The last thing any responsible borrower wants is to slip up and miss a credit card payment. Late bills lead to hikes in your credit card APR, late fees, penalties, and damage to your credit score.

Unfortunately, it’s easy to get confused about when you have to pay, especially given the number of terms you need to know to understand your credit card’s billing cycle. We’ll help by explaining what a closing date on a credit card is, how it’s different from a due date, and when you should make your credit card payments.

Table of Contents

What is a credit card statement closing date?

A statement closing date is the last day of a credit card’s billing cycle. It can be referred to in many other ways, including as the:

- Closing date

- Statement closing date

- Statement date

- Statement balance date

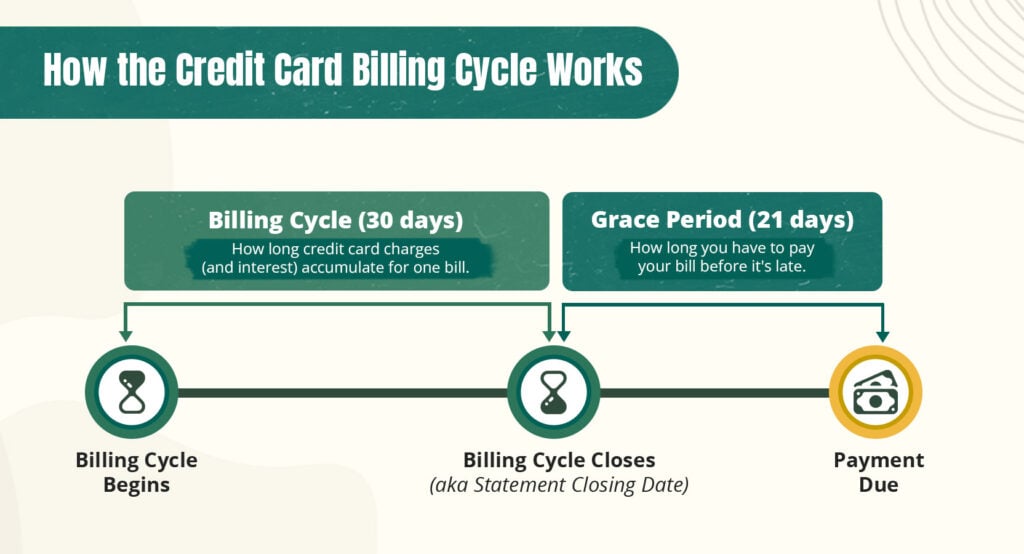

On this day, all your credit card charges for that billing cycle (a 28 to 31 day period) will be tallied up. Your card issuer will add them to any outstanding balances you already have on your account, along with any interest charges or fees you’ve incurred. The total will be your statement balance.

Your statement balance then determines how much your minimum monthly payment will be. This payment will be due 21 or more days after your statement closing date, on your payment due date.

The 21+ day-period between your closing date and due date is called the grace period. Your credit card grace period gives you time to collect enough money to pay your statement balance (or at least the minimum payment). Many credit card issuers also won’t charge interest during the grace period.

To make this timeline clearer, here’s an image illustrating how your credit card billing cycle works:

Depiction of a credit card billing cycle

What does “next closing date” mean?

Your next closing date is the upcoming closing date for your current billing cycle. This term can be confusing, as your next closing date might be as little as a week after the payment due date on your last statement.

This is counterintuitive—because credit card billing cycles are around a month long, you’d expect there to be about a month between a given payment date and the next closing date. They’re closer together than that because as you know, each closing date and its corresponding payment date are separated by a 21+ day period.

Let’s look at an example:

- Your current closing date is June 1.

- Your payment due date is June 22.

- Your next closing date is June 29.

If you fail to pay your entire balance from your previous billing cycle—the one that ended on the June 1 closing date—by June 22, those charges and their subsequent interest will be added to the balance generated on your June 29 closing date.

What’s the difference between a closing date and a payment due date?

Your credit card’s payment due date is the date by which you must make at least the minimum monthly payment determined by your statement balance, otherwise that payment is considered late.

By law, the due date must come at least 21 days after the closing date.

You do not need to pay any part of your credit card bill before the closing date. Rather, the closing date determines how much you owe for that billing cycle, and how much you must pay by the due date.

Consequences of failing to pay by the payment due date

Failing to pay your closing date’s statement balance by the due date:

- Can lead to late fees and a hike in your interest rate (known as a penalty APR) if you don’t make the minimum monthly payment.

- May damage your credit score if you continue to not pay for 60 days or more.

- Will lead to interest charges on any balance left over after the payment due date (even if you do make the minimum payment, as long as you don’t pay your credit card in full).

- Add charges (from your remaining balance and subsequent interest) to your next statement balance.

Can I use my credit card before the closing date?

Yes, you can use your credit card before the closing date (as well as afterwards). Your credit card closing date is merely the last day of that billing cycle. It has no impact on your ability to use your card.

Charges you make on or after your closing date will be added to the next billing cycle. This is why your statement balance and current balance may be different.

Should I pay my credit card before the statement closing date?

While you aren’t required to pay off your credit card before the statement closing date, paying all or at least some of your bill by then may improve your credit score. That’s because paying down your balance by the closing day can lower your credit utilization rate.

Your credit utilization rate is the amount of credit you’re borrowing at a given time, which is an important factor in calculating your credit score. However, the credit bureaus can only calculate your utilization rate based on the borrowing information provided by your credit card issuers.

Most credit card issuers report your monthly borrowing practices, including your outstanding balance, on your statement closing date. This means if you have a lower balance on that day, your credit utilization rate will be lower, which can boost your credit score.

Pay your bill multiple times per month to boost your credit score

An effective credit hack for raising your score is to pay your credit card bill throughout the month, including before your closing date, so your credit utilization is reported as low. This is the rationale behind the 15/3 credit hack, which is a guideline that’s meant to help you remember when to pay your credit card bill.

Again, this isn’t required to avoid late fees and other penalties, but paying early is a good habit to get into, not just for the sake of your credit but for your overall financial management.