Venmo is one of the most widely used P2P (peer-to-peer) payment apps. It allows you to send or receive money easily without the need to deal with cash.

If you need to make a transfer right away and you don’t quite have enough in your checking account, you may be tempted to hook your credit card up to Venmo. It’s possible to do this, but there are a few drawbacks you should consider first.

Table of Contents

Does Venmo take credit cards?

Yes, Venmo allows you to link a credit card to your account, and you can use your card to send money to someone (as well as make regular purchases).

Venmo accepts credit, debit, and prepaid cards across all four major card networks (Visa, Mastercard, American Express, and Discover) as long as the card is registered under your name. 1

How to link a credit card to your Venmo account

To set up credit card payments on your Venmo account, follow the instructions below.

On the Venmo app

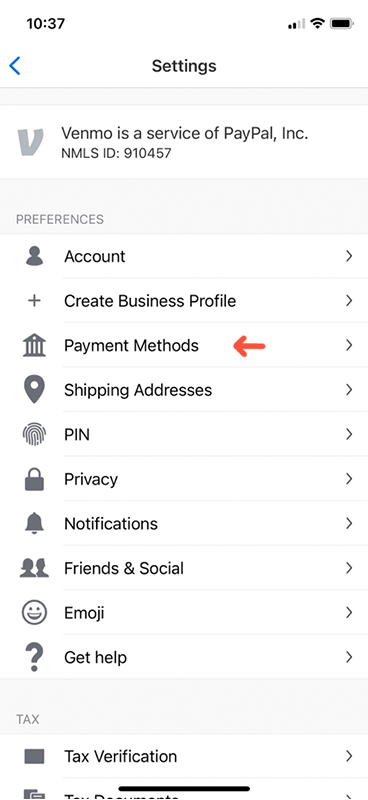

After loading up the Venmo app, navigate to the Settings menu. Click Payment Methods.

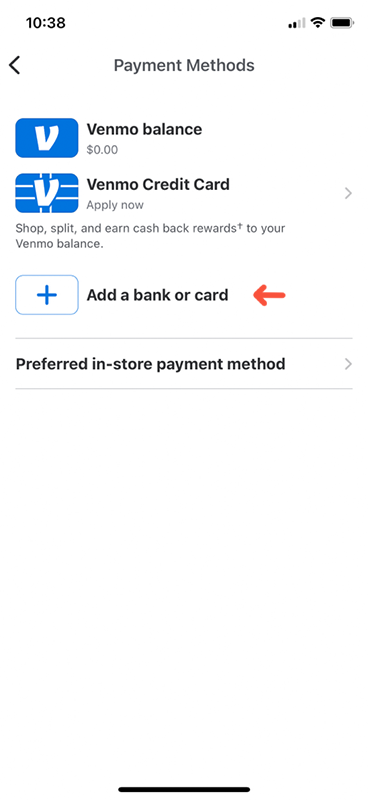

On the Payment Methods screen, click Add a bank or card.

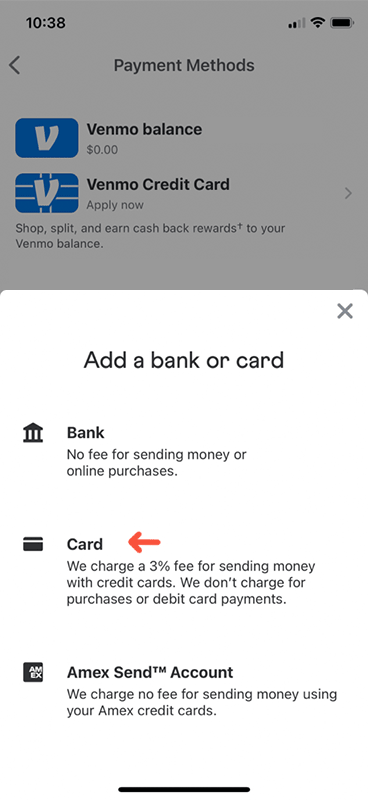

On the next screen, click Card.

On the final screen, enter your personal information and your card details. Double-check and submit it, and your account will be linked.

Online

You can also link a credit card in Venmo’s web interface. Follow these steps:

- On their online portal, click “Edit payment methods”

- Choose “Add Debit or Credit Card”

- Enter your card information

Should you link a credit card to Venmo?

Just because you can Venmo people using your credit card doesn’t mean you should. Doing so has both pros and cons. Before following the setup instructions above, make sure you’ve considered both.

Disadvantages of using a credit card on Venmo

Above all, using a credit card to send money on Venmo can be expensive (much more so than using a debit card or bank account). Be prepared for the following:

- High fees: Venmo will charge a fee of 3% of the transfer amount every time you send someone money using your credit card. 2 This fee is specific to money transfers; they won’t charge it if you just use your card to buy something.

- Cash advance penalties: Some card issuers treat money transfers through Venmo as a type of credit card cash advance. In this case, they may charge you a cash advance fee and a higher interest rate than your card normally has. What’s more, cash advances are usually exempt from credit card rewards programs, so you won’t be able to earn points or cash back on your transaction.

- Interest charges: You’ll be charged interest on any credit card transactions you make through Venmo, and if your transaction is treated as a cash advance, interest may begin accruing immediately.

Basically, the extra charges associated with using a credit card on Venmo mean you’re paying more to send the same amount of money. You’d be surprised at how quickly these charges can add up and land you in too much credit card debt.

It’s always cheaper to just link your bank account or debit card to Venmo and send people money that way instead.

Advantages of using a credit card on Venmo

Despite the drawbacks, there are also a few reasons why you may want to use a credit card through Venmo:

- Useful for emergencies: Obviously, Venmo allows you to use a credit card to send people money or transfer money from a credit card to a bank account. Credit cards can’t normally do this, and it’s possible you’ll need to do it in an emergency, despite the added expense.

- Earning credit card rewards: If you have a rewards card, then linking it may enable you to earn rewards by using Venmo. Just be sure to check with your card issuer first; as mentioned, many companies don’t consider Venmo transactions to be “eligible purchases” capable of earning rewards. (This is almost certainly the case if your card issuer treats Venmo transactions as cash advances.)

- Keeping your credit strong: Setting up your credit card in Venmo can help you keep it active if you aren’t otherwise using it. This may benefit your credit score, since card issuers often close inactive accounts, which can cause a drop in your credit score.

Again, hooking your credit card up to Venmo is less efficient than just using a bank account or debit card, but that doesn’t mean it will necessarily be a disaster for your finances. In some (admittedly limited) cases, the pros may outweigh the cons.

If you do it, just make sure you keep an eye on your spending and pay all of your credit card bills on time.

Is using a credit card with Venmo safe?

In general, using a credit card with Venmo is safe. Venmo encrypts your sensitive data and lets you lock the app so that hackers and criminals can’t use your card.

However, you should still take common-sense measures to protect yourself:

- Use Venmo’s security features: Your Venmo account is only as secure as you make it. Choose a strong password that uses both letters and numbers and that isn’t a dictionary word. Set up a PIN and opt for multi-factor authentication (e.g., text verification if someone logs in from an unknown device). You should do this before linking your credit card—in fact, do it right after you create your account.

- Don’t log in from public Wi-Fi: It isn’t safe to use Venmo over public networks, such as in a library or cafe. Make sure your home Wi-Fi network has a secure password before using it, too.

- Enable text notifications: Venmo will text you every time a transaction is made on your account, which will alert you if someone uses your card without your knowledge. However, you have to opt into this feature, which you can do in the Settings > Notifications menu.

- Only Venmo people you trust: It’s possible to have all the security measures in the world and still fall victim to scams. Only send money to people you trust (and whose identities you’re absolutely sure of, since scammers may pose as friends or relatives).

If you link your credit card to your Venmo, check and see if your card issuer offers zero fraud liability. This is a standard benefit on many credit cards that means you won’t have to pay any illegitimate transactions, e.g., ones made by fraudsters or identity thieves.

Alternative services to Venmo (and their credit card policies)

If you’ve decided that Venmo isn’t for you, there are several alternatives. The table below shows the major ones and whether or not they’ll let you send money with a credit card.

Credit Card Policies of P2P Money Transfer Services

| Platform | Allows credit cards? | Added fees |

|---|---|---|

| Apple Pay | Yes | 3% |

| Cash App | Yes | 3% |

| Google Play | Only for purchases, not money transfers | N/A |

| PayPal | Yes | 2.9% plus a $0.30 flat fee |

| Zelle | Yes | No |

Note that on any of these platforms, your transaction might also be treated as a cash advance, so it might come with essentially the same downsides as using your credit card with Venmo.

Should you use the Venmo Credit Card?

If you’re looking into using a credit card with Venmo, you might have encountered the Venmo Credit Card.

Note that this isn’t a credit card that’s meant to be used with Venmo—it’s just a branded credit card that Venmo offers (the card issuer is Synchrony Bank). It has all the same downsides as any credit card when you use it to send money via Venmo.

That said, if you’re a frequent Venmo user, this card isn’t a bad choice. The Venmo Credit Card has no annual fee and offers several perks:

- Personalized rewards: The Venmo Credit Card gives you cashback rewards tailored to your spending habits. You’ll get 3% cash back on your top spending category each month, 2% on your second top spending category, and 1% on all other eligible purchases.

- Rewards are easy to redeem: Cash back rewards on the Venmo Credit Card have flexible redemption options. You can use the money you get back to make payments, make purchases, or send money to other Venmo accounts. You can also transfer the funds to a bank account or debit card linked to your Venmo account.

- Option to convert cash back to crypto: If you opt to enable the Cash Back to Crypto option, then Venmo will convert your cash back rewards directly into cryptocurrency without charging you any extra fees. 4

- Designed to make splitting bills easy: Just like Venmo itself, the Venmo Credit Card is designed to make it simple to split costs. Each physical card has a QR code that your friends can scan to directly access your Venmo page.

- Manage your card directly on the Venmo app: You can manage your Venmo Credit Card account and track your card activity directly on the Venmo app.

Again, even with the Venmo Credit Card, the 3% fee on sending money still applies if you send it using your credit card. There’s no way to get around this—it’s an inevitable downside of using your credit card with Venmo.