You’ve probably heard that it’s a good idea to regularly check your credit reports. If so, you’ve probably also heard that you can do that on AnnualCreditReport.com.

Given how widespread credit repair scams are, it’s understandable if you’re wondering whether checking your credit on this website is safe. Fortunately, it is—AnnualCreditReport is a legitimate website. However, there are other fraudulent sites which look very similar to it, so when you check your credit report, be careful.

Table of Contents

What is AnnualCreditReport.com?

AnnualCreditReport.com is a website that provides consumers with free access to their credit reports from each of the three major credit bureaus in the US (Experian, TransUnion, and Equifax).

The three credit bureaus jointly created AnnualCreditReport.com after the Fair and Accurate Credit Transactions Act (FACTA) was passed in 2003. This act affirmed that US citizens have the right to review their credit reports from each of the major credit bureaus free of charge once per year. 1

You can now access your credit reports for free once per week

Normally, you can only get your free credit reports once per year. However, due to the COVID-19 pandemic, you can access free copies of your credit report once per week until the end of 2022. 2

Is AnnualCreditReport.com legitimate?

Yes, AnnualCreditReport.com is legitimate. In fact, it’s the only website authorized by federal law to provide your free annual credit reports. 3

AnnualCreditReport.com is also safe to use. The site uses encryption protocols (SSL) that protect your data from being stolen. 4

However, fraudsters sometimes create “imposter” sites that look very similar to AnnualCreditReport.com, so when you check your credit, pay attention to make sure that you’re on the right site. We explain how to avoid credit check scams near the end of this article.

Does AnnualCreditReport.com hurt your credit?

No, AnnualCreditReport.com won’t hurt your credit score. This is because reviewing your own credit report is considered a soft credit check, also known as a “soft inquiry.” This is different from the hard inquiries that lenders run when you apply for new credit accounts.

While hard inquiries can lower your credit score by a few points, soft inquiries don’t hurt your credit, and they’re not visible to potential lenders. 5 As far as your credit score is concerned, there’s no downside to checking your credit reports as often as you want.

How to obtain your free report from AnnualCreditReport.com

You can get your free credit report by opening this link to AnnualCreditReport.com and then following these four steps:

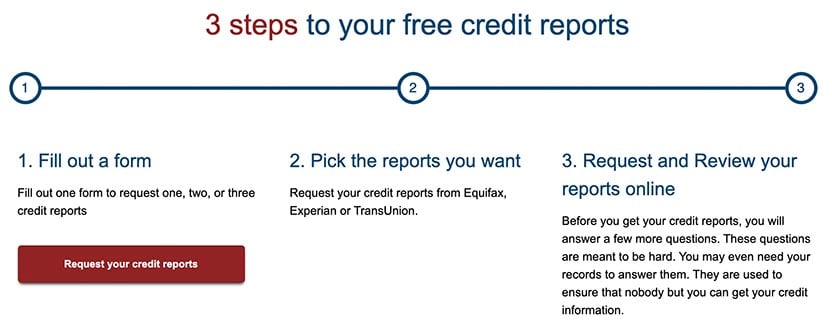

1. Navigate to the form for requesting credit reports

First, click on the button that says “Request your free credit reports.”

You’ll need to click the same button again on the next page as well.

2. Provide your personal information

Next, you’ll be taken to an online form where you’ll be asked to provide the following personal information:

- Name

- Social Security number

- Address (and your previous address if you’ve moved recently)

- Birthdate

Enter the requested info and click the “Next” button.

3. Decide which credit reports you want to request

On the next page, you’ll be asked which credit report you want to access. You can choose to get your credit reports from one, two, or all three credit bureaus. If you request your report online, you should be able to access it immediately. 6

4. Answer security questions to verify your identity

On the final page, you’ll need to answer a few security questions about your finances, such as what your monthly mortgage payments are (if you have a mortgage). You may need to repeat this step for each report you request.

AnnualCreditReport warns that you may need to check your records to answer these questions because they’re deliberately designed to be difficult to answer so that no one except you can access your credit reports.

Can I check my past credit reports on AnnualCreditReport.com?

No, you won’t be able to access your old credit reports on AnnualCreditReport.com or on any other free credit reporting site. However, all of your historical credit information is included in your latest credit reports, so there’s no need to get past reports to compare with new ones.

AnnualCreditReport.com won’t give you your credit score

If you want to check your credit score, take a look at your credit card or loan billing statements—many creditors provide free credit scores to customers. Alternatively, you can pay for a credit-monitoring service, access your FICO score for free on the credit bureaus’ websites, or consult a non-profit credit counselor. 7

How to check your credit report safely

When you check your credit report, be on the lookout for potential scammers and read the fine print before signing up for credit-monitoring services.

Watch out for “imposter” sites

The Federal Trade Commission warns against fraudulent websites with names that look similar to AnnualCreditReport.com, such as “annualcreditreports.com.” Some may even deliberately misspell AnnualCreditReport.com so that their URL looks very similar (for instance, by spelling “credit” with an L instead of an I). 3

In 2005, the World Privacy Forum conducted two studies that found that there were 223 fraudulent sites like this. Many have since been shut down, but some might still be around. 8

How to avoid credit report scams

To avoid scams, take the following precautions:

- Check for spelling mistakes: If you use a credit reporting website, check the address bar to see if the URL has any spelling errors. Do not proceed if there’s anything that looks suspicious.

- Check for “http://”: Be wary of sites with web addresses that begin with “http” rather than “https” because these sites are less secure.

- Navigate to AnnualCreditReport directly: It’s safest to navigate to AnnualCreditReport.com by typing the address into your browser rather than by clicking on links provided on external sites or in emails you’ve received. These types of links are more likely to lead you to fraudulent sites.

- Protect your sensitive data: It’s a good idea to keep important identifying details like your Social Security number and your birthday private and avoid sharing them on social media.

- Use secure passwords: Remember to use secure passwords on all of your personal computers and mobile devices. You can use a password manager like LastPass to make it easier to use different passwords for everything.

- Consider getting your reports offline: To ensure you don’t visit a fraudulent site, you can also get your credit reports over the phone or via mail. Note that you should still be cautious when doing so. Don’t talk to unidentified callers, be wary of phone calls or emails from anyone who claims to represent AnnualCreditReport.com or a credit bureau, and don’t give them any personal information unless you were the one who called them.

How to get your AnnualCreditReport.com report offline

To get your credit reports offline, you can make your request:

- By mail: You can download a form from the AnnualCreditReport.com site and mail it to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

- By phone: You can call +1 (877) 322-8228 and then go through a verification process over the phone to get your report sent to you.

In addition to being safer, this is a good option if you’re having trouble using the AnnualCreditReport.com site (for example, if you answered the security questions correctly and were still told your identity couldn’t be verified—a problem some consumers have reported). 9

Is it safe to check your credit on other websites?

AnnualCreditReport.com isn’t the only place to get free credit reports. You can also get them directly from the websites of the three credit bureaus—Experian, TransUnion, and Equifax. Doing so is usually safe, as long as you follow the tips above to make sure the site is legitimate.

However, if you get your credit report from another website, make sure you read their terms of service carefully. Many sites lure in customers with the offer of free credit reports but actually charge fees. For example, Consumerinfo.com, Inc., which was doing business as Experian Consumer Direct, got into trouble with the FTC in 2005 for using deceptive means to charge people for credit reports that should have been free. 10

Experian still runs several sites that provide credit reports, including:

- FreeCreditScore.com

- FreeCreditReport.com

- Credit.com

Despite their names, these sites aren’t necessarily free (often the credit report itself will be, but to get it, you have to sign up for other services that are paid). Read the fine print and only sign up for paid services that you’re actually interested in.

Takeaway: AnnualCreditReport.com is a website that offers safe access to your free credit reports.

- AnnualCreditReport.com was established by the three major US credit bureaus (Experian, Equifax, and TransUnion) to provide free consumer credit reports.

- AnnualCreditReport.com is a legitimate and secure site, and it’s the only website authorized by the federal government to issue free consumer credit reports.

- You can also request your free credit reports online from the credit bureaus or by mail or phone. Ordering your report over the phone is arguably slightly safer.

- To protect yourself from fraudsters and scammers, carefully inspect website URLs, avoid clicking on unverifiable links, and be careful who you share identifying information with.