Late fees on a credit card are exactly what they sound like—extra payments that your card issuer will charge you if you fail to pay your credit card bill on time.

If you’ve ever had to pay one of these fees, you’re in good company. In 2019, American consumers collectively paid more than $14 billion in late fees. 1 But how exactly do late fees work, and more importantly, how can you avoid them?

Table of Contents

How do credit card late fees work?

Late fees work basically the way you’d expect—if you don’t make your credit card payment on time, your credit card company will tack a punitive fee onto your next month’s balance.

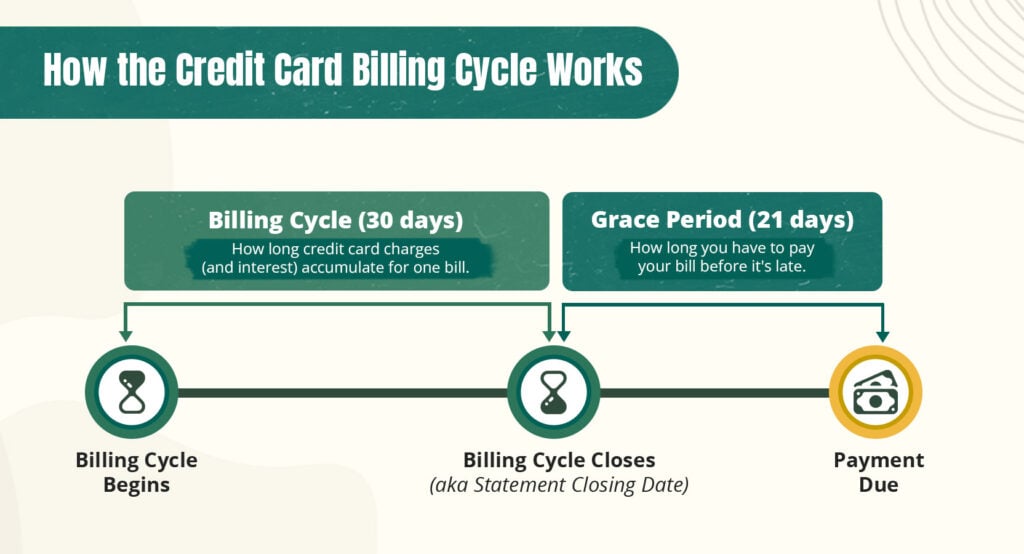

To understand late fees in more detail, you need to understand how your credit card’s billing cycle works. Each cycle ends with a payment due date, as shown in the image below.

Illustrating Credit Card Billing Cycles

On your payment due date, your outstanding debt will come due. You don’t have to pay your entire credit card balance on this date (although if you can, it’s a good idea), but you will have a minimum monthly payment that you’ll be required to make.

If you make your minimum payment in full and on time, your credit card will remain in good standing. However, if you fail to pay it off, your account will become “delinquent” and your credit card company will hit you with late fees as a penalty.

How high can credit card companies set their late fees?

The Credit CARD Act of 2009 sets several benchmarks that credit card issuers use to determine their late fees: 2 3

- Issuers may charge $35 for the first late fee you incur in a 6-month period.

- They may charge $41 for further late fees you incur within 6 months of having made a late payment.

These aren’t hard limits—it’s technically possible for credit card companies to exceed them—but in practice, very few do. These benchmarks are adjusted upwards every year for inflation.

Issuers can also set their late fees lower than that if they choose to. In 2019, the Consumer Financial Protection Bureau found that consumers with major credit cards were charged an average of $26 for a first late payment and $35 for subsequent ones. 1

Late fee tiers

Some credit cards also feature “tiered” late fees, where the amount you’ll be charged depends on your outstanding balance at the time that you missed your payment.

For instance, you might have to pay a late fee of just $10 if you owe $500 or less; a higher fee of $20 if you owe between $500 and $1,000, and so on.

How to find the late fees your credit card will charge

You can find the late fees on your credit card by viewing your cardholder agreement or your card’s Schumer Box (a full list of the card’s rates and fees which the credit card company is obligated to provide).

You’ll probably be able to access this information on your credit card company’s website. If you can’t find it, call the customer service number on the back of your card and ask.

Consequences of paying late on a credit card

As you’ve gathered, the most obvious consequence of missing a payment is that you’ll have to pay a late fee, which will get tacked onto your credit card balance.

If this happens, make sure to pay the fee as quickly as possible. Just like an ordinary charge on your credit card, the late fee will generate interest according to your credit card’s APR. This can cause a relatively small fee to balloon out of control.

Unfortunately, the consequences of missing a payment don’t end there. Depending on how late you are, you may also face:

- Lost rewards: If you’ve earned any credit card rewards, such as airline miles, missing a payment might cause you to forfeit them. Your issuer may also cancel any special benefits you have on your card, such as an introductory 0% APR period.

- Credit score damage: If you’re late with a payment by 30 days or more, your credit card company will report it to the credit bureaus that create your credit reports. A derogatory mark called a late payment will appear on your report, which in turn will cause a drop in your credit score.

- Penalty APR: If your account is delinquent for 60 days or longer, your credit card issuer may raise your ordinary APR, replacing it with a special rate called a penalty APR. This rate will apply to your card indefinitely.

- Debt collection: If you’re drastically late—this usually means at least 180 days—your creditor may charge off your outstanding debt (write it off as a loss) and send it to a debt collector. This will seriously harm your credit score.

- Account closure: If you repeatedly violate your credit card terms by missing payments or you let a debt get to the charge-off stage, your credit card company will probably forcibly close your account.

These consequences can amplify each other in various ways, compounding the harm to your finances and credit.

For instance, if your normal APR is replaced with a penalty APR, it will make your late fee accrue interest at a faster rate. This will make your debts harder to pay off, in turn making it more likely that your card will be closed (and with your damaged credit score, you’ll have a hard time qualifying for a new one).

Failing to pay your credit card bills on time can have a serious effect on your finances. You should avoid late payments if you possibly can.

How to avoid late fees on your credit card

Fortunately, it’s not that hard to avoid making late payments. If you’re struggling, try these solutions:

- Make a budget: If money is tight and it’s hard to scrape together enough cash to pay off your card every month, see if there’s anywhere you can cut back. If there isn’t, you may need to rely more on cash until your finances improve. It’s tempting to lean on your credit card to make ends meet, but while that helps in the short term, it will actually hurt your finances in the long run through interest and late fees.

- Enable autopay: If you’re prone to forgetting to pay, your bank will probably allow you to set up automatic payments onto your card. If you do this, be sure to continue tracking your credit card use—if you just set up autopay and forget about it, it might lead you into overspending.

- Set up reminders: If you’re not comfortable using autopay, you can also just set reminders on your phone (or in your email system) to nudge you to pay at regular intervals.

- Change your payment due date: If your balance always comes due right before your payday (when you have less cash on hand) or at a busy time of the month (when you might forget to pay), you can probably change your due date. Just call your credit card issuer and ask them about it.

- Get a card with no late fees: Some credit cards never charge late fees. For instance, the Apple Card has no fees of any type. That said, if you get a card like this, don’t let the lack of late fees lull you into complacency about making late payments—doing so will still come with the other consequences listed above.

Ultimately, avoiding late fees is just about maintaining responsible credit habits. Just be aware of how much you’re spending and when your payment due date is and you won’t have any problems.

How to get credit card late fees waived

If you do miss a payment and incur a late fee on your card, don’t panic. If this is the first time it’s happened, your credit card company might actually be willing to waive the fee if you follow these steps:

1. Make sure you actually incurred a late fee

As mentioned, if you’re just a day or two late, it’s possible your issuer hasn’t imposed a late fee at all. To find out, log in to your credit card account’s online portal and check your balance.

If you weren’t hit with any fees, you obviously don’t need to contact your credit card company, although you should still advance to the next step (bringing your account current).

2. Pay off your overdue balance

The next step is to pay off your overdue debts. Immediately make last month’s minimum payment.You may also want to pay the late fee itself—if you manage to get it waived, you’ll receive the refund on a future billing cycle.

If you can, pay off your entire credit card balance. This will put you in a stronger negotiating position when you call your credit card issuer. (Also, paying off your credit card in full instead of carrying a balance from month to month is a good habit to get into, anyway.)

3. Call your credit card company and explain why you missed the payment

Once you’re all caught up on your debts, call the number on the back of your credit card. Ask to speak with a representative and say that you want to discuss a late fee that you recently received.

Apologize for missing the payment and explain the circumstances that led to you being late, especially if it was caused by something outside your control. For instance, if you tried to pay with a check via snail mail but the delivery was delayed, explain that.

If recent events in your life (e.g., a medical emergency, divorce, unemployment, etc) have left you struggling, mention that as well. Emphasize the steps you’ll take to prevent something similar from happening in the future.

If you’ve historically had a good relationship with your credit card issuer (meaning this is the first time you’ve missed a payment), you have a decent shot at getting the late fee waived. The goal is to convince them that you’re a responsible borrower and that missing your payment was a one-time fluke that won’t happen again.