If you’re looking at your credit card statement and don’t know how much you owe, how much you can spend, or why the numbers don’t quite add up, don’t worry. It’s pretty easy to understand—as long as you know the difference between your current balance and your available credit.

In this article we’ll break down the differences between current balance and available credit on your credit card so you don’t risk maxing out your card or missing payments.

Table of Contents

What is my current balance?

Your current balance is the amount of money you owe on your credit card as of that day. Your current balance is determined by adding up all the purchases you’ve made on your credit card that have been authorized but not yet paid off. Your current balance and statement balance are different, but your current balance may include any remaining debts from your latest statement balance.

After a purchase is made on your credit card, it takes 1–3 business days to authorize. Once it’s authorized, it will be added to your current balance.

Purchases you’ve made on your card that have not yet been authorized are called pending charges (or pending transactions). Pending charges will not be added to your current balance, but will affect your available credit.

What is my available credit?

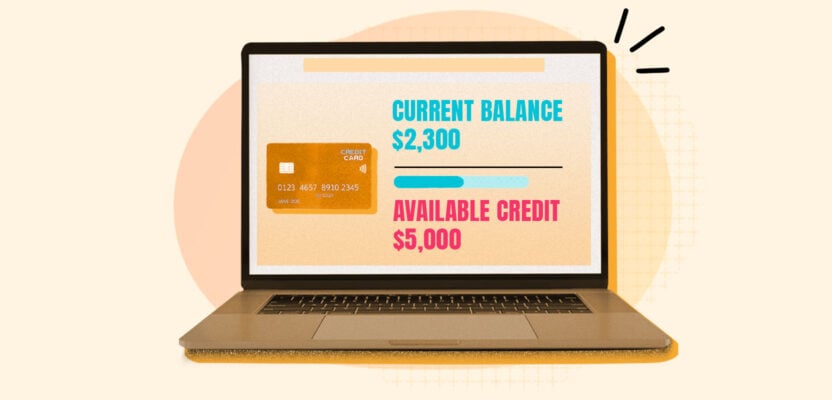

Your available credit (sometimes referred to as your available balance) is the amount of money you have left to use on your credit card. It’s calculated by subtracting all of your unpaid transactions from your credit limit, which is the total amount of money you can spend on a given credit card.

You can calculate your available credit with a simple formula:

Credit limit – current balance – pending charges = available credit

Why doesn’t my available credit add up?

You may notice that your available credit doesn’t make sense given your current balance. There are two reasons why this can happen:

- Pending charges: As purchases aren’t authorized immediately, pending charges will be taken out of your available credit but not yet added to your current balance. You may have pending charges that haven’t been approved that are skewing the amount of available credit you see on your statement.

- Credit card holds: A hold on a credit card is when a certain amount of your credit is rendered unusable before a transaction is cleared. Holds are common at hotels, car rental companies, and gas stations. For example, a hotel may put a hold on your credit card when you book a trip, then allow you to pay your room bill with a debit card or cash when you arrive. This hold will show up on your credit card statement as a deduction from your available credit.

If you feel your available credit is incorrect despite these reasons, call the number on the back of your credit card immediately to sort out the issue.

Why you should monitor your available credit

Check your credit card statement regularly to keep yourself up to date on your available credit. Keeping on top of how much credit you have can help you avoid three major credit pitfalls:

- Maxing out your card: Maxing out your credit card is when you spend up to or beyond your total credit limit. Maxing out your credit card leaves you without available funds if an emergency arises and in some cases can even lead to your card issuer closing your account.

- Being charged over-limit fees: Some credit cards offer over-limit protection which allows you to spend over your credit card limit. However, if you spend over your limit, you’ll be charged an additional “over-limit” fee.

- Damaging your credit score: Using too much of your credit raises your credit utilization rate, which is the amount of your credit you’re using. This is an important factor in your credit score, and you want to keep it low. If you’re using too much of your credit, your utilization rate will go up and harm your credit score.