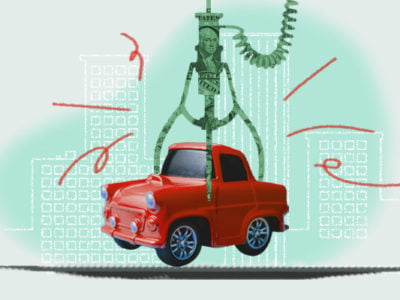

If you miss too many payments on an auto loan—either because you’re unable to pay or because you just forgot—your lender will probably try to repossess your car. If you’re in this situation, it’s understandable if you’re wondering whether you can simply hide your car and prevent them from taking it. After all, you need your car.

The good news is that you may be able to stop the repossession, even if it’s already in progress. However, hiding your car isn’t the best way to do that.

Table of Contents

Can I hide my car from repossession?

Yes, you can technically hide your car from repossession, but that doesn’t mean you should.

Trying to hide your car is a bad idea for several reasons:

- Your lender might still find it: Trying to hide your car doesn’t guarantee that you’ll succeed, especially if you still need to drive it sometimes. In fact, trying to hide it may give you less control over when and where your car is repossessed. For instance, if your car has a GPS tracking device, your lender may be able to find and tow your car while you’re at work, at the grocery store, or far away from home, leaving you stranded.

- Your lender might file a lawsuit: If your lender really can’t get at your car (e.g., if you successfully hide it in your garage), they can sue you and get a court order letting them claim it. Failure to follow a court order like this is illegal and could lead to fines or even jail time.

- Hiding your car might be illegal: Depending on the state that you live in, the very act of hiding your car might be against the law. We cover this in more detail below.

Can you hide your car temporarily?

It’s not that surprising that hiding your car indefinitely is unlikely to work out. But if your goal is to just buy yourself some time (for instance, by holding up the process until you get your next paycheck, at which point you can pay your overdue balance on the auto loan) you might be wondering whether hiding your car temporarily has a better chance of success.

It’s true that hiding your car for just a few days is easier than hiding it indefinitely. However, it’s still not your best move.

Your best bet is to proactively contact your lender, explain your situation, and ask them for a few days of leniency. Repossession is costly for creditors and probably won’t be their preferred option either, so there’s a good chance they’ll work with you.

Is it illegal to hide a car from repossession?

Although there’s no federal law against hiding your car from repossession, some states do have laws against it. This is more likely to be the case if you take special measures to conceal the car or misrepresent its location. In other words, if you normally park your car in your garage, that might not be considered “hiding it,” but parking it somewhere unusual might be.

To find out whether attempting to hide your car is illegal in your jurisdiction, check your state laws and consider consulting with a local attorney.

Ignoring a court order to surrender your car is always illegal

Even if hiding your car isn’t illegal, if the repo agent can’t find it, your lender can take legal action (called replevin) to get a court order forcing you to hand it over. 1

Ignoring a court order like this is always against the law. If you do so, you’ll be held in contempt of court, which can lead to your arrest and potentially fines or even jail time.

How to hide your car from the repo man

As we’ve said, we don’t recommend hiding your car from repossession. However, if you still decide to try, there are three ways to stop a repo agent from finding your car:

- Lock your car in your garage: If you lock your car in your garage, the repo agent can’t take it. Repo agents are given a lot of leeway in what they’re allowed to do—they can come onto your personal property and even hotwire your car—but they aren’t allowed to “breach the peace, which means they can’t damage your property (e.g., by breaking the lock on your garage). 2

- Exchange cars: Exchanging cars with a friend who lives in another town might delay the repossession. If the repo agent is using a tracking device, then they’ll still be able to locate your car, but it’ll take them longer to reach it. This could give you slightly more time to catch up on your loan payments.

Why you shouldn’t remove the GPS tracking device inside your car

If your lender is using a GPS tracker to find your car, removing it will make it much harder for them to seize it. However, doing so is illegal in most jurisdictions. You can ask a local attorney to be sure, but doing this usually isn’t a good idea.

When can your auto lender repossess your car?

Your auto lender can usually repossess your car as soon as you default on your auto loan (meaning you’ve missed a payment on it).

Your creditor doesn’t have to give you any notice before they take your car. 2 However, most lenders will warn you before doing so—repossession is costly and it will rarely be their preferred option.

Personal property inside your car can’t be repossessed

Your creditor has the legal right to repossess your car if you used it as collateral on a secured loan, but they can’t withhold any belongings that you left in the vehicle. They’re obligated to inform you about what they found in your car and arrange an appointment so that you can retrieve it.

How to avoid repossession without hiding your car

You may be able to prevent the repossession of your car by taking one of the following actions:

- Reinstate your loan: You can stop a car repossession by catching up on your payments to reinstate your loan. Lenders are generally willing to reinstate loans because it’s less expensive and more convenient than hiring a repo agent.

- Negotiate with your lender: If you’re struggling to keep on top of your bills, let your creditor know as soon as possible. They may be willing to extend your loan term or accept smaller monthly payments to help you get out of debt.

- Refinance your loan: If your monthly payments on your current loan are too high, you may be able to switch to a more affordable loan. However, this is generally only an option if you haven’t already missed payments on your current loan, since missed payments damage your credit and limit your loan options. Refinancing can also hurt your credit, but the financial benefits could be worth it.

- Sell your car: You may be able to sell your car and use the money to repay your auto loan. Obviously you’ll still lose the car if you do this, but you’ll avoid the harmful effects of incurring a repo on your credit report.

What if you can’t avoid a repossession?

If the strategies above don’t work, you probably won’t be able to avoid the repo. Although this isn’t a situation that anybody wants to be in, you’ll be able to make things easier on yourself by voluntarily surrendering your car to the repo agent.

Voluntary repossession is better because it gives you control over when you have to give up your car, in contrast to involuntary repossession, where the repo man will seize it without warning, potentially stranding you somewhere.

Moreover, although any type of repossession will hurt your credit, a voluntary repo may have a slightly less harmful effect and will look better to lenders and anyone else who reviews your credit report in the future (such as employers or landlords) because it suggests that you took responsibility for your situation. 3

Voluntarily surrendering your car also preserves your relationship with your former auto lender, which will make it easier to negotiate with them if you want to get your car back after the repo takes place.

Takeaway: There are several ways to hide your car from a repo agent, but doing so is usually a bad idea.

- While there’s no federal law preventing you from hiding your car to stop a repossession, it’s illegal in some states. Your lender can also sue you to get your car in a process known as replevin.

- Your creditor can usually repossess your car as soon as you default on your loan, and they’re not required to give you any notice before doing so, although many lenders will anyway.

- If you try to stop the repo man from collecting your car, they may tow it while you’re at work, the grocery store, or somewhere else inconvenient.

- There are three things you can do to hide your car from a repo man: lock it away in your garage, remove a GPS tracking device from inside your car, or exchange it with a friend.

- Instead of hiding your car, the best ways to stop an auto repo are reinstating your loan, refinancing, negotiating with your creditor, or selling the car to pay off your auto loan.