Table of Contents

You may have heard leaving a small balance on your credit card can help your credit score. This isn’t true. In fact, leaving unpaid debts will likely cost you money and lower your credit score. Read on to understand why people believe this common credit myth and why carrying a credit card balance can be bad for your score.

Why you shouldn’t leave a small balance on your credit card

It’s a common myth that keeping a small balance on your credit card from month to month helps your credit score. Some people believe that doing so shows they’re actively using their credit in a responsible manner. Or they believe that since credit card companies earn interest from the balance that isn’t paid in full, they’ll boost credit scores to incentivize borrowers to leave money on their cards.

However, FICO, one of the major companies that produce credit scores, calculates your score with the following five factors: 1

- Payment history (35%)

- Credit utilization / amounts owed (30%)

- Length of credit history (15%)

- New credit (10%)

- Credit mix (10%)

The amount of interest that issuers earn doesn’t have an impact on any of those categories. It’s true that using your credit card regularly will build your payment history and improve your score, but it’s not necessary to carry a balance from month to month to do that.

The truth is, keeping a balance on your credit card won’t benefit your score. In fact, it will likely cost you money and lower your credit score.

Why carrying a balance costs you money

Leaving a balance on your credit card can cost you money in the form of interest. How much interest you accrue depends on your card’s annual percentage rate (APR), which is the official rate that shows you the cost of borrowing. 2

While there are 0% APR credit cards that grant you 0% interest for a certain period of time (typically at least 6 months), they don’t work as get-out-of-jail-free cards. There’s still a risk of finding yourself stuck with a balance you can’t repay, or exceeding your 0% APR period and accruing sudden interest on large sums. A recent study found that the average American pays $9,624 in credit card interest in their lifetime, showing how easy it is to rack up interest on outstanding credit card balances. 3

Furthermore, you’ll lose your grace period if you don’t pay your credit card bill in full. A grace period is when your credit card offers you a 21–30 day period of interest-free spending (but only if your previous bill was paid off).

Lastly, leaving a balance on your card lowers your available credit, making it easier to go over your limit and have your credit card declined.

Why carrying a balance lowers your credit score

Keeping a balance on your credit card can also lower your credit score by raising your credit utilization rate, which accounts for 30% of your credit score.

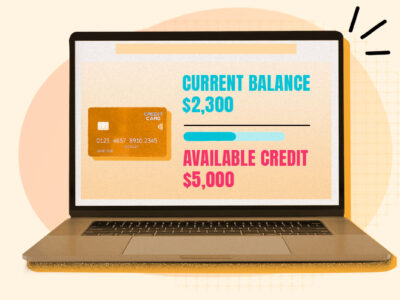

Credit utilization is the percentage of your available credit being used—in other words, your total credit balance divided by your total credit limit.

For example: Say you have three credit cards, with a total credit limit of $10,000, and you carry a total balance of $5,000. You’ll have a credit utilization rate of 50%.

Financial experts suggest that you keep your credit utilization rate below 30% to maintain a good credit score. That is to say, with a total credit limit of $10,000, you’d want to keep your total balance below $3,000. 4

To keep your utilization rate low, keep your balance low and pay your bill at the right time every month—in fact, paying your credit card bill early helps your credit score in most cases. That’s because your credit card’s balance is usually reported on the last day of the billing cycle (called the statement closing date) rather than the due date. So if you have a high balance on your statement closing date, this is the number that will be reported to the bureaus.

In short, the lower your utilization rate, the better your score. To achieve this, pay your credit card in full as soon as possible rather than carrying a balance from month to month.