When debt collectors start calling, it’s important to have a plan. Depending on your situation, you can either choose to pay the debt or find a way to deal with debt collectors without paying.

Before making a decision, explore all your options and avoid making common mistakes that could cost you down the line. The first step is to understand how long debt collectors and creditors can come after you over a debt and whether you can be forced to pay.

Table of Contents

How long can a debt be collected?

In most states, debt collectors can pursue payments for outstanding debts (i.e., contact you about them) as long as they want to. 1

However, in every state, there’s a limit to how long they can actually force you to pay by taking you to court over a debt.

The amount of time that a creditor or debt collector is able to sue you over a debt is called the statute of limitations. After this period is over, your debt becomes time-barred, and it can no longer be collected using legal tools such as court judgments, which allow debt collectors to garnish your wages or seize your assets.

Can debt collectors still try to collect time-barred debts?

As mentioned, it’s usually legal for debt collectors to contact you and ask you to pay a time-barred debt, although there are a few states where it’s illegal.

If your debt has passed its statute of limitations, your debt collector has no way to force you to pay it if you don’t want to. If you keep refusing to pay, they’ll probably give up eventually. At a certain point, the resources required to keep chasing the debt will outweigh the money the debt collector will make if you eventually pay it off.

Bear in mind that one thing debt collectors aren’t allowed to do when pursuing old debt is pressure you into paying by re-aging the debt (reporting an old debt as new to the credit bureaus). If they do this, then you should file a credit dispute immediately.

How to find out the statute of limitations on your debt

Most debts have a statute of limitations between 3 and 6 years, but some reach up to 15 years 1 The exact time limit for collecting a debt depends on several factors:

- What type of debt it is

- The state you live in

- The state named in your original agreement with your creditor

To find out whether your debt is time-barred, look up the statute of limitation on debt in your state and for the type of debt you have (e.g., credit card debt, a student loan, or a mortgage).

If in doubt, check your state attorney general’s website and contact them for more information.

The table below shows the statute of limitations on different types of debts in each state, along with the relevant laws. We’ll briefly explain what the various types of debt are below the table.

Statute of Limitations on Debt by State

| State | Open-Ended Accounts | Written Contracts | Promissory Notes | Oral Contracts | Source |

|---|---|---|---|---|---|

| Alabama | 3 | 6 | 6 | 6 | § 6-2-37 |

| Alaska | 3 | 6 | 3 | 6 | § 09.10.053 |

| Arizona | 6 | 6 | 5 | 3 | § 12-543 |

| Arkansas | 5 | 5 | 3 | 3 | § 4-3-118 |

| California | 4 | 4 | 4 | 2 | § 337 |

| Colorado | 6 | 6 | 6 | 6 | § 13-80 |

| Connecticut | 6 | 6 | 6 | 3 | § 52-576 |

The types of debt covered in this table are:

- Open-ended debts: This essentially refers to credit card debts—i.e., credit accounts that you can repeatedly withdraw from and pay back.

- Written contracts: Most other credit agreements, such as personal loans and mortgages, fall into this category, provided that you agreed to pay the debt back in writing.

- Promissory notes: These are informal written agreements to pay back a debt. They’re usually less complex (and apply to smaller amounts) than full written contracts.

- Oral contracts: If you never signed anything but you agreed to pay back a debt verbally, it’s an oral contract. These often have short statutes of limitations and tend to be hard to enforce in court anyway.

Be careful—it’s possible to accidentally reset the statute of limitations

One slipup could reset the statute of limitations on your debt and expose you to lawsuits. When debt collectors ask you to pay an old debt, be careful not to admit the debt is yours, agree to pay some or all of it, or make any payments (even partial payments). All of these actions can reset the statute of limitations.

What to do if you’re asked to pay an old debt

If a debt collector is chasing you down over an old debt, then you have four options. The best route depends on your situation, including how old your debt is and whether you can afford to pay it.

1. Dispute your debt

If your debt is invalid or you don’t recognize it, then it doesn’t actually matter whether it’s time-barred—you don’t need to pay it either way.

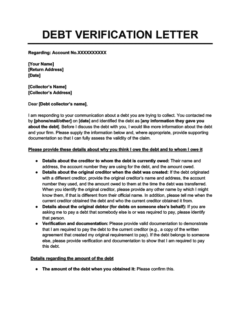

You can dispute invalid debts by sending your debt collector something called a debt verification letter.

If you send this letter within 30 days of first receiving your initial debt validation notice (a letter containing information about your debt) from the collector, then they won’t be able to ask for payment until they’ve given you evidence of your debt. 2 If they can’t provide this, they won’t be able to try to collect your debt again.

Debt Verification Letter

Use this debt verification letter template if a debt collection agency has contacted you about a debt and you want to dispute it. The debt collection agency is obligated to respond to your letter with verification of the debt.

2. Pay it off

If your debt is time-barred, then you have no legal obligation to pay it. However, if you have the money, you may choose to do so anyway.

There are several reasons why you might do this. One, you might simply feel it’s the right thing to do. Two, if your debt is less than 7 years old, paying it might benefit your credit score.

Most debts in collection stay on your credit report for up to 7 years, regardless of whether they’ve passed their statute of limitations or not. If you have an unpaid collection account on your report, it’s hurting your credit.

Paying off collections can improve your credit score, at least in newer credit scoring models. This means that if you apply for new credit or loans in the near future, paying off your debt might increase your chances of getting approved.

If you can’t pay in full, consider a debt settlement

If you want to clear your debt but can’t afford to pay it off in full, then you can try negotiating a debt settlement—an agreement to clear your debt for a partial payment. This will get your your debt collectors off your back, although you should be aware that settled debts still hurt your credit score.

3. Ignore the debt and tell your debt collector to stop contacting you

If your debt is past the statute of limitations, then you can choose to simply ignore your debt collectors. If they keep bothering you, you can send also send them a letter asking them to stop contacting you. Per the terms of the Fair Debt Collection Practices Act (FDCPA), a federal law governing debt collectors, they’ll have to do so. 2

This is only a good idea if your debt is, in fact, time-barred. If it’s old but hasn’t passed its statute of limitations yet, this might provoke your debt collector into suing you.

4. Declare personal bankruptcy

If the debt isn’t time-barred and you need to get rid of it (e.g., because your debt collector is threatening to sue you), you can discharge it by filing for chapter 7 bankruptcy.

Bankruptcy has serious consequences. It’ll seriously damage your credit score and make it difficult or impossible to qualify for certain types of credit. What’s more, bankruptcies can stay on your credit report for 7–10 years. 3

Bankruptcy is a last resort. If your debt is old, it might be approaching its statute of limitations anyway, so double-check and make sure that taking such an extreme step is really necessary.

What to do if you’re sued over time-barred debt

It’s illegal for debt collectors to sue you over time-barred debt, but they may do so anyway if they don’t know that the statute of limitations has run out (or if they hope that you don’t know your rights and think they can intimidate you into paying). 4

Your debt collector won’t win their lawsuit, but you can’t simply ignore it—it’s very important to still show up to court. If you fail to appear, the judge might issue a default judgment against you, allowing the debt collector to seize your property or garnish your wages.

Consult an attorney who’s familiar with your state’s laws, and make sure to appear in court with evidence that the debt is too old to collect, such as a copy of the debt information you received from the collector and proof of the date of your last payment.

You should file a report with the Federal Trade Commission and the Consumer Financial Protection Bureau stating that you were illegally sued over time-barred debt. You can also sue your debt collectors in return for breaking the law by filing an illegal lawsuit.

Takeaway: States have different laws governing how long debt collectors can use legal action to force you to pay a debt.

- If debt collectors are calling you, don't do anything until you confirm that the debt is valid, that it belongs to you, and that it’s not past the statute of limitations on debt in your state.

- If the debt isn’t time-barred, many states still permit debt collectors to try to collect payment from you. They just can’t force you to pay by suing you.

- If you’re being asked to pay an old debt, you can choose to dispute it, pay it, ignore it (and tell debt collectors to stop contacting you), or discharge it through bankruptcy.

- It’s illegal for debt collectors to sue you for time-barred debt. If they do, you can report them and even sue them back.

- Never ignore a lawsuit, even if the debt is time-barred, because debt collectors could win the case by default if you don’t show up in court.