Table of Contents

1. Look for inaccurate information on your credit reports

If you haven’t already, request your credit reports from the major credit reporting bureaus: Experian, TransUnion, and Equifax. You’re entitled to one free report from each bureau once per year (currently once per week due to COVID-19). You can access all three reports online at AnnualCreditReport.com or call (866) 200-6020 to request hard copies. Some sites like this are scams, but AnnualCreditReport.com is a safe website that is federally authorized to provide free credit reports.

Next, carefully review each report for errors and take note of which credit bureaus have reported inaccurate information.

Watch out for these common credit report errors

The Consumer Finance Protection Bureau (CFPB) identifies four types of errors that commonly appear on credit reports.1 Be on the lookout for:

- Identity errors: Mistakes in how your identifying information (e.g., your name, address, phone number, etc) is presented.

- Incorrect account status: Accounts that have been mistakenly reported as being open or delinquent.

- Balance errors: Errors in the amount owed or the credit limit on one of your accounts.

- Data management errors: Errors that may include one account being listed multiple times with different creditors (which can happen if your debt has been sold) or incorrect information reappearing after you’ve had it deleted.

Those are the most common errors that appear on credit reports, although you may find others that you should also correct.

While some errors are superficial, others (like incorrectly reported debts) can cause a more notable drop in your credit score, damaging your ability to get competitive interest rates or even qualify for loans or credit accounts at all.

How disputing errors on your credit report affects your credit score

The act of disputing information on your credit reports will not affect your credit score. However, your score might change (probably for the better) if the bureaus update your information after processing the dispute.2

Note that you’ll never be penalized for disputing your credit reports—doing so can’t hurt your score.

2. Contact your original creditor

If it looks like the mistake originated with one of your creditors (instead of with the bureaus themselves), you should contact the company that reported your information to see if they can correct the mistake for you. If they’re willing to fix it, you won’t need to file a dispute with the credit bureaus at all.

Creditors that report to the bureaus are known as “data furnishers,” and include credit card companies, banks, retail establishments, and utility companies (e.g., power, water, phone, internet, etc). When you get in touch with the data furnisher that reported the mistaken information, follow these steps:

- Contact them by phone or mail

- Notify them of the mistake and provide them with the correct information

- Ask them to send you a letter confirming that the information on your credit report is indeed an error

- Send your creditor’s letter to the relevant credit reporting agency

- Check whether your credit report was updated

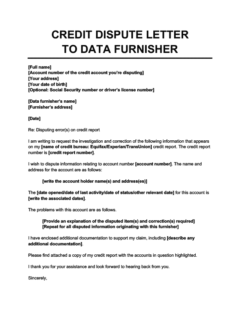

Credit Dispute Letter to a Data Furnisher

Use this credit dispute letter template to file a dispute with a creditor or debt collector. If you recognize a credit account but it's listed with the wrong balance or incorrect status (e.g., if you settled the debt and it's still listed as unpaid), the error may have originated with your data furnisher.

Some companies will contact the credit agency and update your information themselves, in which case you can skip step 5. If they promise to do so, make sure to get written confirmation from them in case they fail to follow through.

If your creditor seems reluctant to cooperate, remind them that if they aren’t able to verify the disputed information, they are required by law to delete it from your credit report within 30 days.3 If the information that your creditor has on file doesn’t match your own and they’re unwilling to update it, then it’s time to begin filing your dispute with the bureaus.

3. Prepare the documents needed for a dispute

When you file your dispute, you’ll need to provide copies of the following documents (whichever are applicable):4

- A government-issued ID card (passport, driver’s license, etc)

- A pay stub or W-2 form with your social security number

- Certified birth certificate

- Marriage certificate

- Court documents verifying your legal name change, if you’ve had one

Depending on the type of data furnisher you’re working with, you may also need to provide:

- A copy of your rental or lease agreement

- A copy of your most recent utility bill, showing your address

- Any documentation you’ve received from your data furnisher that demonstrates the information on your report is inaccurate

- Copies of canceled checks, receipts, or online payments

4. Send a dispute letter to the credit bureau

Next, you should send a dispute letter along with your supporting documents to the relevant credit bureaus. Send the letter by certified mail and keep your return receipt. You can also file your dispute online, though if you do so, make sure to record any confirmation numbers you receive. Always keep the original copy of any documentation that you mail or submit online.

Thoroughly explain the reason for each dispute. Make sure that you clearly reference (and label!) each piece of supporting documentation that you attach.

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

Where to send your dispute letter

You can find contact information for the three main credit bureaus in the table below:

| Experian | Equifax | TransUnion | |

|---|---|---|---|

| Where to send your dispute letter | Experian P.O. Box 4500 Allen, TX 75013 | Equifax P.O. Box 740256 Atlanta, GA 30374-0256 | TransUnion Consumer Solutions P.O. Box 2000 Chester, PA 19016-2000 |

| What you’ll need to send | |||

| Dispute online | Experian's online dispute form | Equifax’s online dispute form | TransUnion’s online dispute form |

Do I need to file a dispute with all three credit bureaus?

You don’t always need to file a dispute with every credit bureau—just the ones that are reporting inaccurate information. That could be just one or two of them, or all three.

As mentioned, if the mistake originated with one of your creditors (e.g., they reported a debt as late that you actually paid on time), then you only need to file a dispute with them—you don’t need to contact the bureaus at all. They’re obligated to follow up with each bureau and correct the error.5

You only need to file with the credit bureaus if the error originated with them, like if they accidentally added someone else’s account to your credit report.

5. Wait for the investigation

After you file, the credit bureau will conduct an investigation into your credit dispute. This will usually take 30 days, but it might take up to 45, depending on both the details of your dispute and the number of other disputes that the bureau is dealing with at that time.6

The credit bureau may need to contact you (or your creditor) for further details, so keep an eye out in case someone tries to get in touch.

6. Review the bureau’s decision

Once the credit bureau has completed their investigation, they must notify you of their decision within five business days.6 They’ll usually send you their decision in writing, and they may also send you an updated version of your credit report.

What to do if your credit dispute is denied

If the credit bureau sends you a decision letter informing you that they’ve rejected your dispute, don’t worry. There are still a few things you can do to get the errors off your credit report (or at least counter their negative effects):

- Gather more supporting documentation: If your dispute was rejected, it might be because you didn’t provide enough evidence to show that the information you’re disputing was incorrect. Try sending another dispute letter with additional documentation that you didn’t provide the first time.

- Contact your creditor again: Sometimes it can help to speak to your creditor directly. Tell them that you’re certain the information on your credit report is incorrect. They may be willing to provide additional information that will help your case.

- File a complaint: If your creditor won’t work with you, send a complaint (along with supporting documentation) to your state’s attorney general’s office or to the CFPB. You can also file a complaint about the credit bureaus if they’re slow to process your dispute or you believe they mismanaged their investigation.

- Seek out a non-profit credit counselor: If you’re stuck, try getting help from a professional credit counselor. They’ll be able to help you understand why your dispute was rejected and what you can do next. Most legitimate credit counselors will help you at relatively little cost, so avoid ones that charge a large fee upfront.

- Consider adding a statement of dispute as a last resort: You have the right to request that the credit bureau add a dispute statement to your credit report, which will appear next to the item you disputed. In this statement, you can briefly explain to anyone viewing your report why you believe that the information is inaccurate.

If you contest the decision made on your dispute, then the bureaus may also add a mark on your credit report next to the relevant account. It might say something like “dispute resolved; customer disagrees” or “consumer disputes after resolution.” If you want to remove this dispute mark, just ask the credit bureaus to do so.

7. Check whether your credit report has been updated

If you receive confirmation that the dispute has been resolved in your favor, the final step is to follow up to make sure that the mistake was actually corrected. Your information should be updated within the 30- to 45-day investigation period, but these changes might not immediately appear on your credit report.

The credit bureaus should update your reports no later than 30 to 45 days after they conclude their investigation, so you should follow up with the credit bureau if they haven’t updated your information after a couple of months.7

Takeaway: Dispute items on your credit report by sending a dispute letter to the credit bureaus.

- Before filing a dispute, familiarize yourself with each of your credit reports and identify which credit bureaus have listed inaccurate information.

- Before contacting the bureaus, try reaching out to your creditor and seeing if they will correct your records.

- If your creditor has inaccurate information that they’re unwilling to change, then send a dispute letter to the credit bureaus that issued the credit reports with erroneous information.

- Follow up to ensure that your credit report has been updated, and periodically review all of your credit reports to maintain accurate records.