No one wants to miss a credit card payment—between late fees, interest charges, and the damage it does to your credit score, it can be a financial disaster. But credit card billing cycles can be confusing. It’s hard to avoid missing payments when you’re not actually sure when you have to pay.

To make the most of your credit card, you need to understand what exactly your billing cycle is, how it works, and why paying attention to it matters for your credit score.

Table of Contents

What is a credit card billing cycle?

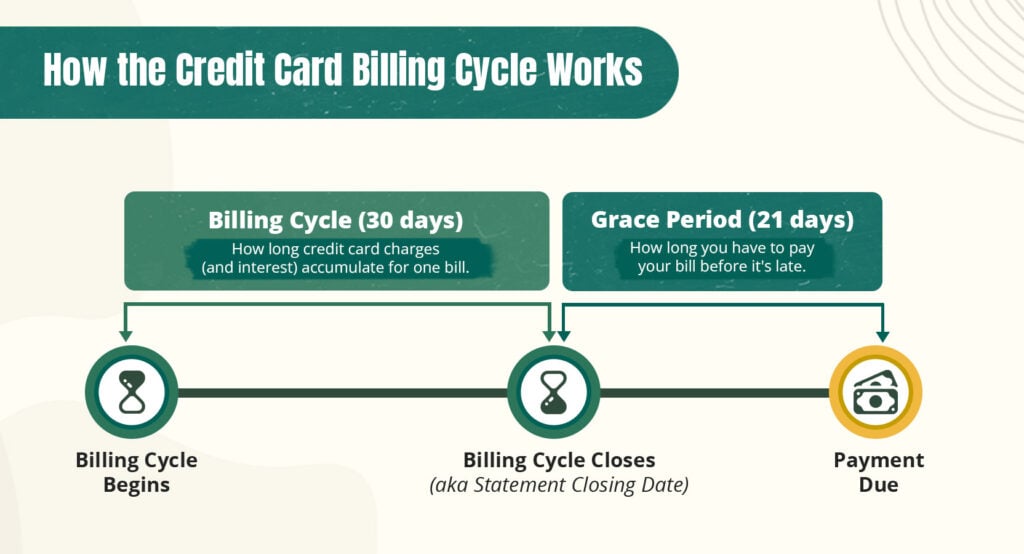

A credit card billing cycle—which can also be referred to as a credit card bill cycle, a billing period, or a credit card payment cycle—is a 28–31 day period that starts on your statement opening date and ends on your statement closing date.

Charges that you make to your card between these two key dates come due (meaning you have to pay them) by your payment due date, which will come roughly 21–30 days after your credit card closing date.

You generally won’t have to pay the charges off in full. Only your minimum monthly payment will be due on that due date. Anything you don’t pay off from the billing cycle will begin accruing interest and will carry over into your next billing cycle.

The image below shows how your billing cycle works.

Illustrating Credit Card Billing Cycles

We’ve described the key dates in your billing cycle in more detail below.

Credit card statement date

Your credit card statement date, otherwise known as your statement closing date, is the last day of the current billing cycle and the first day of the next billing cycle.

On this day, your credit card issuer will tally up the charges that you accrued during the cycle that’s ending and compile them into your credit card statement (aka your credit card bill for the month).

Your statement will include:

- Your total balance for that billing period (this is your statement balance vs your current balance)

- Your due date

- The minimum payment owed by that due date

Your statement closing date will also be the first day of your next billing cycle, meaning charges you make on that day will be included in the following month’s credit card bill.

Credit card due date

Your credit card due date, also known as your payment due date or statement due date, is the date by which you owe your minimum monthly payment. You have to pay this on time to avoid late fees and other consequences for not paying your credit card.

As mentioned, your minimum monthly payment is the only thing you’re required to pay by this date. However, if you choose not to pay off your credit card in full, your balance will begin accruing interest.

Grace period

Your credit card grace period is the time between your statement closing date and your payment due date. It usually lasts 21–30 days. The goal is to give you time to make sure you understand your statement balance and collect the money to pay your bill on time.

Many issuers offer interest-free grace periods, meaning that as long as you pay off your bill in full before the end of the grace period, your charges won’t accrue any interest—as long as your last credit card bill was also paid in full.

However, if you have an outstanding balance that’s carried from month to month, your entire bill will generate interest at the usual rate.

How long is a credit card billing cycle?

A credit card billing cycle is usually 28–31 days long. For example, a typical billing cycle might be from the first of the month to the first of the following month (e.g., May 1 to June 1).

A given card’s billing cycles can vary by up to 4 days depending on the month. One billing cycle may be 28 days, and the next 30 days. 1

Some credit card issuers allow you to change your billing cycle by setting a new statement closing date or due date. However, this depends on the credit card issuer. Your card might have limitations (for instance, restricting how often you can do this) or disallow it entirely.

How does a credit card billing cycle work?

Your credit card billing cycle starts on the statement opening date. You’ll make charges on the card for 28–31 days, then that billing cycle will close.

When it closes, your card issuer will add up the charges on your card and put those charges into your credit card statement. That statement will be sent to you during a 21–30 day period between the statement closing date and due date (known as the grace period).

You then pay your minimum monthly payment by the due date and get charged interest on the remaining balance. The balance and interest charges will carry over into your next billing cycle, and affect the amount you owe by that due date.

If you pay your credit card balance in full by the due date, you generally won’t have to pay any interest. If you carry any unpaid charges into the next month (known as revolving your balance), you’ll have to pay interest.

What kinds of charges can you accrue during your billing cycle?

Your billing cycle charges will most commonly include:

- Charges made during that billing cycle

- Unpaid balances from previous billing cycles

- Interest charges

- Fees (e.g., annual fee, maintenance fees, authorized user fees)

Somewhat less commonly, these charges might also contribute to the outstanding balance on your credit card statement:

- Refund credits

- Statement credits from cashback rewards

- Bill payments

- Cash advances

- Balance transfers

How does my credit card billing cycle affect my credit score?

When you pay your credit card bill matters to your credit score, as does how much you charge to your card each cycle.

There are two main credit score factors that are affected by your billing cycle:

- Your payment history: Payment history is the most important factor in your credit score. It goes up or down depending on whether you pay your bills on time. So your billing cycle’s due date is incredibly important, as failing to make the minimum payment by this date can damage your payment history.

- Your credit utilization rate: Your credit utilization rate is how much of your credit you’re using at a time. It’s better to keep it low, meaning you’re only using a small portion of your credit. As your credit use will often be reported to the credit bureaus on your statement closing date, having a high balance on that day may give you a high utilization rate.

If you’re trying to improve your credit score, consider paying most of your current cycle’s balance before the statement closing date (so your card issuer reports a low credit utilization rate).

Even if you can’t manage that, you still should make sure to make your minimum payment by the statement due date (so your payment history stays in good standing).