Table of Contents

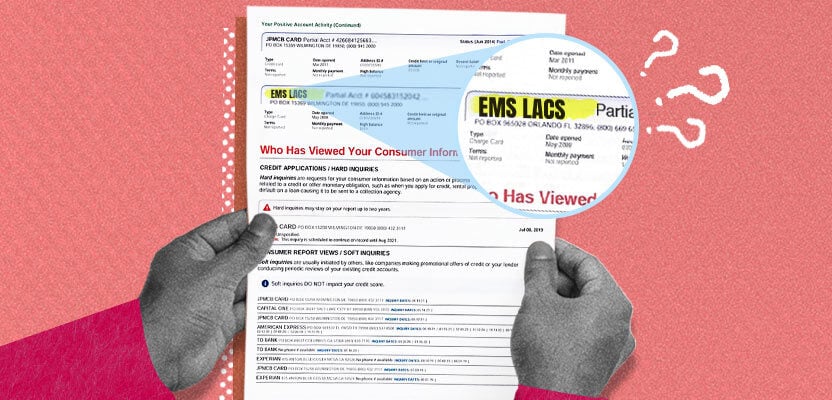

What is EMS LACS on my credit report?

EMS LACS stands for Equifax Mortgage Services.

Equifax Mortgage Services is a branch of credit bureau Equifax that provides consumer credit information and data analysis services to mortgage lenders. They offer credit reports, financial records, employment history, and other information. 1 2

If you see EMS LACS on your credit report, you probably applied for a mortgage recently and your lender used Equifax Mortgage Services to review your credit history.

EMS LACS can also appear on your credit report under these names:

- EMS

- Equifax MTG

- EMS Atlanta

- Equifax Mortgage Services

- Equifax Mortgage Solutions

Equifax Contact Information

If you want to remove EMS LACS from your credit report, write to their address:

Address: P.O. Box 740256

Atlanta, GA 30374-0256

Phone Number: (866) 349-5191

Website: www.equifax.com

Disputing an incorrect entry on your credit report can be stressful and difficult. Consider working with a professional.

Is EMS LACS a scam?

No, EMS LACS isn’t a scam—Equifax Mortgage Services is a legitimate organization. If their name is on your credit report, it probably indicates that a lender used their services to check your credit.

If you’re certain that there’s activity on your credit report under EMS LACS that shouldn’t be there, it’s possible you’ve been the victim of identity theft.

We’ll discuss the reasons (both legitimate and fraudulent) that EMS LACS might be on your credit report in more detail in the next section.

Why is EMS LACS on my credit report?

EMS LACS is probably appearing on your credit report as an inquiry. There are really only two reasons why you’d have a EMS LACS inquiry:

1. You applied for credit

You’ll see EMS LACS on your credit report if your prospective lender used one of the company’s products to run a credit check on you to determine whether or not to extend you credit. There are two possible ways that an inquiry can appear on your credit report:

- Hard inquiry: You’ll see a hard inquiry on your credit report if you actually applied for new credit, such as a car loan or mortgage.

- Soft inquiry: You’ll see a soft inquiry on your report if someone checked your credit for reasons unrelated to credit applications or to prequalify you for an installment loan or other type of credit.

The main difference between hard and soft inquiries is that hard inquiries will bring your credit score down by a few points, whereas soft inquiries don’t affect your credit score.

2. Someone stole your identity

If you see a EMS LACS credit inquiry on your credit report but you didn’t apply for credit, then it could be a sign of identity theft. If you suspect that someone’s stolen your identity, then there are a few steps you need to take:

- Contact Equifax Mortgage Services or the company that used their services to check your credit and gather the details of the application.

- Report the identity theft to the Federal Trade Commission (FTC). Go to www.identitytheft.gov and answer the questions to generate an identity theft report and recovery plan.

- Contact the relevant credit bureaus (Equifax, Experian, or TransUnion) and have a fraud alert placed on your credit report.

You only need to contact one of the three bureaus and have a fraud alert placed on your credit report. The bureau you contact will coordinate with the other two, and your fraud alert will be acknowledged by all three. 3

Carefully monitor your credit reports in order to catch identity theft as early as possible. The sooner you report it, the less damage will be done.

How does a EMS LACS inquiry affect my credit score?

Hard inquiries have a small, short-term effect on your credit score. However, too many hard inquiries can significantly lower your score and make it difficult to get approved for new lines of credit at competitive rates.

How much a EMS LACS credit pull actually affects your credit score depends on your credit history and how recent the inquiry was. Hard inquiries usually cause a small drop in your FICO or VantageScore credit score, but the effect shouldn’t last more than a year. 4 What’s more, they won’t stay on your credit report for more than two years.

How to remove EMS LACS from my credit report

If you want to delete EMS LACS from your credit report, then try one of these two approaches for removing hard inquiries from your credit report.

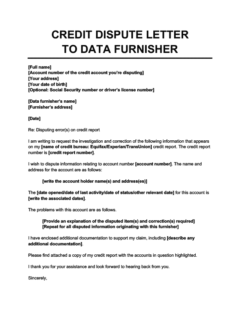

1. Send a dispute letter

If you suspect that your EMS LACS inquiry is a mistake, then you can send a dispute letter to the credit bureaus. You should also send a dispute letter if you think that EMS LACS is on your credit report due to fraudulent activity or identity theft, but you should first file a report with the FTC and follow the other steps outlined above.

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else. Use this credit dispute letter template to file a dispute with a creditor or debt collector. If you recognize a credit account but it's listed with the wrong balance or incorrect status (e.g., if you settled the debt and it's still listed as unpaid), the error may have originated with your data furnisher.

Credit Dispute Letter to a Credit Bureau

Credit Dispute Letter to a Data Furnisher

Once you’ve filed a dispute, the credit bureau will be required to investigate and correct any inaccurate information on your report, usually within 30–45 days. 5

2. Use a credit repair company

A credit repair company will act as a middleman between yourself and your creditor, Equifax Mortgage Services, and/or the credit bureaus. A credit repair professional might be able to get a EMS LACS hard inquiry off your credit report by helping you gather all the required documents and evidence and doing the hard work for you by handling your communications with your creditor and the credit bureaus.

However, be wary of scammers. By law, credit repair companies are not allowed to make false promises or charge you before they’ve helped you. 6 Moreover, while hiring a credit repair company can save you some time and hassle in disputing items on your credit report, they won’t necessarily be able to erase valid inquiries or turn a bad credit score into a good credit score overnight.

In many cases, credit repair companies won’t be able to do anything for you that you couldn’t do yourself, so consider whether it’s worth paying for a third party to help you get EMS LACS off your credit report.

Takeaway: EMS LACS is a credit reporting agency that runs credit checks on behalf of lenders.

- If you see EMS LACS on your credit report, it means that you recently applied for new credit and your prospective lender used Equifax Mortgage Services’s services to assess your creditworthiness.

- Like any hard inquiry, your EMS LACS inquiry will probably cause a small drop in your credit score. However, the effect is temporary, and the inquiry will disappear after 2 years.

- If you think the EMS LACS inquiry on your credit report is a mistake, then you can get it removed by disputing it with the credit bureaus or getting help from a credit repair company.

- If you haven’t made any credit applications and you suspect that the EMS LACS inquiry is the result of identity theft, then file a report with the Federal Trade Commission.