Table of Contents

What is a judgment?

A judgment (also sometimes spelled “judgement”) is a court ruling that settles a legal dispute between two people or groups. In the context of debt collection, having a “legal dispute” usually means that you didn’t repay a debt and your lender decided to sue you.

If the court entered a judgment against you, it probably means that one of three things happened:

- You lost your case in court

- You didn’t reply by the date specified in the court summons

- You ignored the lawsuit entirely

What happens after a court files a judgment against you?

If you’re sued by your lender and the court enters a civil judgment against you, you’ll usually receive a notice in the mail informing you of what happened.

In addition to the loan itself, your judge may also decide to make you pay for collection costs, accrued interest, and the collection agency’s attorney fees.

Your lender will be able to use the judgment to collect your debt by doing the following: 1

- Garnishing your wages (they can take up to 25% of your disposable earnings) 2

- Freeze or garnish funds from your bank account

- Putting a property lien on your belongings (meaning they can repossess them if you don’t repay your debt soon)

Federal law prohibits debt collectors from garnishing many federal and state benefits (such as Social Security and VA benefits). If a debt collector garnishes protected money, immediately inform your bank, the collector, and the judge who awarded the judgment that the money should have been exempt. You should also consider speaking with an attorney. 3

What property can be taken to settle a judgment?

The property that debt collectors are allowed to take to settle a court judgment varies from state to state.

In most jurisdictions, along with your wages and bank funds, lenders can usually take any of the following:

- Stocks (including any dividends)

- High-value motor vehicles

- Valuable collections and jewelry

- Any other property you put down as collateral on a secured loan

Exempt property

In every state, there are certain types of property that a debt collector usually can’t take, even if they have a court judgment.

In particular, lenders typically can’t repossess any of the following items:

- Clothing

- Basic household furnishings

- Pets

- Family pictures

- Child support payments

- Your car

- Your house

However, there are exceptions. If you’ve used any of the above as collateral to secure a loan, your lender has a legal claim to your property, meaning they have the right to take it.

In many states, debt collectors may also be able to take any property that’s normally exempt if it’s of particularly high value, or if you own other pieces of property like it. For example, in Washington, collection agencies can only force the sale of your home to execute a court judgment if you have more than $125,000 in equity or if it’s your second house. 4

In general, the idea behind protecting your property from seizure is to allow you to maintain a reasonable standard of living. This is why your primary residence, your car, and your basic household furnishings are usually exempt. The goal isn’t to protect non-essentials.

Contact your State Labor Office to learn exactly what property your lender can and can’t seize to settle a judgment.

How does a judgment affect your credit?

Judgments no longer have any effect on your credit score. Between July 2017 and February 2018, the three credit bureaus (Experian, Equifax, and TransUnion) removed all judgments from consumer credit reports. 5

Accordingly, judgments no longer hurt your credit because the two main credit scoring companies (FICO and VantageScore) use only the information in your credit report to calculate your credit score.

Why don’t judgments appear on your credit report anymore?

Judgments and tax liens no longer appear on your credit reports due to a 2015 settlement between the credit bureaus and more than 30 State Attorneys General, who were concerned about inaccurate information appearing on many credit reports. Following this settlement, the bureaus removed most public records (which include judgments and tax liens) from consumers’ reports. 5

Currently, bankruptcies are the only type of public record that can still appear on your credit report and can affect your score. It’s possible that judgments will reappear on consumers’ credit reports in the future, but for the time being, if you see one, it’s probably a mistake, and you should dispute it on your credit report by sending a letter to the credit bureaus.

How to avoid a court judgment

There are several ways you can prevent a debt-related civil judgment:

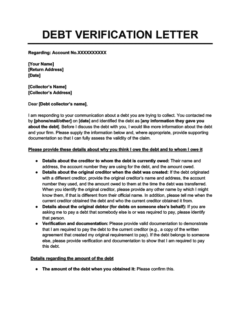

- Dispute the debt: If a debt collector contacts you about a debt that you don’t owe, send them a debt verification letter within 30 days. If you do so, they won’t be allowed to contact you until they’ve verified the debt in writing. 6

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

- Ask for a new payment agreement: If you’re having trouble paying a debt and you’re worried your creditor or debt collector might take you to court, ask them if they’ll allow you to repay your debt in installments over a longer period. You can also enroll in a debt management plan (DMP) with a credit counseling agency, who will negotiate with your lender on your behalf.

- Fight your case in court: If you can’t prevent your lender from taking you to court, you must show up and fight your case to avoid having a judgment entered against you by default. Consider hiring an attorney with experience defending debtors and knowledge of the Fair Debt Collection Practices Act (FDCPA).

- File for bankruptcy: As a last resort, you can sometimes discharge an outstanding judgment by filing for bankruptcy, although this depends on whether you get a chapter 7 or chapter 13 bankruptcy. You shouldn’t take the decision to declare bankruptcy lightly—it can seriously hurt your credit. It’s usually worth consulting with a bankruptcy attorney before you make a decision.

How to settle a judgment

If you lose a lawsuit and you have some savings available, you can also try negotiating with your debt collector for a debt settlement. When you settle your debts, your lender or debt collector clears your debt in exchange for a lump-sum payment that’s less than what you owe. Debt collectors might be more willing to agree to a settlement if they think you may be about to discharge the debt by filing for bankruptcy, or would be unable or unwilling to pay it otherwise.

Alternatively, if the courts entered a default judgment against you because you didn’t show up for your hearing, you still have the right to dispute it. Consult with an attorney as early as possible, otherwise, your lender may start to collect on the judgment.

Takeaway: A judgment is a court order ruling resulting from a lawsuit.

- If your creditor or debt collectors sue you and you don’t reply to the summons or lose the lawsuit, the courts may enter a judgment against you.

- A lender can use a judgment to collect your debt by garnishing your wages or bank funds, putting a lien on your property, or seizing some of your assets.

- What property debt collectors can take with a judgment varies by state. Your lender can usually repossess any property you used to secure the loan, even if it would otherwise be exempt.

- To prevent a lawsuit over a debt that’s not yours, dispute it within 30 days of being notified of the debt. If you’re sued over a valid debt, be sure to show up in court.

- If your lender gets a court judgment against you, try negotiating for a debt settlement.