Table of Contents

What is a hard inquiry?

Hard inquiries (also known as hard pulls) are a type of credit check. They appear on your credit report when you apply for a new credit account, such as a loan or credit card.

Hard inquiries lower your credit score by a few points. Although they stay on your credit report for up to two years, the effect on your score is shorter, lasting up to six months for your VantageScore credit score and up to a year for your FICO score. 1 2

For that reason, only apply for credit when you need it to avoid triggering too many hard inquiries.

Hard inquiries vs. soft inquiries

Hard inquiries are distinct from soft inquiries, which are credit checks that aren’t from lenders. Landlords and employers often conduct soft inquiries as part of routine background checks. Unlike hard inquiries, these don’t affect your credit score because they’re unrelated to applications for new credit.

How to remove inquiries from your credit report

There’s no way to remove a legitimate hard inquiry from your credit report (before it falls off your report on its own, that is).

However, if the hard inquiry is an error that shouldn’t actually be on your credit report, then you can file a dispute with the credit bureaus that are reporting it. If you’re successful, they’ll remove it from your report and your credit score will immediately recover.

What causes illegitimate hard inquiries to appear on your credit report

Illegitimate hard inquiries usually appear on your credit report for one of three reasons:

- An identity thief opened new credit lines under your name

- A company ran a hard inquiry on you without your consent

- Someone made a clerical error

Whatever the cause, if the hard inquiry is an error, then getting it removed will be free and relatively simple. Follow the steps below to remove these inquiries from your credit report.

If you’ve been the victim of identity theft, take steps to protect yourself

If you think the erroneous hard inquiry is the result of identity theft, immediately freeze your credit and file a report at IdentityTheft.gov. You should also change all of your passwords and directly contact your lenders, credit card issuers and your bank as well.

1. Check your credit reports

To check your credit report, you can directly contact the major credit bureaus (Equifax, Experian, and TransUnion). Alternatively, you can get your reports from AnnualCreditReport.com. Although some sites like this are scams, AnnualCreditReport.com is perfectly safe (and is actually authorized by the federal government to provide free credit reports to consumers).

Read through your credit report and look for suspicious hard inquiries, such as inquiries from lenders that you don’t recognize or that appear to be duplicated.

Note that an inquiry may be legitimate despite appearing suspicious at first glance. Here are two common scenarios in which this can happen:

You bought a car from a dealership

You may notice multiple hard inquiries in a short period after taking out an auto loan to buy a car. This indicates that the dealership sent your application to multiple lenders to find the best deal.

Although you’ll receive multiple hard inquiries in situations like this, they’ll count as one for the purpose of your credit score. When you receive multiple hard inquiries for a certain type of loan (such as an auto loan or mortgage) within a short period, both FICO and VantageScore treat them as a single inquiry. This way, you’re not penalized for shopping around to find the best rates.

FICO’s shopping period is 14 days in older models and 45 days in newer models, whereas VantageScore’s is 14 days. 3 4

You applied for a store credit card

Retailers often enlist third-party services to run hard inquiries when you apply for store credit. In this case, the name of the company on your report may be unfamiliar.

Check your email for the creditor’s name

To find out whether you authorized a particular hard inquiry, do an email search for the company in question. If you find you did send that company an application, check whether you authorized them to make an inquiry by rereading the terms and conditions.

2. Contact the original lender

If you find a hard inquiry that you believe isn’t legitimate, contact the creditor responsible. Explain the situation and ask them to remove the inquiry from your report. If this works, this will allow you to avoid filing a formal dispute with the credit bureaus.

Make sure to clarify which hard inquiry you want to remove. Give the creditor the date it appears on your report and any other identifying details you can.

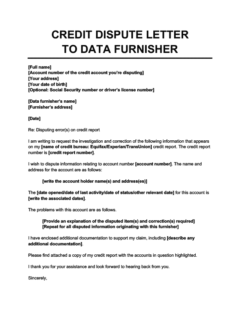

Credit Dispute Letter to a Data Furnisher

Use this credit dispute letter template to file a dispute with a creditor or debt collector. If you recognize a credit account but it's listed with the wrong balance or incorrect status (e.g., if you settled the debt and it's still listed as unpaid), the error may have originated with your data furnisher.

3. File a dispute with the credit bureaus

If your creditor won’t remove the hard inquiry from your report, contact the credit bureau(s) that provided the report with the mistaken inquiry and dispute your credit report.

File your dispute in writing by sending a dispute letter. You can either file online or by sending an actual letter. If you file your dispute by mail, keep another copy for your records. Doing so provides you with documentation, which makes it easier to take legal action later if you need to.

You can also file a dispute over the phone, but this makes it harder to document the process, so it usually isn’t advisable.

You can get a dispute letter template from the Federal Trade Commission.

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

Be sure to include the following items and information in your letter:

- Your name, address, Social Security number, and date of birth

- The date that you wrote the letter

- Details of the dispute (including the name of the lender and the credit bureau whose records you’re contesting)

- A description of the inquiry

- The credit report in question with the inquiry clearly indicated

- A request for prompt removal

Also, attach any other documents that will help you make your case. For example, you can include an identity theft report, supporting documentation from your creditor, and bank statements. You won’t get these documents back, so send copies, not the originals.

Is it better to dispute online or by mail?

There are mixed opinions among experts about whether it’s better to dispute by mail or online. Each approach has its pros and cons.

Pros and cons of disputing by mail

Many experts recommend disputing by certified mail because it provides a clear paper trail with dates and proof of receipt. However, it does have downsides. For example, it takes longer for your dispute to be received and processed, and you could be at risk of identity theft in the (unlikely) event that your letter is misdelivered or stolen.

Pros and cons of disputing online

Disputing your credit report online is quick and convenient, but it also comes with downsides that you should carefully consider. For instance, online dispute forms sometimes limit your options when it comes to describing your situation. This might prevent you from accurately explaining why you believe the hard inquiry is invalid.

More importantly, filing a dispute online sometimes requires accepting terms and conditions that will waive your right to sue the credit bureaus. Equifax, Experian, and TransUnion all have binding arbitration clauses in their service agreements, which seriously limits your right to hold them legally responsible in court if they fail to properly handle your dispute. 5 6 7

You can sometimes opt out of these arbitration agreements, but you have to do so proactively, and there’s usually a time limit after which you cannot do so.

How to dispute hard inquiries with each credit bureau

You’ll need to file a dispute with each credit bureau that’s displaying the mistaken hard inquiry on your credit report.

In the table below, you’ll find all the information you need to file a dispute by mail, by phone, or online with Experian, Equifax, and TransUnion.

| Experian | Equifax | TransUnion | |

|---|---|---|---|

| Send a dispute letter | Experian P.O. Box 4500 Allen, TX 75013 | Equifax P.O. Box 740256 Atlanta, GA 30374-0256 | TransUnion Consumer Solutions P.O. Box 2000 Chester, PA 19016-2000 |

| What you’ll need to send | |||

| Dispute by phone | Call the number on your credit report. For assistance, call Experian's National Consumer Assistance Center at 1-(888) 397-3742. | Call (866) 349-5191 Hours: Monday–Friday 9 AM–9 PM EST Saturday–Sunday 9 AM–6 PM EST | Call (833) 395-6941 Hours: Monday – Friday 8:00 AM – 11:00 PM ET |

| Dispute online | Experian's online dispute form | Equifax’s online dispute form | TransUnion’s online dispute form |

4. Wait for a verdict

The credit bureaus are required to resolve your dispute within 30 to 45 days. They’ll correct your records if they determine that the hard inquiry was a mistake or if they’re unable to verify it. 8 9

If they reject your claim, consider getting help from a nonprofit credit counseling company. They may be able to help you with your claim or with repairing your credit in general. The National Foundation for Credit Counseling (NFCC), a non-profit company that offers credit counseling at relatively low rates, is a good resource if you need help.

Takeaway: You can get hard inquiries removed from your credit report by disputing them with the credit bureaus

- You can dispute hard inquiries you didn’t authorize to get them off your credit report, but the only way to remove an accurate hard inquiry is to wait until it comes off on its own after two years.

- Hard inquiries are caused by applications for new credit, such as a loan or credit card. They’ll usually only knock a few points off your credit score, and the effect will only last a few months.

- Multiple hard inquiries for the same type of loan are treated as one for the purpose of your credit score, as long as they’re made within a short span of time. This lets you shop around for loans without hurting your credit.

- Potential causes for an invalid hard inquiry include identity theft, unapproved credit checks, and clerical errors.

- Your dispute with the credit bureaus should be resolved within 30 to 45 days, and if the hard inquiry is unverifiable or inaccurate, they’ll remove it from your credit report.