Table of Contents

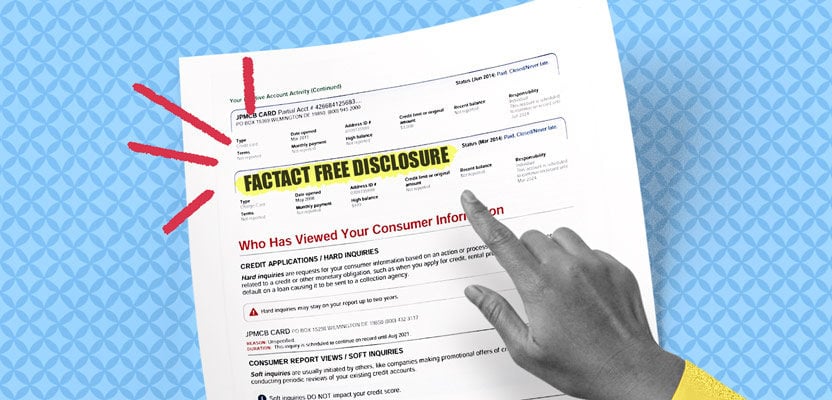

What is Factact Free Disclosure on my credit report?

“Factact Free Disclosure” refers to the FACT Act, which is the acronym for the Fair and Accurate Credit Transactions Act of 2003. Factact Free Disclosure will appear on your TransUnion, Experian, or Equifax credit report if you requested a free copy of your credit report.

What is the FACT Act?

The FACT Act is a federal law designed to make it easier for consumers to access their credit reports from the major US credit bureaus and ensure their accuracy. The law was enacted on December 4, 2003, as an amendment to the Fair Credit Reporting Act. 1

Here’s a summary of the key rights you’re given under the FACT Act:

- Free access to your credit reports from the major credit bureaus once per year

- Notification when your credit information is used for “risk-based pricing” (e.g., when a creditor looks at your credit to determine what interest rate to offer you on a loan)

- The right to place a fraud alert on all of your credit reports

- The right to request your credit score from each bureau and receive information on how it was calculated

Along with the FACT Act came the establishment of AnnualCreditReport.com, which is a federally approved site for requesting credit reports.

Due to COVID-19, you can now get free credit reports once per week

To help alleviate some of the stress on consumers, Equifax, TransUnion, and Experian are now offering one free credit report each week through the end of 2022.

Does Factact Free Disclosure hurt my credit?

No, Factact Free Disclosure won’t hurt your credit. This is because it only appears when you’ve requested a free annual copy of your credit report, and the credit bureaus don’t want to penalize consumers for being responsible and monitoring their credit.

In general, there are two types of inquiries that can appear on your credit report:

- Hard inquiry: You’ll see a hard inquiry on your credit report if you actively applied for new credit, such as a new credit card, a car loan, or a mortgage.

- Soft inquiry: You’ll see a soft inquiry on your report if you checked your own credit or if someone checked your credit for reasons unrelated to a credit application. When landlords and insurers run your credit, it usually counts as a soft inquiry. So do the checks that lenders run (on their own initiative) when deciding whether or not to preapprove you for a credit card.

The main difference between hard and soft inquiries is that hard inquiries will bring your credit score down by a few points, whereas soft inquiries don’t affect your credit score at all.

Checking your own credit triggers a soft inquiry, which does not negatively affect your credit score. What’s more, lenders are only able to see hard inquiries, not soft inquiries. 2 This means that there’s no downside to checking your own credit.

It’s sometimes a good idea to try to remove hard inquiries from your credit report, but there’s no need to take action against a Factact Free Disclosure item unless you didn’t request a free credit report (in which case the inquiry might be a sign of fraud).

What to do if you didn’t request a free credit report

If you see Factact Free Disclosure on your credit report but you didn’t request a copy of your credit report, then it could be a sign of identity theft.

If you suspect that someone’s stolen your identity, then there are a few steps you need to take:

- Report the identity theft to the Federal Trade Commission (FTC). Go to www.identitytheft.gov and answer the questions to generate an identity theft report and recovery plan.

- Contact one of the credit bureaus (Equifax, Experian, or TransUnion) and have a fraud alert placed on your credit report.

You only need to contact one of the three bureaus to have a fraud alert placed on your credit report. The bureau you contact will coordinate with the other two, and your fraud alert will be acknowledged by all three. 3

If you don’t plan on applying for credit in the near future, you might also want to place a credit lock or credit freeze on your account, which will prevent anyone from applying for credit in your name. In contrast to placing a fraud alert, you’ll need to contact all three bureaus individually to do this.

Carefully monitor your credit reports in order to catch identity theft as early as possible. The sooner you report it, the less damage will be done.

Takeaway: You’ll see Factact Free Disclosure if you requested a free copy of your credit report.

- Factact Free Disclosure is named after the Fair and Accurate Credit Transactions Act (FACT Act) of 2003, which allows consumers free access to their credit reports.

- Factact Free Disclosure will only show up on your credit report as a soft inquiry, meaning it won’t hurt your credit and won’t be visible to lenders.

- If you see Factact Free Disclosure but you didn’t request a copy of your credit report, then you might want to issue a fraud alert in case your identity has been stolen.