If you’ve ever applied for a loan or credit card, then you’ve probably received a hard inquiry before—a mark that appears on your credit report when a lender runs a credit check on you. Hard inquiries drop your credit score by several points, but how long does this effect last?

The good news is that hard inquiries aren’t nearly as long-lasting and damaging as the other negative marks that can show up on your credit reports. Read on to find out exactly how long they last and what this means for your credit and finances.

Table of Contents

How long will a hard inquiry remain on your credit reports?

Hard inquiries stay on your credit report for up to 2 years. 1 After this period ends, they’ll be deleted from your credit history.

This is much shorter than the credit-reporting limit for most other items, which ranges from 7 to 10 years, with 7 being by far the most common. 2

Why don’t hard inquiries stay on your credit report for more than 2 years?

The reason hard inquiries don’t stay on your credit history for very long is that they mainly predict your financial behavior in the short term. They don’t necessarily suggest anything about your long-term borrowing habits.

The way the credit bureaus see it, applying for new credit might be a sign that you’re financially struggling (which could lead to overspending or making late payments). However, the longer you manage your new account responsibly, the less likely this is to be the case, so it doesn’t make sense to penalize you for hard inquiries for a long time.

How long do hard inquiries affect your credit score?

Although hard inquiries remain on your credit report for 2 years, they affect your credit score for a maximum of 12 months in FICO’s credit scoring model and 6 months in VantageScore’s.

Sometimes the damage can be even shorter-lasting—in many cases, your score will mostly or fully recover after just a few months.

Do hard inquiries lower your credit score while they’re on your report?

Yes, hard inquiries usually lower your credit score, but not by very much. The number of points a hard inquiry will take off your score depends on several factors, but usually your score will drop by no more than 5 points in FICO’s models and no more than 10 in VantageScore’s. As mentioned, even this small effect is temporary.

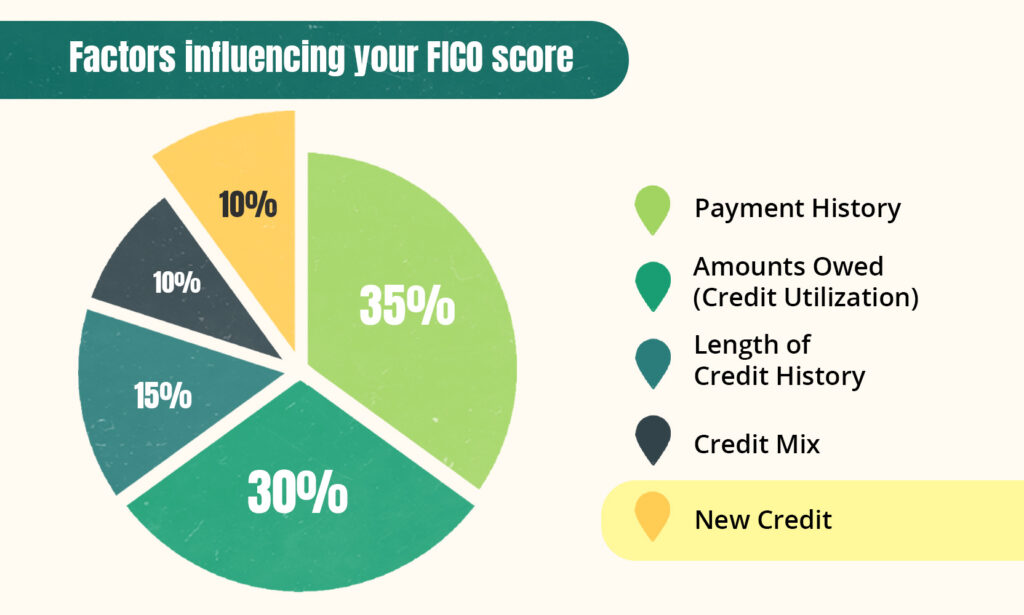

This is consistent with both models’ approaches to the pursuit of new credit, which, as shown in the tables below, is one of the least important factors used to calculate your credit score.

Small Impact of Hard Inquiries on Your FICO Score

Small Impact of Hard Inquiries on Your VantageScore

The upshot is that because hard inquiries have only a minor effect and fall off your credit report so quickly, you don’t need to worry about them too much. The exception is if you get too many hard inquiries in a short period.

Although there’s also no hard limit on how often you can apply for credit cards and loans, you should only apply for credit when you actually need it. This way, the number of inquiries on your report will remain reasonably low and your credit score won’t suffer.

Credit scoring companies don’t penalize you for rate shopping

FICO and VantageScore have a special rate-shopping window (or de-duping period) where multiple hard inquiries are treated as one. This means you won’t be penalized for comparing interest rates from different lenders, as long as you submit all your credit applications within a short period (14 to 45 days, depending on the scoring model used). 3 1

What to do about hard inquiries you don’t recognize

If you’ve noticed a hard inquiry on one of your credit reports that you don’t recognize, don’t panic. The most likely explanation is that you authorized a hard credit check with a lender or landlord and they used a third-party company to check your credit.

This can result in an unfamiliar name appearing on your credit reports. If you’re unsure, check this list of credit inquiries to find out what the inquiry code means and what company it’s associated with.

However, if you’re certain you didn’t authorize any credit checks at all, it’s possible that the hard inquiry is the result of identity theft.

Reporting fraudulent hard inquiries

If you think that someone has access to your personal information and may be trying to open credit accounts in your name, immediately follow these steps:

- Contact the company that made the hard inquiry. Tell them you didn’t authorize it, and ask for details about the circumstances leading to the credit check (e.g., who authorized it and what type of credit were they applying for?)

- Report the identity theft to the Federal Trade Commission (FTC). Go to www.identitytheft.gov and answer the questions to generate an identity theft report and recovery plan.

- Contact any of the three main credit bureaus (Equifax, Experian, or TransUnion) and have a fraud alert placed on your credit report. You only need to contact one of the bureaus, and they’ll coordinate with the others so that all three acknowledge your fraud alert.

You may also want to freeze your credit or get a credit lock to stop fraudsters from triggering any more credit inquiries. Make sure to carefully monitor your credit reports over the next few months for further signs of fraudulent activity.

Removing hard inquiries from your credit report

If you don’t want to wait 2 years for a hard inquiry to fall off your credit report on its own, then you may be able to get it deleted early. The main way to get hard inquiries deleted from your credit reports is to file a credit dispute with the letter below.

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

Credit disputes typically only work for inaccurate marks on your credit report (such as marks belonging to someone else or those arising from identity theft). They can’t remove legitimate marks—the only way to delete those is to wait 2 years for them to fall off your report naturally.

Takeaway: Hard inquiries stay on your credit report for 2 years, although they won’t affect your credit score for that long.

- Hard inquiries appear on your credit reports when you apply for credit, such as a loan or credit card. It shows potential lenders that you’re trying to borrow money.

- Hard inquiries cause a small drop in your credit score, but you’ll only lose a few points, and the damage won’t last more than a year.

- Unlike hard inquiries, soft inquiries appear on your credit report for reasons unrelated to credit applications, and they won’t hurt your credit score.

- If you see a credit inquiry on your credit reports that you didn’t authorize, file a fraud report and protect yourself by freezing or locking your credit.

- The main way to get hard inquiries removed from your credit report is to file a credit dispute. However, this generally only works with inaccurate marks on your credit report.