Getting pre-approved for a credit card can be exciting—but it can also be confusing, since it’s not always clear what “pre-approval” actually means.

When you’ve been pre-approved, does that mean you’re guaranteed to qualify for the card, or is it a marketing buzzword that you shouldn’t take seriously? And how exactly is the term “pre-approved” different from “prequalified”?

Read on for a breakdown of what these terms mean and what implications they have for your credit.

Table of Contents

- What are credit card pre-approval and prequalification?

- Other types of pre-approval in the credit industry

- How do credit card pre-approval and prequalification affect your credit?

- Is applying for credit card pre-approval or prequalification a good idea?

- How to opt out of credit card pre-approval offers

What are credit card pre-approval and prequalification?

When it comes to credit cards, prequalification is a type of pre-approval.

In the credit card industry, pre-approval is an umbrella term. It can actually refer to two different stages in the credit card application process, which are also known as:

- Prequalification

- Prescreening

Overall, prequalification and prescreening are fairly similar, but they have a few key differences.

What is credit card prequalification?

Prequalification is an early (and optional) step in the credit card application process. Essentially, it’s when you ask a creditor to take a brief look at your credit and finances and tell you whether you’re likely to qualify for the card you want or not.

Prequalification doesn’t lead to a formal offer for the card. If you successfully prequalify, that essentially just means that the card issuer is letting you know that your application will probably be successful, but it isn’t a guarantee.

What is credit card prescreening?

You may also sometimes receive unsolicited offers in the mail for credit cards that you’ve been “pre-approved” for. This type of pre-approval is also called prescreening.

Prescreening is initiated by credit card issuers. The issuer asks the credit bureaus (the companies that prepare consumer credit reports) to conduct a mass credit check and find consumers who they think might qualify for certain cards. They then write to them to encourage them to apply.

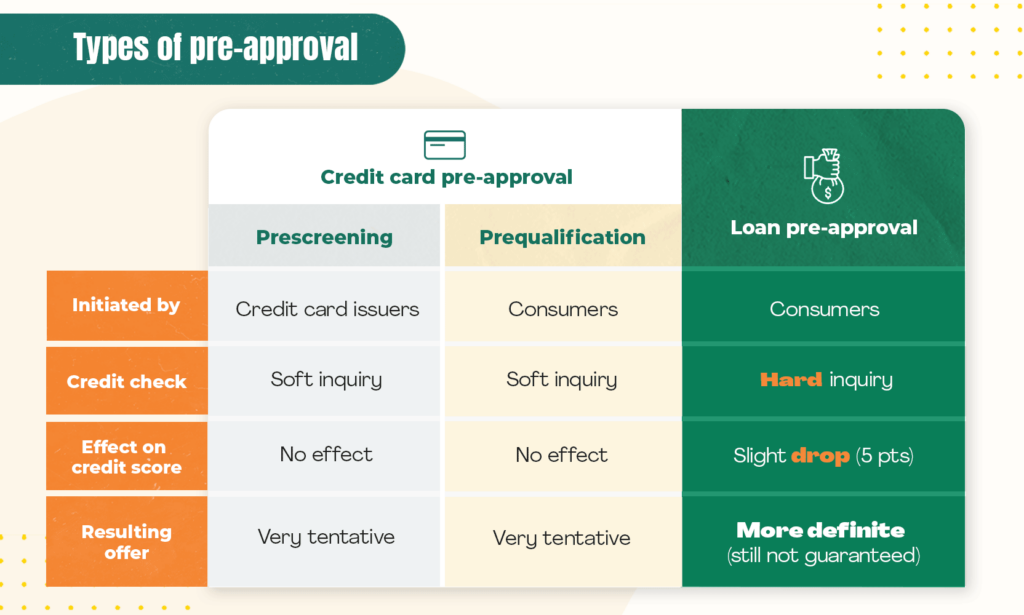

Prescreening is similar to prequalification, the main difference being that prequalification is always initiated by consumers—people who want to see what credit cards they’ll qualify for—whereas card issuers conduct prescreening checks all on their own with the goal of drumming up business.

Prequalification and prescreening don’t result in definite offers

It’s important to note that neither type of credit card pre-approval provides a firm guarantee that you’ll actually get the card you were supposedly “pre-approved” for.

If you’re prequalified or prescreened for a card, the credit card issuer thinks you’ll probably qualify for it—but it’s always possible they’ll change their mind after you formally apply and they conduct a more thorough credit check.

In this way, credit card pre-approval is a bit different from other types of pre-approval, such as mortgage pre-approval. We’ll explain this in more detail below.

Other types of pre-approval in the credit industry

Lenders that provide loans (especially mortgages) often use the term pre-approval, but they mean something very different than credit card issuers do.

It’s important to be aware of the differences between loan pre-approval and credit card pre-approval so that you don’t get confused.

Loan pre-approval vs. credit card pre-approval

Mortgage pre-approval involves a much more thorough credit check than either of the two types of credit card pre-approval described above. Consequently, if you’re successfully pre-approved for a mortgage, your lender will give you a more definite offer that they’ll be less likely to renege on. By contrast, credit card pre-approval offers are much more tentative.

Put another way, although getting pre-approved for a mortgage doesn’t absolutely guarantee that you’ll get the loan you want (your lender can still back out), it’s a lot closer to a guarantee than credit card pre-approval.

This more serious type of pre-approval doesn’t really exist in the credit card industry. Again, if a credit card issuer says that they offer pre-approval, they almost always mean either prescreening or prequalification.

Credit Card Pre-Approval vs. Loan Pre-Approval

How do credit card pre-approval and prequalification affect your credit?

Credit card pre-approval never affects your credit in any way, regardless of which type it is. Prequalification and prescreening can’t damage your credit score, and lenders won’t be able to see that you applied for pre-approval when they check your credit history in the future.

This might come as a surprise, since other types of pre-approval do affect your credit. For instance, mortgage pre-approval lowers your credit score. That’s because it involves a credit check known as a hard inquiry, and hard inquiries cause your credit score to drop by around 5 points.

Credit card pre-approval doesn’t have this effect because, as mentioned, it isn’t as serious as loan pre-approval. Consequently, it involves a soft inquiry, which is a type of credit check that never affects your credit score.

If you actually apply for a credit card that you’ve been prequalified or prescreened for, your lender will conduct a more thorough check at that point, which will involve a hard inquiry. However, this won’t happen until you submit your formal application.

Is applying for credit card pre-approval or prequalification a good idea?

If you’re interested in a credit card, there’s no reason not to apply for prequalification, since it doesn’t have any downsides for your credit. (Remember, prequalification is the only kind of pre-approval you can actually apply for, since prescreening is initiated by the card issuer.)

Note that prequalifying doesn’t actually make your card issuer any more likely to approve your application. Really, it just gives you a clearer idea of what your odds are.

If you successfully prequalify, you can apply with more confidence—and on the flip side, if you’re rejected, you can avoid wasting your time (and incurring an unnecessary hard inquiry) by applying for a card you won’t be able to get.

How to opt out of credit card pre-approval offers

Although unsolicited pre-approval offers (i.e., letters encouraging you to apply for cards you’ve been prescreened for) don’t damage your credit, they can get annoying.

If you’d rather not receive offers like this, you can opt out of prescreening by visiting OptOutPrescreen.com or by calling 1-888-567-8688.

This will block the major credit bureaus from including you in mass prescreening checks. 1 Unfortunately, it doesn’t apply to smaller credit bureaus, which means you still may occasionally receive prescreening offers, but you’ll receive significantly fewer after opting out.