If you’ve been contacted by a debt collector, it’s understandable if you’re pretty worried, especially if you don’t recognize the debt they’re trying to collect.

Don’t panic—if you send a debt verification letter, you might be able to avoid paying the debt. At the very least, you’ll be able to buy yourself some time to think.

Table of Contents

What is a debt verification letter?

When a debt collector calls you or sends you a debt validation notice informing you that you owe a debt, you have the right to reply with a debt verification letter. This is a request for evidence confirming that you actually owe the debt, which your collector is legally obligated to provide.

If they’re not able to provide this information, they have to stop trying to collect the debt and remove the associated collection account from your credit report.

Your right to debt verification is guaranteed by a law called the Fair Debt Collection Practices Act (FDCPA). The FDCPA protects you from harassment by debt collectors by setting rules for what they can and can’t do when they’re trying to collect money from you.

Don’t confuse “debt verification letters” with “debt validation notices”

Although they have similar names, they’re very different. A debt validation notice is the initial communication that a debt collector is required to send to you. A debt verification letter is what you send in reply.

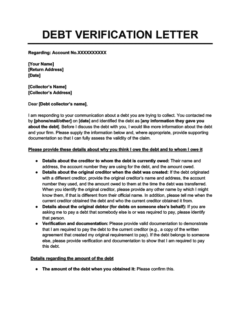

Downloadable debt verification letter template

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

How to write a debt verification letter (with examples)

I am responding to your communication about a debt you are trying to collect. You contacted me by [phone/mail/other] on [date] and identified the debt as [any information they gave you about the debt]. Before I discuss the debt with you, I would like more information about the debt and your firm. Please supply the information below and, where appropriate, provide supporting documentation so that I can fully assess the validity of the claim.

Please provide these details regarding why you think I owe the debt and to whom I owe it

- Details about the creditor to whom the debt is currently owed: Their name and address, the account number they are using for the debt, and the amount owed.

- Details about the original creditor when the debt was created: If the debt originated with a different creditor, provide the original creditor’s name and address, the account number they used, and the amount owed to them at the time the debt was transferred. When you identify the original creditor, please provide any other name by which I might know them, if that is different from their official name. In addition, please tell me when the current creditor obtained the debt and who the current creditor obtained it from.

- Details about the original debtor (for debts on someone else’s behalf): If you are asking me to pay a debt that somebody else is or was required to pay, please identify that person.

- Verification and documentation: Please provide valid documentation to demonstrate that I am required to pay the debt to the current creditor (e.g., a copy of the written agreement that created my original requirement to pay). If the debt belongs to someone else, please provide verification and documentation to show that I am required to pay this debt.

Details regarding the amount of the debt

- The amount of the debt when you obtained it: Please confirm this.

- Itemization for added amounts: If any additional interest, fees, or charges have been added since the last billing statement from the original creditor, please list these (including dates and amounts). In addition, please explain how the added interest, fees, or other charges are expressly authorized by the agreement creating the debt or are permitted by law.

- Itemization for deducted amounts: If there have been any payments or other reductions since the last billing statement from the original creditor, please list these (including dates and amounts).

- Itemization for other changes: If there have been any other changes or adjustments since the last billing statement from the original creditor, please specify these.

- The last billing statement sent to me by the original creditor: Please provide a copy of this document.

- Other verification and documentation: Please provide full verification and documentation of the amount you are trying to collect, and explain how that amount was calculated. In addition, explain how the other changes or adjustments are expressly authorized by the agreement creating the debt or permitted by law.

Details regarding the age of the debt

- Relevant dates: Please tell me when you obtained the debt, when the creditor claims it was due, when it became delinquent, and when the last payment was made on this account.

- The statute of limitations: Have you made a determination that this debt is within the statute of limitations applicable to it? Please tell me when you think the statute of limitations expires for this debt and how you determined that.

Evidence of your authority to collect this debt

- Local debt collection licensing: Does your firm have a debt collection license from my state? If not, say why not. If so, provide the date of the license, the name on the license, the license number, and the name, address and telephone number of the state agency issuing the license.

- Nonlocal debt collection licensing: If you are contacting me from a place outside my state, does your firm have a debt collection license from that place? If so, provide the date of the license; the name on the license; the license number; and the name, address, and telephone number of the state agency issuing the license.

I wish to have this information and documentation from you so that I may make an informed decision about whether I owe this money. In the meantime, please treat this debt as being in dispute and under discussion between us.

How to send the debt verification letter

Send your letter to the address the debt collector gave when they provided your debt validation information (you can also check this list of debt collection agencies for contact information).

Use certified mail and ask for a return receipt when you send it. It’s important to verify that they received your letter in case they ignore it and you need to file a complaint that they violated the FDCPA.

Alternative ways to dispute debts

You should have received debt validation information from your debt collector when they first contacted you (or shortly afterwards). How you can dispute your debts in collections depends on how you received this information.

- If you received the debt validation information electronically: If you check the debt validation information, it will include an email address or website portal where you can dispute your debt. It must also include a mailing address where you can send a debt verification letter. 1 2

- If you received the validation information by post: The letter you received will have a tear-off slip that allows you to dispute the debt, as in this example debt validation notice from the Consumer Financial Protection Bureau. The notice may also include an email address and/or website portal where you can dispute debt electronically. If you prefer not to use this tear-off slip, you can also write a debt verification letter. 3

- If you received debt validation information over the phone: You won’t have a tear-off slip and might not have an email address or website portal where you can dispute your debt. If so, you’ll have to use a debt verification letter instead. The validation information you received must include the collector’s mailing address.

If you didn’t receive any validation information and the company doesn’t respond when you ask for it, then it could be a sign that they’re a scam. In this case, you should take steps to verify that your debt collector is legit before communicating with them further.

Will a debt verification letter work?

A debt verification letter will work, in the sense that it will get your debt collector to stop contacting you, as long as you send it within 30 days of receiving the debt validation notice (known as the “debt validation period”).

Thanks to the FDCPA, if you send a written request for debt verification (or submit one electronically) within the validation period, then the debt collector must stop contacting you until they can verify your debts. 4 This gives you some time to decide what to do next.

The debt collector may even stop contacting you altogether if they don’t have enough information to verify your debts.

However, your rights aren’t protected by the FDCPA if you don’t dispute the debt within 30 days. They’re also not protected if you make your debt verification request over the phone, so you should make it in writing, either by sending a debt verification letter or by using the tear-off slip mentioned above.

You can also request the name and address of your original creditor

In the same way that debt collectors must stop contacting you while you dispute a debt, if you ask a debt collector for the name and address of your original creditor, they have to stop contacting you until they provide this information.

Can I still send a debt verification letter after more than 30 days?

Yes, you can still send a debt verification letter even if it’s been more than 30 days since you received your debt validation notice.

The FDCPA explicitly notes that failing to dispute a debt doesn’t mean that you’re admitting that the debt is legitimate. However, your rights won’t be protected under the FDCPA if you don’t submit your dispute (electronically or in writing) within 30 days. 4 5

If you dispute a debt after the 30-day mark, the debt collector might still verify it, but they’re not legally obliged to. They also don’t have to stop their collection efforts once they receive their letter. They’re allowed to assume that the debt is valid and continue trying to collect money from you.

Note that, if you send a debt verification letter (or tear-off debt dispute form), and it arrives a bit later than 30 days after the debt validation notice, it still qualifies as being within the debt validation period, as long as you posted it within 30 days 6

What happens after I’ve sent my debt verification letter?

Once you’ve sent your debt verification letter or submitted a debt dispute (online or offline), you just have to wait for a reply.

When will I get a reply to my debt verification letter?

You will generally get a reply to your debt verification within 30 days. If you haven’t received a response within 30 days, it’s likely (although not certain) that you never will, meaning that your dispute was successful. Bear in mind that this only applies if you disputed the debt within the allotted 30 day time period after receiving the validation notice from your collector.

If you disputed the debt outside of the debt validation period, you may never receive a response, but that doesn’t mean your dispute was successful.

What are the odds that my dispute will be successful?

There seems to be about a fifty-fifty chance that you’ll receive a reply if you dispute a debt. In one 2009 Federal Trade Commission study, debt buyers (one type of debt collection agency) couldn’t verify disputed debts about half of the time. If this is anything to go by, there’s a reasonable chance that a debt collector won’t be able to verify your debts, in which case they can’t make you pay. 7

What happens if my dispute is successful?

As mentioned, when you successfully dispute a debt, your debt collector usually won’t respond. Occasionally, they might write back to you saying they’ve received your validation request, reviewed it, and given your account back to the seller or updated your credit report to remove the account. If you receive a letter to this effect, hold onto it.

How will a debt collector verify my debt?

As the Consumer Finance Protection Bureau notes, the FDCPA doesn’t mention exactly what debt collectors have to do to investigate a debt or what counts as “verification.” This means that it’s unclear what kind of documentation you’ll get to verify your debts. 8

In theory, debt verification could include evidence like:

- Credit card bills

- Statements leading up to the payment you missed

- Your original contract with your creditor

- A letter explaining the transfer of ownership from the original lender to the debt buyer

In practice, you probably won’t receive most of that documentation. According to the Federal Trade Commission, “[m]any debt collectors have responded to verification requests by only confirming in writing for consumers that the amount demanded is what the creditor claims is owed.” In other words, they just send a statement saying they’ve checked their records and the debt is valid. 9

You can challenge a validation response

If you believe that the debt validation you’ve received is inadequate, send a letter asking the debt collection agency to provide more proof. In the meantime, you can also let the credit bureaus know that you’ve received insufficient validation of the debt and ask them to take it off your credit report.

What if the debt collector is able to verify the debt?

If a debt collector does verify your debt, the next step is to work out how old it is. The initial validation information your collector sent you is supposed to include an “itemization debt” establishing its age.

If the debt is time-barred

Once debt exceeds a certain age (which is known as the statute of limitations, and varies depending on the laws in your state), it becomes time-barred debt, meaning that debt collectors can no longer sue you for it. It’s sometimes worth paying time-barred debt, but the choice is up to you—your debt collector has no way to compel you to pay it.

Beware that paying (or offering to pay) any amount of time-barred debt will reset the statute of limitations, opening you up to lawsuits.

If the debt isn’t time-barred

If you have a verified debt that isn’t time-barred, you probably have to pay it. When you do, you have a few options that you can explore:

- Pay for delete: Before you pay your debt, you can send a pay for delete letter asking your debt collector to remove the associated collection account from your credit report in exchange for your payment. This isn’t guaranteed to work, but if it does, your credit score will improve.

- Debt settlement: If you’re having trouble paying, you can send a debt settlement letter asking your collector to clear your debt in exchange for a partial payment. This will damage your credit, but it can be a good option if your debt is too large to pay.

- Debt management: You can also contact a nonprofit credit counselor and ask them to negotiate with your collector to create a manageable repayment plan. (Note that despite the similar names, debt management and debt settlement are very different—among other differences, debt management doesn’t damage your credit, which makes it a good option to explore first.)

Other ways to protect yourself from debt collectors

If you dispute a debt within 30 days and the debt collector carries on trying to collect money from you without sending you debt verification, you have grounds to file a complaint with the following organizations:

- Federal Trade Commission

- Consumer Financial Protection Bureau

- Your state’s Attorney General’s office

If a debt collector responds to your verification letter, read their response carefully. The FDCPA limits what debt collectors can and can’t say to you, so be aware of your rights and make sure they’re playing by the rules.

If a debt collector tells you that they intend to sue you, take it seriously. It’s illegal for a debt collector to threaten any action they can’t take or that they don’t intend to take. Contact an attorney, and do your best to pay the debt if you possibly can.

Takeaways: It’s your legal right to demand debt verification

- If a debt collector contacts you about a debt, you have the right to dispute it.

- If you dispute a debt, the debt collector has to prove that the debt is valid (and that they’re a legitimate debt collector) by providing debt verification.

- For your rights to be protected under the FDCPA, you must dispute the debt within 30 days of receiving a debt validation notice. You must also dispute it electronically or in writing (disputing it over the phone doesn’t count).

- Provided you dispute the debt within the validation period, your debt collector must stop all collection efforts until they’ve provided you with verification of your debt.