There’s a widespread myth that it’s necessary to carry a small unpaid balance on your credit card in order to have a good credit score. This isn’t true—usually, doing that won’t benefit your score at all, and it will chip away at your savings with unnecessary interest charges.

The truth is that, not only is it a good idea to pay off your credit card in full each month, it’s a good idea to pay it off early if you can. This has several benefits both for your credit score and your finances.

Table of Contents

Can paying your credit card bills early help your credit score?

Yes, when you pay your credit card bill affects your credit score, and paying early can help it. We’ll explain how and why a little further down in this article, but first you need to know what it means to “pay early.”

What does it mean to pay your credit card bills early?

Credit card billing cycles can be fairly complicated, but to understand what paying early means, you really just need to know about two key dates:

- Statement closing date: This is the day that your final bill is calculated by your credit card company and sent to you. However, you don’t have to pay it immediately.

- Payment due date: This is the day that you actually have to pay your bill. If you don’t pay off your balance by this date, you’ll have to pay interest (and will get a late fee if you don’t make at least the minimum required payment).

There’s usually a roughly 21-day gap (known as the “grace period”) between your statement closing date and payment due date.

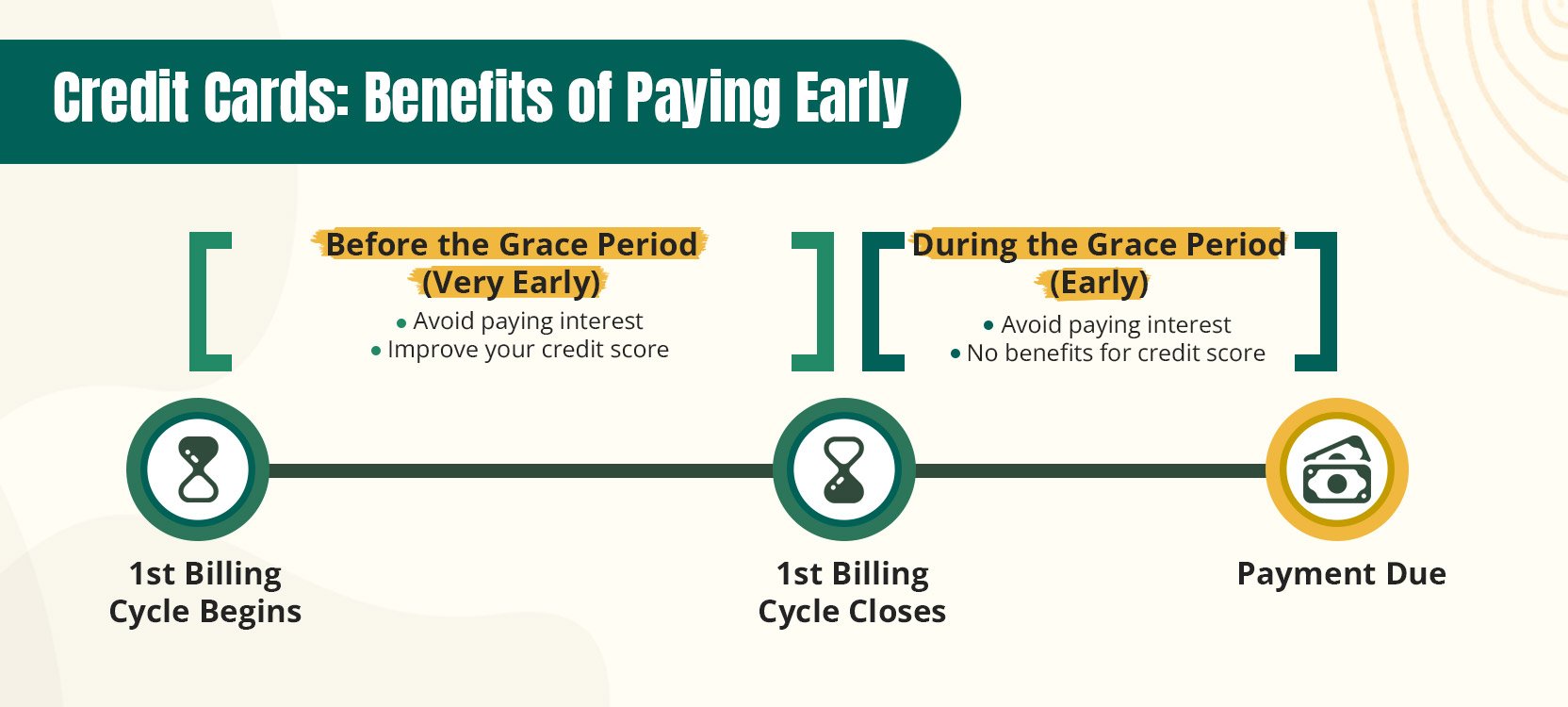

Illustrating the key dates in your billing cycle

To give you a clearer idea of the timeline of your billing cycle, take a look at the graphic below.

As we said, you don’t need a full understanding of how billing cycles work to understand the benefits of paying early—it’s enough to understand the key dates in the image above.

How paying your credit card bills early helps your credit score

When people talk about “paying early,” they can mean either:

- Paying off your balance after your statement closing date, but before your payment due date (i.e., during the grace period)

- Paying off your balance before your statement closing date (i.e., before the grace period begins)

Both have benefits for your finances and credit score.

1. Benefits of paying off your balance before the statement closing date

Essentially, paying off your balance during the grace period lets you avoid paying interest.

How this works: Technically, on the payment due date, you only have to pay a fraction of the amount you owe to avoid late payments (known as the “minimum payment”). However, any money that you don’t pay off will incur interest.

If you pay off the entire balance that you had on your statement closing date, you won’t have to pay any interest. This has obvious benefits for your finances—it’s always good to avoid unnecessary charges if you can.

Paying promptly like this can indirectly benefit your credit score, at least over a long period of time (it contributes to your payment history and makes it less likely you’ll get careless and make late payments). But it won’t necessarily have a “boosting” effect immediately.

2. Benefits of paying off your balance before the grace period

If you pay off your balance before the grace period even begins, you’ll also avoid paying interest. In addition, you also might boost your credit score.

How this works: Your statement closing date isn’t just the day that your card issuer calculates what you owe on this billing cycle. On your closing date, they’ll also report your balance to one or all of the credit nationwide bureaus that create credit reports:

- Experian

- Equifax

- TransUnion

At this point, your credit card balance will appear on your credit report and begin to affect your credit score.

Both major credit scoring models (FICO and VantageScore) consider the amount of money you owe on your various cards—aka your credit utilization rate—when calculating your credit score. The less credit that you’re using, the better.

Paying off your credit card balance before it’s reported to the bureaus keeps your credit utilization rate low. In other words, it makes you look like you’re using less credit. This will improve your credit score.

Illustrating the benefits of paying early

To make the benefits of paying before the two key dates a little clearer, review the image below.

As you can see, the earlier you can pay your balance off, the more benefits you’ll get.

When is the best time to pay your credit card bills?

In general, you should pay off your credit card bills as early as possible. Pay it off before your statement closing date if you can, but if you can’t make that deadline, still try to pay it off in the grace period.

Be careful about making partial payments

Note that if you make a partial payment before your statement closing date, your card issuer will calculate your interest and minimum payment from whatever balance remains.

This means you’ll have to make a further payment during the grace period—at least the minimum payment to avoid paying a late fee, and the full balance to avoid paying interest.

There’s nothing wrong with making partial payments, but if you do, be sure to pay attention to where you are in your billing cycle. Partial payments tend to make things more complicated.

Should I pay my credit card bill early?

Yes, to reiterate, you should pay your credit card bill early. Although credit card billing cycles can be complicated, the upshot here is very simple: paying earlier has essentially no downsides and has several benefits for your finances and your score.