When you pursue the negotiation strategy known as pay for delete, you send a letter asking a creditor or debt collector to remove a negative mark, such as a collection account, from your credit report. In exchange, you offer to pay the debt associated with the mark.

Read on to learn how to use our pay for delete letter template to maximize your chances of success.

Table of Contents

Downloadable pay for delete letter templates

We offer two pay for delete letter templates below. Before downloading and sending either of them, check and make sure you really owe the debt in question, particularly if you’re dealing with a debt collector instead of your original creditor.

Collectors are obligated to validate debts within five days of contacting you about them. If you’re unconvinced by what they provide, send them a debt verification letter and consider disputing the item on your credit report.

While you’re investigating your debt, you should also check how old it is. Although pay for delete generally works better on old accounts, negative marks associated with debts fall off your credit report after 7 years. If your debt is approaching that threshold, negotiating pay for delete might not be necessary.

Pay for Delete Letter to Collector

Use this pay for delete letter template to ask a debt collection agency to remove a collection account from your credit report. Pay for delete works best on old debts in collection, so this is the scenario the strategy is most suited to.

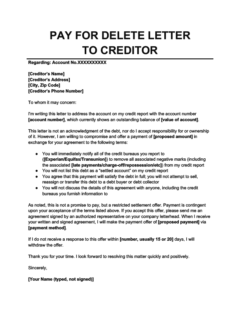

Pay for Delete Letter to Creditor

Use this pay for delete letter template to ask your original creditor to remove another type of negative mark, such as a late payment or a charged-off account that they haven't sold to a debt collector yet. Creditors tend to be less receptive to pay for delete letters than debt collectors.

Will these pay for delete letters actually work?

Unfortunately, no pay for delete letter is guaranteed to work. Some creditors and collectors have policies against accepting pay for delete proposals. In fact, the credit bureaus disapprove of this type of negotiation because it undermines the accuracy of the credit reporting system. The latest FICO and VantageScore credit scoring models have been updated in ways that are meant to discourage pay for delete.

Also, by its nature, pay for delete only works on debts that you haven’t paid yet. If you’re looking to remove negative marks for credit accounts that you’ve already paid off, you should ask for a goodwill deletion using our goodwill letter template instead.

In general, your odds of success depend on whether you’re negotiating with:

- Your original creditor: Your odds are relatively slim. Many creditors have blanket policies against negotiating pay for delete, and you have less leverage when your debt is relatively recent (which it is, if your creditor hasn’t transferred or sold it to a collector yet).

- A collection agency: Your odds are better, although still not certain. Debt collectors deal with older debts, which means you have more leverage because collectors know that otherwise they might have to write your account off as a loss.

Either way, there’s not much risk involved in pay for delete—the worst your creditor or debt collector can do is say no—so even though it’s not guaranteed to work, it’s still worth a try. However, you should be careful about proposing pay for delete on old accounts that your debt collector has seemingly given up on collecting, as any communication from you can prompt them to restart their collection efforts.

Keep all correspondences in writing

It’s important to keep track of all correspondences between you and your creditor or debt collector. Try to avoid negotiating over the phone. If they accept your pay-for-delete offer, make sure to get their confirmation in a letter or email, and save a copy for your records.

How to write a pay for delete letter

To create your letter, download the appropriate pay for delete template above. Throughout the letter, replace the placeholder information in brackets with your personal info.

If you modify the letter in other ways, try to avoid writing too much. Keep the focus on the transaction you’re proposing. Your tone should be polite, but not apologetic.

Be careful not to admit that the debt is legitimate or acknowledge that you owe it—note that the letters above say that you’re willing to “compromise” and pay it anyway. Admitting that the debt is yours can restart the statute of limitations on the debt, prolonging the period before it will become time-barred (at which point debt collectors can’t sue you over it anymore).

Pay for delete letter example

Below you can find an example of a typical pay for delete letter, addressed to a debt collection agency. We also break down how to write it and why it’s effective.

To whom it may concern:

I’m writing this letter to address the account on my credit report with the account number [account number], which currently shows an outstanding balance of [value of account].

This letter is not an acknowledgment of the debt, nor do I accept any responsibility for or ownership of it. While I retain my right to request verification of the debt in question, I am willing to compromise and offer a payment of [proposed amount] in exchange for your agreement to the following terms:

- You will immediately notify all the credit bureaus you report to ([Experian/Equifax/TransUnion]) to remove all references to this account from my credit reports

- You agree that this payment will satisfy the debt in full, and agree to accurately mark it as so, as a “paid in full” account

- You will not list this debt as a “settled account” or a “paid collection”

- You will not attempt to sell, reassign or transfer this debt to another debt collection agency or creditor

- You will not discuss the details of this agreement with anyone, including the credit bureaus you report to

As noted, this is not a promise to pay, but a restricted settlement offer contingent upon your acceptance of the terms listed above. Should you accept this offer, please send me an agreement to the aforementioned terms signed by an authorized representative on your company letterhead. When I receive your written and signed agreement, I will make the payment offer of [proposed payment] via [payment method].

If I do not receive a response to this offer within [number, usually 15 or 20] days, I will withdraw the offer and exercise my right to use other methods to dispute the debt (as outlined in the Fair Debt Collection Practices Act).

Thank you for your attention to this matter.

Sincerely,

[Your name]

How to send your pay for delete letter

Once you’ve created your pay for delete letter, send it to your creditor or debt collector—whoever owns your debt. You can find their address by checking your credit report, their company website, or this list of debt collection agencies. They may also have an email address that you can send an electronic copy of the letter to, but be sure to send a hard copy as well.

Pay for a return receipt so that you can tell whether your creditor or collector received your letter, and be sure to keep a copy for your records.

Note that creditors and collection agencies aren’t obligated to respond to pay for delete letters, so you may have to follow up with them a few times.