In July 2022, FinanceJar conducted a survey to investigate how consumer credit scores are affected by demographics. We asked respondents about their:

- Current credit scores

- Overall financial situations

- Demographic information

We attempted to pin down the relationship between credit scores and other socioeconomic factors, such as race, gender, and even body mass index (weight). Here’s what we found.

Table of Contents

- What percentage of people know their credit scores?

- What is the current average credit score?

- What is the relationship between credit score and income?

- What is the relationship between credit score and education?

- What is the relationship between credit score and age?

- What is the relationship between credit scores and race?

- What is the relationship between credit scores and body mass index (BMI)?

- What is the relationship between credit score and household size?

What percentage of people know their credit scores?

With our first question, we established how many people actually knew their credit scores to begin with. Of our respondents:

- Just shy of one third (32.05%) had checked their credit scores in the past 2 years.

- However, of those who had, virtually everyone claimed to remember their scores. 57% said they remembered “exactly” and 60.43% said they remembered “approximately.” A staggering 0.0% (not even a single respondent) admitted to not remembering at all.

In other words, most consumers don’t regularly check their credit scores, but those who do tend to retain the information.

How do people check their credit scores?

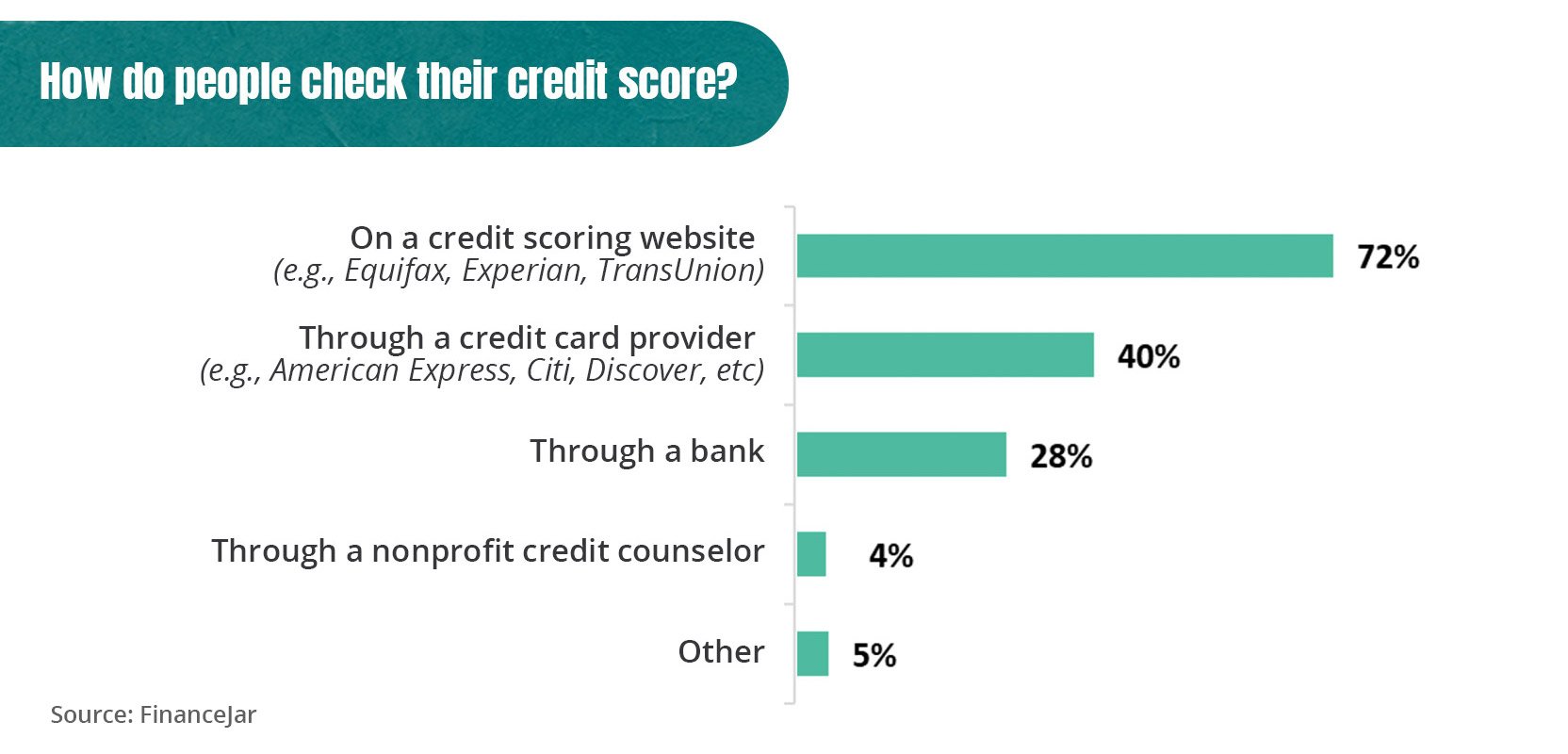

We asked the respondents who had checked their scores where and how they did so.

A significant majority (nearly 3 out of 4 people) used a credit scoring website, such as a credit bureau’s. Many people (40%) also received their scores from their credit card provider (it’s common for card issuers to provide free credit scores to their customers).

Major Sources for Consumer Credit Scores

We allowed respondents to pick multiple answers, and many people who reported that they checked their scores through their card issuer also used scoring websites (that’s why these percentages don’t add up to 100%).

Of those who selected “Other,” more than two thirds reported that they checked their scores through Credit Karma. As Credit Karma operates both an app and a website, it’s likely that some of their users also selected the first answer (“On a credit scoring website”) as well.

The upshot: Most people prefer to get their scores on dedicated websites, and Credit Karma has made serious inroads among credit-savvy consumers in the US.

The scores offered by CreditKarma aren’t the same as the ones most lenders check

If you use Credit Karma to check your score, you should know that it offers VantageScore credit scores rather than FICO scores. When you apply for credit, most lenders will check your FICO score, not your VantageScore, which makes the score that Credit Karma displays of limited use. Their website is obviously very popular among consumers who like to keep tabs on their credit, but it’s important to know what you’re getting.

What is the current average credit score?

We found that the current average credit score (the mean) was 669. This is somewhat lower than the average credit score in the US in 2021, which was 716 in FICO’s credit scoring model and 695 in VantageScore’s. (Note that our data includes both FICO scores and VantageScores.)

The single most common credit score (the mode) was much higher, at 720, followed by 750 and 650. The data showed sharp spikes at these numbers, which suggests that they actually represent clusters of scores. In other words, we suspect that people with hard-to-remember scores were likely to just select the nearest round number.

What is the relationship between credit score and income?

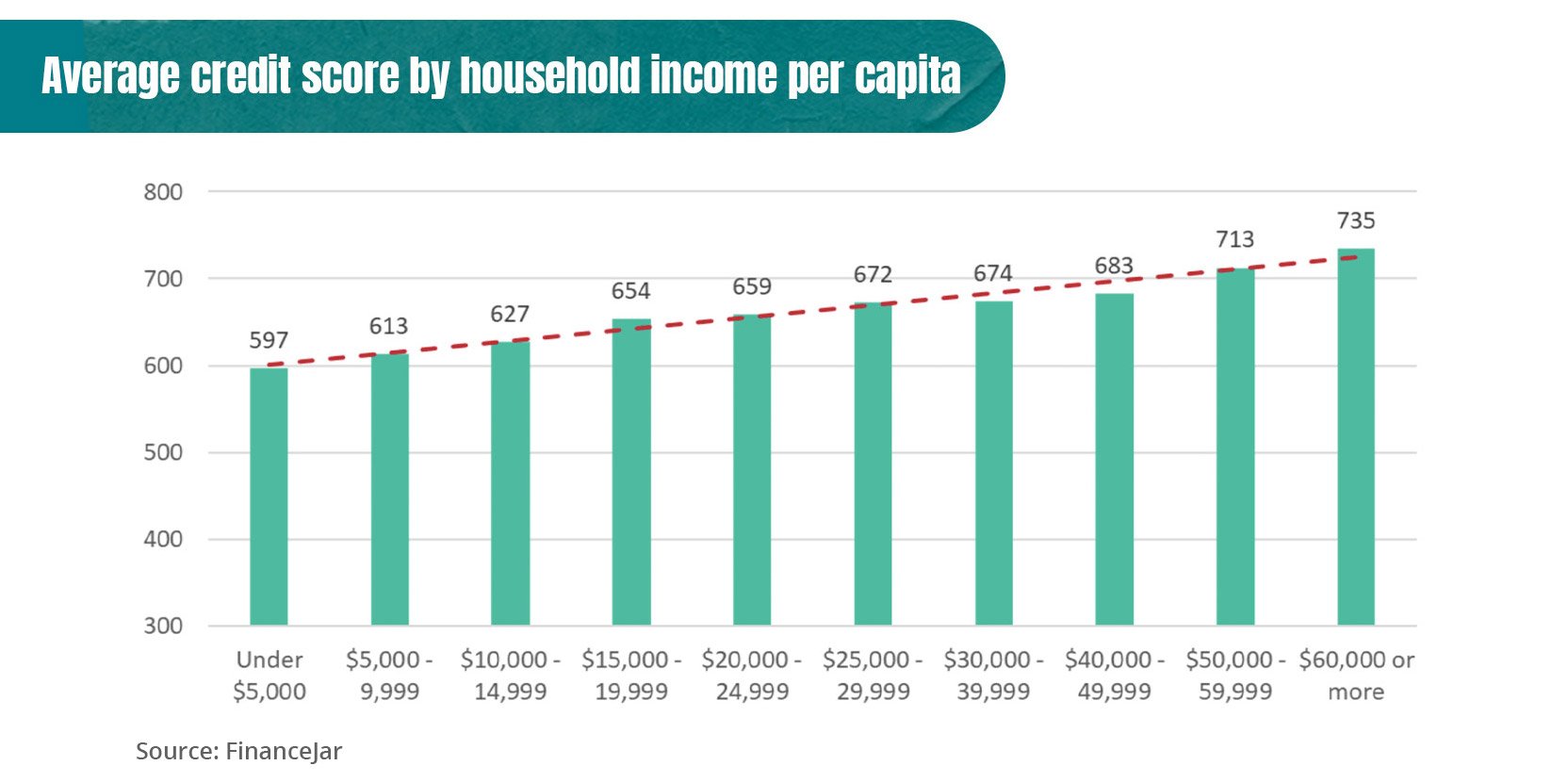

We asked respondents about their yearly incomes. We found a clear correlation between income level and credit score, which matched our expectations—the relationship between income and credit is well established.

Average Credit Scores by Income Levels

On average, an increase in income of $10,000 per year was associated with a credit score increase of 28 points.

Why is a higher income correlated with a higher credit score?

Superficially, the relationship between income and credit looks simple. There are at least 5 factors that go into the calculation of your credit score, but it’s mainly a reflection of just two:

- The payment history on your credit report—e.g., whether you’ve historically paid your bills on time or you have a lot of derogatory marks, such as late payments, on your report.

- How responsible your current credit use is—do you keep your spending at a reasonable level or do you habitually max out your credit cards?

Obviously, it’s easier to pay off your bills and avoid overspending when your income is higher. That seems like it might explain the correlation between income level and credit score, with no further analysis needed.

Correlation vs. causation

However, it’s important to remember that correlation isn’t the same thing as causation. In other words, it’s tough to say whether a higher income really makes it easier to manage your credit, or whether it’s just associated with better credit health for other reasons.

For instance, it could also be that people who are already managing their credit well have a better chance of becoming high earners (e.g., because they have soft skills that make it easier to land a high-paying job).

Really breaking down the causal relationship (or lack thereof) between income and credit would require more research. It’s important to bear in mind the difficulty of interpreting complex data when you read articles like this one.

What is the relationship between credit score and education?

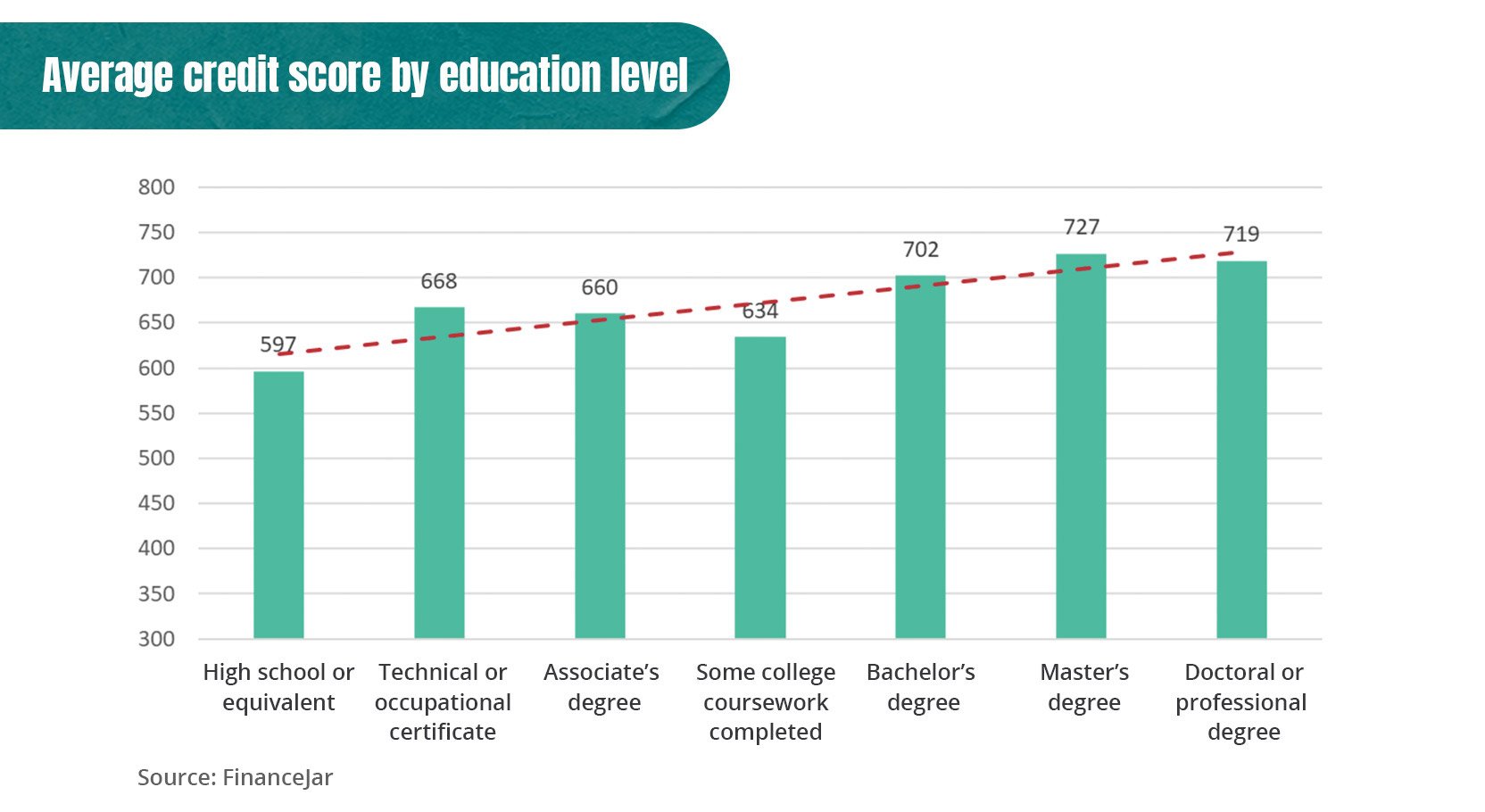

We also asked our survey respondents about their education levels. Our results here were unsurprising—the higher your education level, the better your credit score is likely to be.

Correlation Between Credit Score and Education Level

It’s possible to sort respondents into three loose “clusters” based on whether they had:

- A high school degree only: Only having a high school diploma or a GED (with no college coursework completed at all) was associated with having a relatively bad credit score of below 600.

- Some higher education: Respondents who had completed some higher education but hadn’t obtained a bachelor’s degree generally had fair credit scores (in the 600s).

- A college degree: Respondents with a bachelor’s degree or higher tended to have good credit scores of 700 and above.

Why is a higher education level correlated with a better credit score?

Again, there are several possible explanations for this relationship. We’ve listed a few:

- People with higher degrees are in a better position to land high-paying jobs, which makes it easier for them to pay their bills on time.

- People with healthier finances (and better credit) are better able to afford to pursue higher education, which can be expensive.

- Pursuing higher education teaches you some of the skills necessary to manage credit responsibly.

- People who pursue higher education tend to have personalities that make them more likely to care about responsible credit use.

These aren’t the only possibilities, of course. The real reason could also be something else entirely, or a combination of several factors.

What is the relationship between credit score and age?

It’s no secret that credit scores tend to increase with age. Sure enough, the data we collected supported this. Consumers aged 60 or above had scores almost 100 points higher than those in their 20s or 30s.

Credit Scores by Age

On average, every 10 years of age corresponds to an 18-point increase in your score.

Why is age correlated with a better credit score?

It’s easy to speculate that older people are more financially established, which translates to a better credit score. This is probably true—in particular, people from older generations are likely to be better-off than millennials and Gen Z, who have had their incomes depressed by the 2008 financial crisis and the COVID-19 pandemic. 1

However, there’s another (very simple) reason why older people tend to have better credit scores: the length of your credit history is a factor that directly contributes to your score. People in their 20s and 30s just haven’t had as long to establish credit, so their scores will necessarily be lower.

Interestingly, in our data, the scores of consumers aged 70 years or older dropped off from the peak of 730 (the average score in the 60–69 demographic). This may be because they’re more likely to be retired and have lower incomes, or simply because they’re less likely to take out loans and actively use credit, which may skew their results.

What is the relationship between credit scores and race?

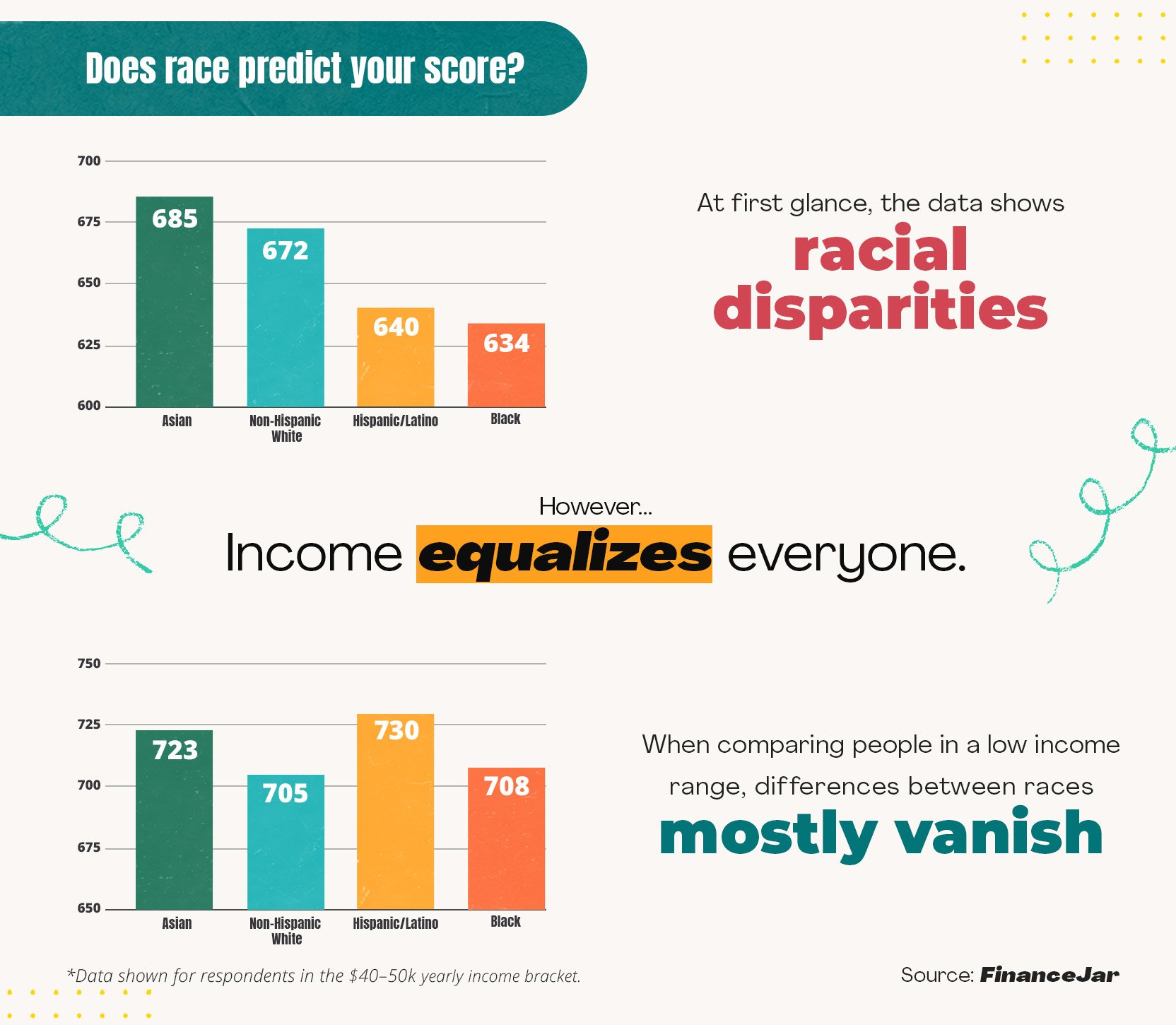

It’s also an established fact that credit scores are correlated with race. This arguably isn’t very surprising, as race is deeply entangled with other socioeconomic factors, such as income and education.

These factors affect credit scores (albeit indirectly) to the extent that some people have even concluded that the credit scoring system is rigged against minorities.

In our survey, Non-Hispanic white and Asian respondents had scores that were about 40 points higher than Black and Hispanic/Latino respondents on average.

Relationship Between Race and Credit Score

Interestingly (and somewhat surprisingly), we found that when you correct for income, the differences become much smaller. For example, respondents in the 30–40k income bracket had remarkably similar credit scores, regardless of race.

Relationship Between Race and Credit Score (Corrected for Income)

In other words, the main reason that white respondents had higher credit scores than Black and Hispanic respondents was that they had higher incomes on average.

However, there’s one exception: Asian respondents had disproportionately high credit scores in three of the middle-income brackets. The data we collected is too limited for us to speculate why this might be, but there’s a very clear pattern.

What is the relationship between credit scores and body mass index (BMI)?

We also asked respondents to give us their weights. We were curious to see if there was a relationship between body mass index (BMI) and credit scores.

What we expected

We hypothesized that being overweight would predict having a low credit score. As we’ve shown, having poor credit is correlated with having a low income, and we reasoned that low-income individuals are more likely to:

- Work jobs that give them less control over their schedules, leaving them with less time to cook for themselves.

- Have trouble affording high-quality meals and ingredients.

- Live in food deserts, giving them limited access to fresh, healthy food in the first place. 2

- Be stressed (some studies have found a correlation between work-related stress and obesity, although the relationship is inconsistent). 3

These seemed like reasonable guesses to us. However, the data didn’t match our expectations. We found no clear correlation between having poor credit and being overweight.

Relationship Between BMI and Credit Score

As you can see, obesity (having a BMI of >30) is correlated with having a somewhat (although not drastically) lower credit score. However, respondents in the “Overweight” category (with BMIs of 25–30) actually had the highest average credit score, at 677, 12 points higher than respondents in the “Normal” category.

A further increase in BMI (to the point of advancing into the “Obese” category) was associated with a 28-point drop in score.

The formula for body mass index is BMI = kg/m^2

Your body mass index is equal to your weight in kilograms divided by your height in meters squared. BMI is a simple measure and doesn’t look at your actual body composition (for instance, muscle is heavy, so athletic but muscular people often technically fall into the Overweight category). While BMI is useful for research purposes, it doesn’t mean much when it comes to individuals.

How income affects the credit/BMI relationship

To better understand our findings, we broke the data down by income level:

Relationship Between BMI, Credit Score, and Income

The pattern described above (credit scores peaking in the Overweight category) was fairly consistent across different income levels, with two exceptions:

- <10k USD: Respondents who reported incomes under $10,000 had uniformly bad credit scores that fell into a fairly narrow range.

- 30k–50k USD: The pattern in this category was completely different—BMI was inversely correlated with credit score (i.e., the less that respondents weighed, the better their scores).

In all other income brackets the trend was clear: being slightly (but not seriously) overweight was associated with having a higher credit score.

How gender affects the BMI/credit relationship

We also broke the data down by gender and found that the credit score/BMI relationship differed between men and women.

Among women, having a normal BMI was associated with having better credit, and obesity was correlated with a depressed credit score.

Relationship Between BMI and Credit Score (by Sex/Gender)

In other words, women actually showed the pattern that we expected. It was mainly among men that it ran contrary to our expectations.

Why was our hypothesis wrong?

We discovered at least one possible reason why the relationship between BMI and credit wasn’t what we expected: we overestimated the degree to which low income predicts obesity.

BMI by Income Level

As you can see, being wealthier doesn’t necessarily translate to having a lower BMI. It’s true that in our survey, the two lowest income brackets reported the highest rates of obesity, but we found that the next-highest rate of obesity was found in the highest-income group (those making $60,000 USD or above).

Moreover, the relationship between income and weight was fairly ambivalent across the board. The prevalence of each BMI category does change based on income level, but not in a very predictable way.

Put another way: a lot of Americans are overweight or obese, regardless of how wealthy they are.

Our survey results are consistent with the academic research that has been done on this topic. Data from a 2005–2008 survey by the National Center for Health Statistics (NCHS) showed that among men, obesity is about equally prevalent at all income levels, but among women, it’s concentrated among lower earners. 4 This survey affirms the findings of a 1989 review of 144 studies on socioeconomic status and obesity. 5

Our hunch is that this explains why women showed the trend that we expected, but men did not.

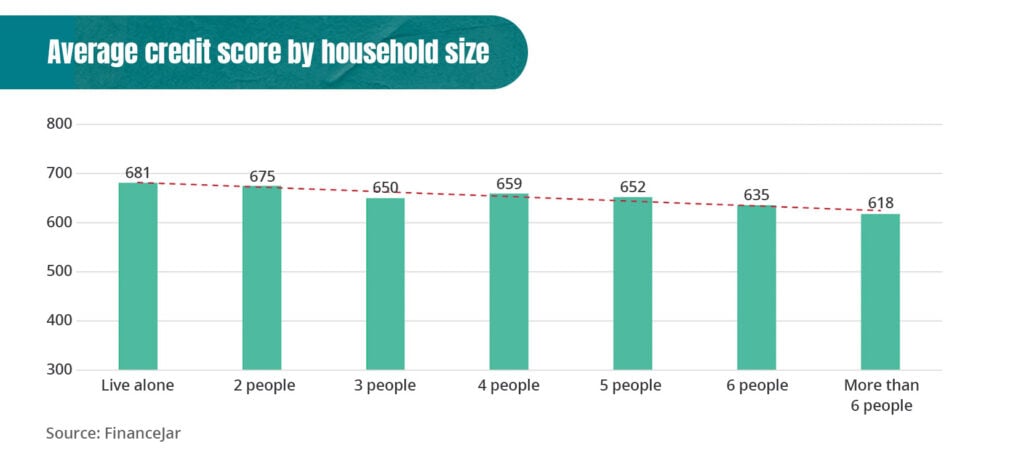

What is the relationship between credit score and household size?

We also investigated the relationship between household size and credit score. It turns out that there’s a strong inverse correlation. Consumers from larger households reported significantly lower credit scores.

Relationship Between Household Size and Credit Score

There are several possible explanations for this. Our best guess: respondents from larger households have more dependents, which obviously implies they also have heftier financial obligations.

As delightful as having a large family can be (for some of us, anyway), as it turns out, it might not be the best thing for your credit.

Takeaway: There’s a relationship between credit scores and age, race, and income, but no clear relationship between credit scores and BMI.

- Statistically speaking, the older you are, the better your credit score is likely to be.

- Unsurprisingly, a higher income also predicts a better credit score.

- Our findings on race and credit were consistent with earlier studies that we’ve read: white and Asian consumers have higher credit scores on average. However, the relationship becomes much more complex when you correct for income.

- The relationship between credit and body mass index is complex. Respondents in the Overweight BMI category actually had the highest scores on average.

- People from larger households tend to have lower credit scores on average.