If you’ve been getting calls from debt collectors, you’re not alone. According to the Urban Institute, around 77 million Americans have at least one debt in collections recorded on their credit reports. That amounts to around 35% of the people who have credit reports to begin with. 1

Dealing with debt collectors is usually unpleasant, but it doesn’t have to be a nightmare. Having a debt in collections doesn’t mean you have to put up with being harassed. Make sure you know your rights and understand the laws protecting you so that you know what to do if a debt collector crosses the line.

Table of Contents

What laws protect you from harassment by debt collectors?

In the US, debt collectors are governed by a 1977 law called the Fair Debt Collection Practices Act (FDCPA).

The FDCPA significantly restricts how and when debt collectors and debt collection agencies can contact you about debts that they think you owe. These restrictions are meant to protect consumers from debt collectors, who have a reputation for aggressive and sometimes unethical behavior in pursuit of unpaid debts.

What are your rights under the FDCPA?

The FDCPA protects you from the following:

- Disruptive calls: The FDCPA bans debt collectors from calling you incessantly or at inconvenient hours (presumed to be before 8 am or after 9 pm, your time). It also bans collectors from making automated calls and calls with prerecorded messages.

- Privacy violations: Debt collectors can’t call your workplace if you tell them you don’t want to receive calls there, and they can’t discuss your debt with anyone but your attorney or spouse. (They can contact other people you know once to ask for your contact information, but they can’t disclose that you owe a debt.)

- Verbal abuse: The FDCPA prohibits collectors from using obscene or profane language when they contact you.

- Empty threats: Debt collectors can’t threaten actions that they can’t legally take. For instance, collectors can’t garnish your wages without a court order for non-government debts or sending you to jail). They also can’t threaten actions they don’t intend to take (e.g., threatening to sue you when they have no intention of actually doing so)

- Misinformation: The FDCPA prohibits debt collectors from lying about their own identity or giving any inaccurate information about the debt that you owe.

Placing further restrictions on debt collectors

In addition to the list above, the FDCPA gives you several tools to draw even stricter boundaries on how debt collectors can contact you. We’ll describe these in the section below.

The FDCPA only governs third-party debt collectors

The FDCPA only governs debt collectors that pursue debts on behalf of others. It doesn’t restrict the behavior of “first-party debt collectors,” i.e., companies collecting debts that they own themselves, such as credit card issuers collecting overdue balances and hospitals collecting medical bills. However, some states have their own laws governing first-party collectors.

How to stop debt collectors from harassing you

The FDCPA makes it possible to stop debt collector harassment. The exact method you should pursue depends on what kind of harassment you’re concerned with.

If you’re worried about any kind of harassment mentioned in the list above, such as collectors calling you at odd hours, you don’t need to do anything special to prevent that—the FDCPA already bans that kind of behavior. (If a debt collector is doing it anyway in violation of the FDCPA, skip to the end of this article to learn how you can enforce your rights.)

In addition to the standard protections that the FDCPA always provides, it also empowers you to:

- Require debt collectors to only communicate with your attorney

- Temporarily stop collectors from contacting you until they verify your debt

- Prevent debt collectors from contacting you at work

- Stop virtually all communications from debt collectors (permanently)

How to require debt collectors to contact you through your attorney

Per the FDCPA, if a debt collector knows you’re represented by an attorney, they’re only allowed to contact them to discuss your debts (unless your attorney fails to respond within a reasonable frame of time).

If a debt collector is bothering you and you have an attorney (or you have the resources to hire one), doing so is a great idea. Not only will this get the collector off your back, you can ask your attorney to record all of the communications they receive. If the collector violates your rights at any point, this makes it easier to prove it.

How to stop debt collectors from contacting you until they verify your debt

When a debt collector contacts you about a debt, you have the right to send them something called a debt verification letter. This is a letter demanding evidence that you actually owe the debt (such as records from the person or company you originally owed it to, e.g., your bank, a hospital, etc).

Per the FDCPA, if you send this letter within 30 days of your debt collector first contacting you, they cannot contact you again until they’ve verified your debt.

You can use this period of no contact to get a temporary reprieve from the debt collector’s harassment and plan your next move. It will last until your debt collector is able to dig up information on your debt, which could take anything from several days to one month. (If you haven’t heard back after that, it probably means they were unable to verify your debt and you won’t hear from them again.)

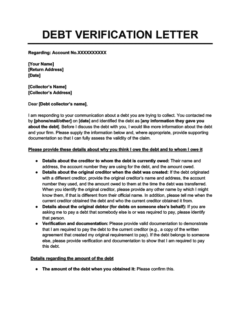

You can create a debt verification letter using the template below:

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

How to stop debt collectors from contacting you at work

As mentioned above, the FDCPA gives you the right to bar debt collectors from bothering you at work. To stop them, just tell them in writing that you can’t take calls at work and not to contact you there again. Legally, they have to abide by your request.

How to completely stop debt collectors from contacting you

If you’ve decided that you don’t want to hear from a debt collector at all—anytime or anywhere—you have the right to shut down communication from them completely.

Here again, all you have to do is submit your request in writing. There’s no specific phrase you need to use to stop debt collectors—just send them a letter telling them to stop contacting you immediately. They’ll be legally obligated to respect that. 2

There are two exceptions to this no-contact rule:

- An initial confirmation: Your debt collector can respond to your letter with a single message confirming that they received it and won’t contact you again.

- Notification of a lawsuit: They’re also allowed to break their silence to tell you if they’re pursuing legal action against you (filing a lawsuit). However, this has to be an actual lawsuit—they can’t contact you just to threaten one.

Barring that, you won’t hear from the debt collector ever again.

How this method can backfire

This method is a great way to prevent debt collectors from harassing you, but comes with certain risks.

If you really owe the debt in question, then stopping the collector from contacting you leaves them with just one option: suing you. In other words, it can force debt collectors to escalate things to a lawsuit when otherwise they’d have stuck to less-drastic methods of collecting your debt.

So, when is this method a good idea? It’s a good idea to shut down debt collectors in the following circumstances:

- You don’t actually owe the debt: Sometimes, debt collectors will contact people over illegitimate debts, such as debts that belong to other people or that were the result of clerical errors and never existed to begin with.

- The debt is time-barred: All debts have “statutes of limitations,” which are limits on how long debtors can be sued over them. If your debt has passed its statute of limitations, it’s known as time-barred debt, which means that if your debt collector files a lawsuit, they’ll automatically lose.

- You’re going to file for bankruptcy: When you declare personal bankruptcy, an “automatic stay” is placed on your debts rendering them temporarily uncollectible, and ultimately the court may discharge them completely. This protects you from lawsuits, but unfortunately, it also means that if you’re planning on filing for bankruptcy, your debt collector might step up their collection efforts in a last-ditch effort to get you to pay.

If any of the above are true, you don’t have to be afraid of a lawsuit—your collector is unlikely to file one, and if they do, they won’t win. This means that you have nothing to lose by telling them to stop contacting you.

If your debt collector does file a lawsuit, don’t ignore it

Unfortunately, if a collector sues you over nonexistent or time-barred debt, you still have to show up to court, even though the outcome is virtually guaranteed. If you ignore the summons, the court might file a default judgment against you or even hold you in contempt of court, which is one of the only ways you can go to jail for debt.

What to do if a debt collector illegally harasses you

If a debt collector ignores your rights under the FDCPA and harasses you in any way, such as by calling you at prohibited hours or ignoring a request to stop contacting you, you have several options.

Filing a complaint

If a debt collector violates your rights, you can file a complaint with several governmental institutions. They’ll investigate the issue and may penalize the debt collector accordingly.

You can file a complaint with:

Submit as much documentation as you can along with your complaint, like illegal voicemails or emails that the collector left.

You can also submit a complaint to the Better Business Bureau (BBB). This might not accomplish much—the BBB is nationally recognized, but it isn’t a government agency and has no official power—but your complaint will still create negative publicity for the debt collection agency and might pressure them into backing off.

Filing a lawsuit

If a debt collector violates the FDCPA by harassing you, you can also sue them. If you win, they’ll be forced to pay:

- Whatever “actual damages” you sustained—for example, money making up for lost wages because their harassment caused you to miss work

- Any additional damages that the court decides to award you, up to a maximum of $1,000

If you think you’ve been illegally harassed, you should strongly consider speaking with an attorney, and again, collect as much documentation as you can.

In general, even if the messages you’re receiving from your debt collector don’t rise to the level of harassment, it’s best to communicate in writing as much as possible. This creates a clear paper trail, which means that if things go badly in the future, your dispute won’t boil down to your word against theirs.

Takeaway: Federal law protects you from debt collector harassment

- All third-party debt collectors are governed by a law called the Fair Debt Collection Practices Act (FDCPA).

- The FDCPA bans debt collectors from threatening, abusing, or harassing you.

- This law also gives you the tools to significantly restrict how debt collectors are allowed to contact you. Doing this is a surefire way to protect yourself from being harassed, but make sure you don’t leave your collector with no option but to sue you.

- If a debt collector harasses you in violation of the FDCPA, you can file a complaint with several governmental organizations and file a lawsuit against them.