Credit card billing and interest can be confusing, but understanding how your payment cycle works can help you use your credit card much more efficiently. For example, many cards offer something known as a grace period—a time period in which you can make purchases that won’t accumulate interest.

Keep reading to learn what a credit card grace period is, how you can benefit from it, and how long most grace periods last.

Table of Contents

What is a grace period on a credit card?

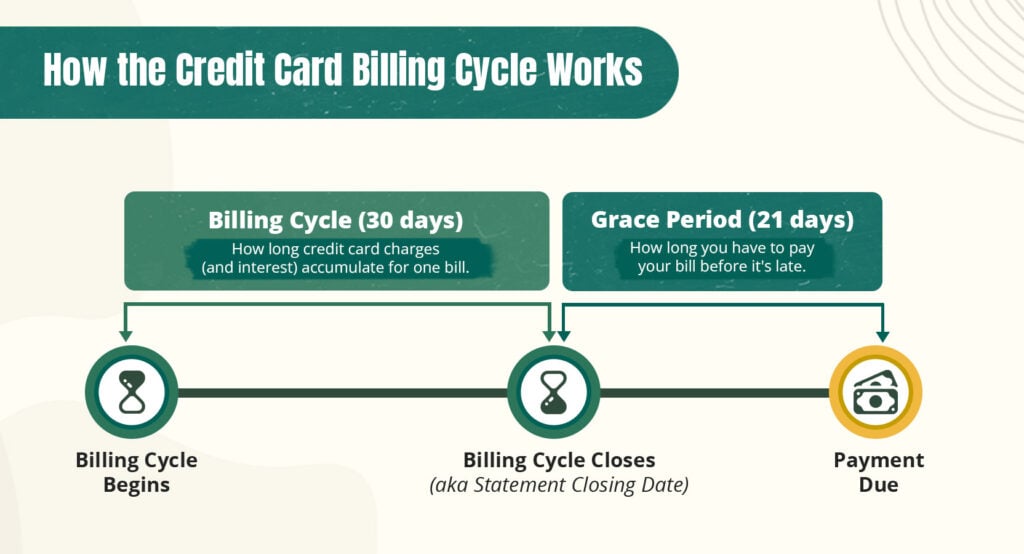

A grace period on a credit card is the span of time between the end of your billing cycle (aka your statement closing date) and that billing cycle’s payment due date.

It’s important to understand those terms:

- Statement closing date: As mentioned, this is the end of your credit card billing cycle. On this date, your card issuer will send you your statement balance (keep in mind your statement balance and current balance are different), which is a list of all the charges you racked up on your card during that cycle and which you now have to pay off (or at least make a minimum payment on).

- Payment due date: However, you don’t have to pay your balance immediately on the closing date. You’ll have at least 21 days before the due date, by which time you’re required to make a payment.

Again, the period of time between those two dates is known as your grace period.

Illustrating your credit card billing cycle

To make the timeline of your billing cycle clearer, review the illustration below.

Note that the grace period is technically part of your next month’s billing cycle, not the cycle that you’ve already received a balance for.

Many grace periods are interest-free

Many credit card issuers waive interest charges on purchases made during the grace period—as long as you fulfill certain conditions, which we’ll describe in detail below. However, this isn’t a requirement. Whether or not card issuers offer an interest-free grace period is at their own discretion.

If your credit card does offer an interest-free grace period, you can take advantage of it to minimize your spending and use your card much more efficiently than you’d normally be able to.

How to tell if your card has a grace period

To see if your credit card has a grace period, check the card’s “rates and fees” or “terms and conditions” page. You can also check the information in your card’s online portal. Your grace period will typically be listed near your card’s APR.

If none of these return results, call the number on the back of your card and ask a customer representative.

Why is your credit card grace period important?

Your grace period is important because it reduces your borrowing costs and helps you manage your finances. Here are the two major benefits of a credit card grace period:

- Extra time to pay: A grace period gives you extra time (at least 21 days) to secure the finances to pay off your statement balance. This lets you avoid late fees and improve your credit score.

- No interest: Depending on the length of your credit card’s grace period, you could enjoy 21–55 days of interest-free spending on your credit card. As mentioned, we’ll explain this in detail in the next section.

How do credit card grace periods work?

As we said, your credit card’s grace period begins on the last day of your billing cycle, known as your statement closing date. You may also see this day referred to as your:

- Statement date

- Closing date

- Close date

Your statement closing date is an important day in your credit card billing cycle, as this is when your card issuer will tally up all your charges for that cycle and submit your bill to you. Any purchases you make on your card after the statement closing date will be added to your next cycle’s bill.

How interest works in the grace period

If you pay off your statement balance (the bill you just received) in full by the payment date, you won’t be charged any interest on those purchases.

Moreover, if you have an interest-free grace period, then purchases you make during the grace period—between your statement closing date and your payment due date—also won’t accrue interest.

However, there’s a catch: this is only true if you completely pay off your statement balance. If you don’t pay it off in full (even if the unpaid amount is very small, such as $5), then not only will you be charged interest on that $5, you’ll also immediately be charged interest on any purchases you made during the grace period.

Even worse, this interest will apply retroactively. This means it will be charged as though it had begun accruing as soon as you made the charges, instead of beginning to accrue on the payment due date when you failed to pay your statement balance in full.

An example of how credit card grace periods work

Credit card grace periods can be a little unintuitive, so they’re best explained with an example.

Let’s say you owe $500 on a credit card which has a statement closing date of March 15. Your due date for the bill is April 10. In other words, your grace period is March 15 through April 10.

During the grace period, you rack up a further $200 of charges on the card. As of April 10, you owe:

- Previous statement balance: $500

- Grace period charges: $200

- Total balance on the card: $700

At this point, there are two possible scenarios. You could pay your previous statement balance in full, or you could fail to do so.

If you pay in full

If you pay your previous statement balance (the full $500) by April 10, your $200 in purchases made during the grace period won’t accumulate interest.

As long as you pay off that $200 (plus any additional purchases you make during that cycle) by your next due date, you’ll successfully avoid paying credit card interest on the entire $700 balance you currently owe.

If you don’t pay in full

However, let’s say you fail to pay the entire $500 by April 10. Maybe you just make the minimum required payment on your card (e.g., $20, leaving $480 unpaid), or maybe you pay off the majority of the balance but can’t pay off everything (e.g., you pay $495, leaving just $5 unpaid).

In both of these scenarios, you’re giving up your interest-free grace period. You’ll be charged interest on your remaining balance from the previous cycle, regardless of whether that’s $480 or $5. You’ll also immediately be charged interest on the $200 you spent during your grace period.

As you can see, even failing to pay off your bill by a very small amount can have serious financial consequences if you used your card heavily during your grace period.

How long will you lose your grace period for?

In the above scenario, there’s no guarantee you’ll get your grace period back once you enter the next billing cycle. If your credit card issuer is generous, they’ll only waive your grace period for the month you failed to pay in full, but they also might nix it for the next three or six months or even for an indefinite period.

Credit card issuers are able to do that because they aren’t legally required to offer an interest-free grace period at all. Essentially, interest-free spending is a privilege, not a right, and they’re allowed to take it away for as long as they want.

How to make the most of your grace period

It’s understandable if you find your credit card’s grace period exasperating or confusing, since there’s several different dates that you have to keep track of. Fortunately, the takeaway—what you should actually do—is very simple.

In a nutshell, just make sure to pay off your statement balance completely every month. If you do, you can use your card without paying interest (a very good thing, since credit cards tend to have high interest rates).

If you fail to pay off even one month’s balance in full, then the charges you make during the next month’s billing cycle (and potentially even charges you make after that) will accrue interest, and you won’t be able to use your card as efficiently.

Exceptions to credit card grace periods

You now know that your grace period will be negated if you don’t pay your credit card bill in full and on time. Additionally, some credit cards don’t offer a grace period to begin with, particularly ones that are available to people with bad credit scores.

There are further exceptions to credit card grace periods, such as:

- Cash advances: This refers to money that you withdraw from an ATM using your card, essentially like a small personal loan.

- Balance transfers: A balance transfer is a transaction where you move debt from one credit card (or multiple cards) to another to simplify your finances.

- Convenience checks: These are special checks that draw money from a line of credit—in this case, your credit card.

These actions are usually exempt from grace periods, so they’ll begin accumulating interest at your card’s designated rate starting from the date of transaction.

How long is the typical grace period on a credit card?

The typical grace period for a credit card is between 21–25 days, but can be as long as 55 days.

By law, credit card companies are required to send you your bill at least 21 days before that statement’s payment due date. So at minimum, your grace period should be 21 days long. However, many card issuers offer longer grace periods.

For an idea of the typical grace period, here’s what the major credit card issuers offer:

- Visa grace period: One calendar month 1

- Mastercard grace period: 30 days 2

- American Express grace period: 21-25 days 3

- Capital One grace period: At least 25 days 4

How to extend your credit card grace period

You can’t actually extend your grace period, as it’s a set time frame determined by your credit card issuer.

However, understanding your billing cycle can help you maximize your credit card use and keep your finances in good standing.

Once you know when your grace period begins and how long it lasts, you can make the most out of this interest-free purchasing period. For example, if you have a big upcoming purchase, time it during your grace period and ensure all your bills are paid on time to avoid paying interest on your big buy.