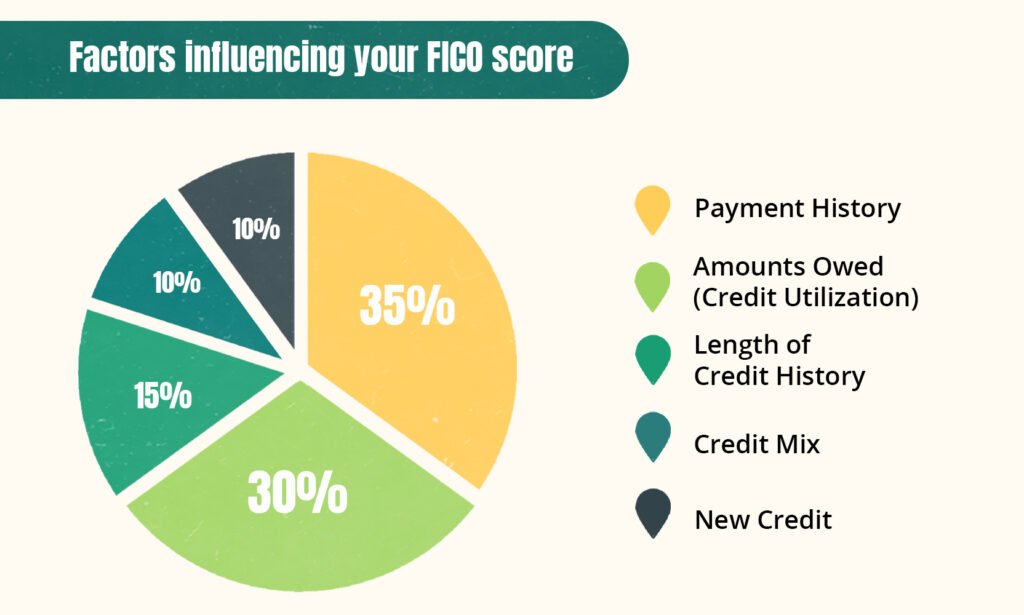

To understand this, you need to be familiar with the factors that determine your credit score. Here’s a breakdown of what determines your FICO credit score:

FICO Credit Scoring Factors

As you can see, 80% of your FICO credit score is made up by your payment history, credit utilization, and credit history. These are the main factors that credit piggybacking targets. It does so in the following ways:

Payment history

Your payment history is a record that shows whether you’ve always paid your bills on time or whether you tend to miss payments.

If you’re an authorized user on someone else’s account, your own credit is tied to theirs. If they’re a responsible borrower with a history of paying bills on time, your credit score will reflect some of their good payment history. (Although not all—many credit scoring models weight shared payment history less heavily than your own individual history.)

Credit utilization rate

Your credit utilization is how much of your credit you’re currently using. It’s calculated by dividing your total outstanding balance on all of your cards by your total credit limit (the maximum amount you can spend across all of your cards).

When you become an authorized user, your credit limit increases, as you’ve added a new credit card’s limit to your portfolio. Assuming the primary cardholder keeps their spending on the card relatively low, this will decrease your credit utilization rate, which is good for your credit score.

As with your payment history, credit piggybacking can also have a negative effect on your credit utilization if the primary cardholder uses too much of their credit. If their utilization rate on the card is higher than your own average utilization, they’ll actually be hurting your credit, not helping it.

For best results, you should strive to keep your credit utilization below 30%, and under 10% if you possibly can.

Credit age

Your credit age, or the length of your credit history, is the average age of your credit accounts. Lenders want to see evidence that you’ve been a responsible borrower for a long time, so an older credit age is better for your credit score.

If you’re added to a credit card that’s been open for a long time, this can raise your average credit age. This is one of the main reasons piggybacking is effective for young people with insufficient credit histories.

Keep in mind that piggybacking will only benefit this scoring factor if you’re being added to an account that’s older than your current average credit age. If you’re being added to a fairly new account, it may not help your score at all.

Is piggybacking credit a good idea?

Piggybacking on someone’s credit is a solid strategy for improving your credit score, as long as you do it right. In this case, “doing it right” means:

- Piggybacking off of someone you actually know, not a paid service

- Ensuring that the primary cardholder is trustworthy and has a solid payment history

- Using the card you’re added to responsibly, and monitoring the account to make sure the primary cardholder does the same

If you take all of those precautions, piggybacking has no real downsides, and can have real benefits for your score.

How much will piggybacking credit improve my score?

The benefit that you’ll see from piggybacking credit depends on your credit file. As mentioned, using this strategy is an especially good idea if your own credit history is relatively sparse.

According to a simulation conducted by the Federal Reserve, if you have a “thin” credit file (i.e., you have fewer than two credit accounts), being added as an authorized user might boost your score by 45 to 64 points—a major improvement. 1

On the other hand, if you already have your own established credit history, then adding one more card to your credit report won’t have as much of an effect. The Federal Reserve’s study suggests that most people with average credit files will see an increase of just 6–7 points.

How long does it take for piggybacking credit to work?

It’s hard to predict how long it will take for piggybacking on someone’s credit to work (i.e., for it to improve your credit score).

In many cases, the primary cardholder’s account history will show up on your credit report within 30 days, but you might have to wait longer. Anecdotal reports from consumers suggest that sometimes, credit card issuers can take up to two credit card billing cycles (a total of around 60 days) to report this data.

Not all credit card issuers report piggybacked data

As you know, how your piggybacking impacts your score depends on how your card issuer reports to the credit bureaus. Credit reporting isn’t legally required, so card issuers can choose whether or not to report, how many bureaus to report to, and what activity is reported.

Some card issuers have a policy against reporting “piggybacked” credit histories (meaning they don’t report authorized users to the credit bureaus at all). If this is the case for your issuer, being an authorized user won’t benefit your credit score, rendering it largely pointless.

Before you take the plunge, make sure to confirm with your card issuer that they’ll add data to your credit reports when you’re added as an authorized user.

Other ways to improve your credit

Piggybacking is only one method of improving your credit score, and definitely shouldn’t be the only one you use. To maintain a good score in the long term, you need to develop good borrowing habits.

Here are some other ways you can improve your score (either instead of or in combination with piggybacking credit):

- Dispute credit reporting errors: Regularly check your credit reports and ensure the information is accurate. If you find something amiss, dispute the credit reporting error right away. You can do this by sending a credit dispute letter.

- Repay your debts: Debt can significantly lower your credit score and make healthy financial habits even harder to develop. If you want to improve your credit but have outstanding debts, make repayment your first priority. If you’re struggling, you can consolidate your debts, form a debt management plan, or get help from a credit counselor.

- Pay your bills at the right time: Paying off your credit card balance is one of the most important steps you can take toward a high credit score. While paying your balance in full at any time is great for your credit, when you pay your credit card bill can also make a difference. We find that paying before your statement closing date and never missing payments is one of the best methods for boosting your score.