Spotting an error on your credit report can be alarming. If you notice one, you can dispute the inaccurate information by sending something known as a credit dispute letter.

Credit reporting errors can lower your credit score and seriously damage your financial health, so you should send your letter as soon as possible.

Table of Contents

Downloadable credit dispute letter templates

Use one of these templates to create your dispute letter.

In most cases, you should send your letter to one or more of the credit bureaus that produce your report (e.g., Experian, Equifax, or TransUnion). However, it sometimes makes sense to file a dispute with a creditor or debt collector instead. These companies are known in the credit industry as “data furnishers” because they report data to the bureaus.

We provide templates for both situations below.

Credit Dispute Letter to a Credit Bureau

Use this credit dispute letter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information (e.g., an incorrect address), as well as credit accounts that you don't recognize, should usually be disputed with the bureaus. Often they're the result of the bureau confusing you for someone else.

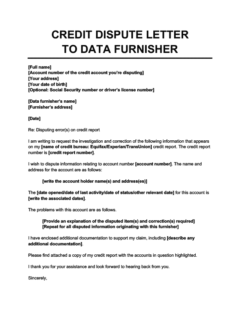

Credit Dispute Letter to a Data Furnisher

Use this to file a dispute with a creditor or debt collector. If you recognize a credit account but it's listed with the wrong balance or incorrect status (e.g., if you settled the debt and it's still listed as unpaid), the error may have originated with your data furnisher.

Your right to send these dispute letters is outlined in the Fair Credit Reporting Act (FCRA), a federal law that regulates how your credit information is collected and also guarantees you free access to your credit reports from each of the credit bureaus.

What kind of information can I use these templates to dispute?

There are four common types of errors that you can correct using these dispute letters: 1

- Identity errors: Mistakes in the information the credit bureaus use to identify you, such as your address, name, or phone number.

- Account status errors: Accounts that show an outstanding balance that you actually paid, incorrectly reported missed payments, duplicated debts, and other similar errors.

- Balance errors: Accounts displaying an incorrect current balance or credit limit.

- Data management errors: Accounts that appear multiple times under different creditors, or previously deleted (inaccurate) information suddenly reappearing on your report.

Note that you can usually only dispute inaccurate or unverifiable information on your credit report. If you try to remove valid items, there’s a chance it will work, but it’s unlikely, and the deleted information may reappear on your report later.

How to write a dispute letter (with examples)

In your dispute letter, you should list all items that you believe to be incorrect, provide evidence, and explain how you believe the information should be corrected.

Use the following letter as your model. This is an example of a letter to a credit bureau, so you’ll need to modify it slightly if you want to dispute an item with a data furnisher, such as a creditor or debt collection agency. However, most of the language in it is applicable to both situations.

Example dispute letter to a credit bureau

Dear [Credit Bureau],

I am writing to request the investigation and correction of the following information that appears on my [name of credit bureau: Equifax/Experian/TransUnion)] credit report. The credit report number is [report number], and my name and Social Security number are as follows: [name and SSN].

My report lists my previous address, which was:

[Address]

However, as of [current date], I have relocated to the following address:

[Current address]

Please find a copy of my lease enclosed with this letter, and please update my address accordingly.

I also wish to dispute information relating to account number [account number], which was opened on [opening date]. This account is in good standing, but it has been incorrectly reported as charged off.

Please find a copy of my payment history enclosed with this letter along with all relevant billing statements. I have also enclosed several other pieces of documentation to support my claim, including a copy of my written correspondence with the original creditor. Please update the account accordingly.

I have also attached a copy of my credit report with items that I am disputing highlighted.

Thank you for your assistance and look forward to hearing back from you.

Sincerely,

[Your Name]

How to dispute different types of incorrect information

The way you should write your dispute letter depends on what kind of information you want to remove from your credit report.

Below are a few examples of issues you might address with a dispute letter, as well as language you can copy and paste into your letter template.

Incorrect personal information

This might be an incorrect address or any kind of identifying information that’s listed incorrectly. It’s important to make sure that this information is updated when you make major life changes, such as moving or changing your name.

You can address this by writing something like:

My report lists my old address at [address], but I have relocated to [new address] as of [date]. Please find a copy of my lease [or other documents with your new billing address] enclosed with this letter, and please update my address accordingly.

Paid account showing a balance due

Use language like this to challenge an incorrectly reported balance:

The account shows that I still owe money to [name of company], but I paid the full amount owed on [date]. Please find a copy of my payment history enclosed with this letter, and update the account to accurately reflect that I have paid it in full.

Fraudulent account on your report (due to identity theft)

Attach a copy of the Federal Trade Commission’s identity theft affidavit (available from IdentityTheft.gov) along with your letter.

I was a victim of identity theft, and I do not recognize this account on my credit report. Please find a copy of my FTC identity theft affidavit enclosed with this letter, and remove the inaccurate accounts from my report.

Account in good standing reported as charged off or in collections

If you find an account is erroneously listed as a charge-off or collection account, write:

My account is in good standing, but it has been reported as charged off. Please find a copy of my payment history enclosed with this letter along with all relevant billing statements, and update the account accurately.

Derogatory account more than 7 years old still on your report

All negative items (except for certain bankruptcies) should fall off your credit report after 7 years. If this doesn’t happen, write:

The derogatory account is still on my credit report, but it has been over seven years since the date of the first related delinquency, as shown on the report. Please update it by removing the account.

Discharged or settled debt reported as owed

If you settled an outstanding debt with a debt settlement letter (or discharged it entirely, e.g., through bankruptcy) and your report doesn’t reflect the change, ask the credit bureaus to correct the issue immediately.

My report shows that I still have an outstanding balance on this account, but I reached a debt settlement agreement with [name of company] on [date]. The condition of that settlement was for the account to be updated as “paid in full.” Please find a copy of all correspondence relating to the settlement agreement enclosed with this letter, and update the account to show it as paid in full.

Your report shows a bankruptcy, but you have never filed for one

If your report shows a bankruptcy that you never filed, dispute it with the following language. Theoretically, you shouldn’t have to attach any documentation, because bankruptcies are public records. If there’s an erroneous bankruptcy on your credit report, it probably means the bureaus have confused you with somebody else.

My report shows a bankruptcy filed on [date], but I have never filed for one. Please correct the report by removing the bankruptcy in question.

How to send your credit dispute letter

Send your letter via certified mail and pay for a return receipt so that you know the recipient got it.

If you’re disputing information on your credit report with the company that furnished it, send the letter directly to them. Their address should be on your credit report.

If you’re sending a credit dispute letter to one or more of the credit bureaus, you can find their addresses in the following table (as well as their websites, if you want to file a dispute online).

Where to send a dispute to the credit bureaus

| Experian | Equifax | TransUnion | |

|---|---|---|---|

| Where to send your dispute letter | Experian P.O. Box 4500 Allen, TX 75013 | Equifax P.O. Box 740256 Atlanta, GA 30374-0256 | TransUnion Consumer Solutions P.O. Box 2000 Chester, PA 19016-2000 |

| Dispute online | Experian's online dispute form | Equifax’s online dispute form | TransUnion’s online dispute form |

Alternative ways to file a credit dispute

In addition to writing a credit dispute letter, there are other ways to file a credit dispute.

You can also file:

- Online: As mentioned, you can file an online dispute with the credit bureaus at the websites linked in the table above. Some (although not all) creditors and debt collection agencies allow you to file disputes online as well; you’ll have to check their website for more information.

- Over the phone: Similarly, all three credit bureaus (and some data furnishers) allow you to file disputes over the phone. You can find the number to call on your credit report or on the company’s website.

How should you file your dispute?

There’s no one right way to file a credit dispute. Filing by phone or online is quicker than via mail, but you can include more detailed information in a letter than you could by checking boxes online. You can also more easily keep a record of your dispute by copying the letter and sending it by registered post.

What are 604 and 609 letters?

If you’ve encountered other letter templates online, you might be wondering if you can use any of them as an alternate way to file a dispute. The answer, unfortunately, is no.

Many sites mention these letters:

- 604 ACT dispute letters: These are just regular credit dispute letters like the ones in this article—just listed under the wrong name. “604 ACT” refers to section 604 of the FCRA, which outlines when the credit bureaus may let someone view your credit report. 2 As this section has nothing to do with credit disputes, the term “604 ACT letter” is a misnomer.

- 609 dispute letters: You might also encounter 609 dispute letter templates. These are also meant to dispute items on your credit report, but they’re not very effective at doing so because they’re based on a misreading of section 609 of the FCRA. In virtually every case, it’s better to send an ordinary credit dispute letter instead.

What happens after you send your credit dispute letter

Once you file your dispute, the credit reporting agencies must investigate it within 30-45 days of receiving it. Once they complete their investigation, they must then notify you of their decision within five business days. 3

If your dispute is successful, the credit reporting company will update your report by removing the erroneous items. Make sure to regularly check your report to make sure they did so correctly.

What if my credit dispute fails?

If your dispute fails, you can try again. However, you should provide additional information if you resubmit your dispute. Otherwise, the credit bureau or furnisher might dismiss the dispute as “frivolous.” 4

If further disputes fail to resolve the issue, you have three options:

1. Add a statement to your credit report

If you asked a credit bureau to investigate an item on your credit report and the dispute didn’t resolve the matter to your satisfaction, you have the right to place a brief statement about the dispute in your file.

If the item in dispute caused a drop in your credit score, your statement won’t do anything to fix it. It’s possible (although not particularly likely) that lenders will read what you wrote when you apply for a new credit account and they conduct a credit check. 5 Overall, adding a statement to the disputed item isn’t particularly useful, but it’s better than doing nothing.

2. Contact an attorney and/or file a lawsuit

In the worst-case scenario—if you’re certain there’s incorrect information on your credit report and the credit bureaus and your original data furnisher aren’t properly investigating it—you can also consider filing a lawsuit.

If you can prove that a credit bureau failed to follow the rules in the FCRA, you can hold them liable for damages and attorney fees. Similarly, if a creditor or debt collector willfully breaks the FCRA’s rules, it’s potentially liable for damages.

If you file a lawsuit, do so before the earlier of these deadlines: 6

- Five years after the date you were harmed by an FCRA violation

- Two years after you find out that you were harmed by the FCRA violation

If you need more help or advice to dispute information with a credit reporting company, you can contact a lawyer. If you’re not sure whether you can afford one, search online for free legal services in your state.

3. Contact your state Attorney General and the CFPB

If your credit dispute wasn’t successful, you can also get in touch with your state’s Attorney General to find out whether your state provides other protections for consumers in addition to the FCRA.

If you believe that one of the credit bureaus (or a creditor or debt collector) violated the law, you can also file a complaint with the CFPB by contacting them online or calling (855) 411-2372.

Takeaway: Dispute letters are one way to get incorrect information off your credit report

- A credit dispute letter is a letter that you send to the credit bureaus or to a data furnisher (i.e., a lender or debt collector who sends information to the credit bureaus) asking that they remove or correct errors on your credit report.

- You can dispute problems such as incorrect personal information, accounts placed on your report due to identity theft, or paid accounts that are showing up as unpaid.

- You can submit disputes by phone or online as well as by writing a dispute letter.

- Consumer reporting agencies must investigate disputes within 30–45 days of receiving them and then notify you of their decision within five business days.

- If you’re not satisfied with the outcome of a dispute, you can resubmit it. If that’s not successful, you can place a statement next to the disputed item, and as a last resort, you can file a lawsuit.