When you’re in the market for a new credit card, you don’t want to have to comb through pages of fine print. Credit card issuers used to take advantage of this by burying hidden fees where nobody would ever find them—that is, until the Schumer Box was introduced.

Now, credit card companies are required to provide you with an easy-to-read table telling you everything you need to know about a credit card’s rates and fees. Here’s how to read a Schumer Box, what information it contains, and where to find it.

Table of Contents

Schumer Box example and explanation

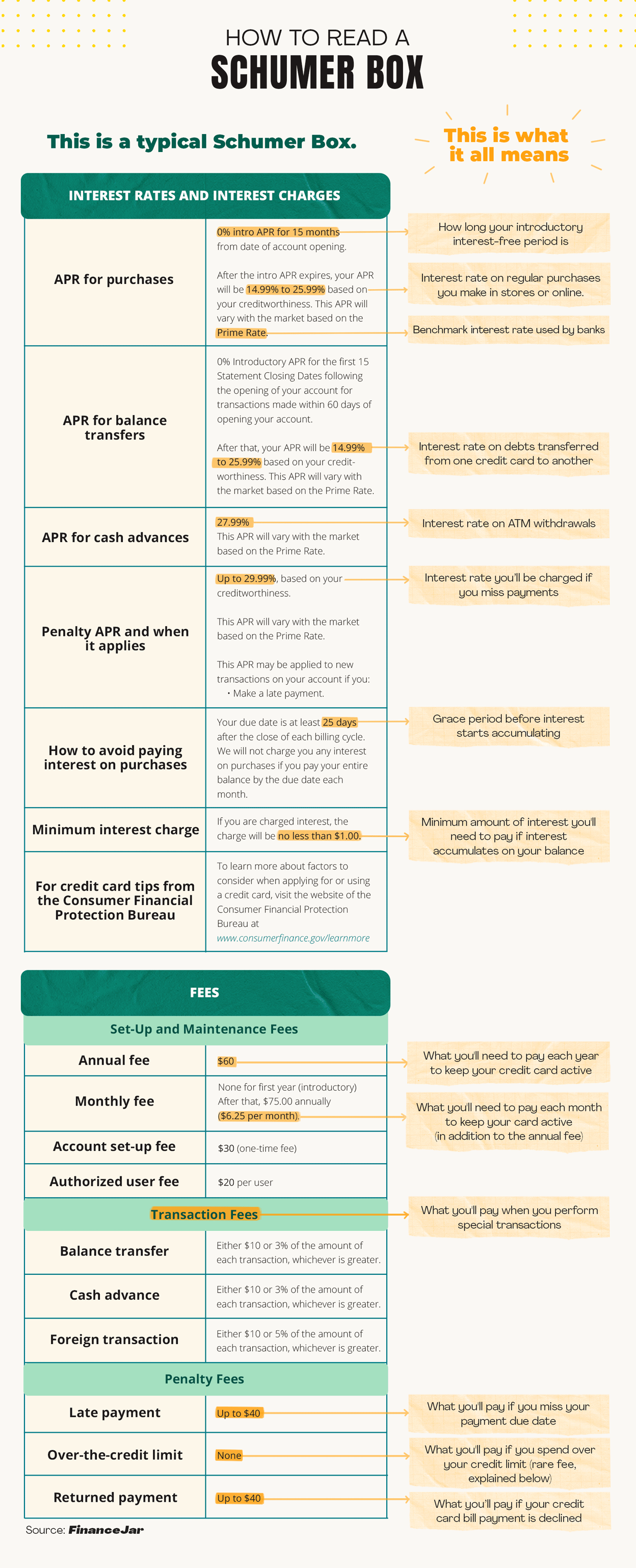

Below is an example of what you’ll find when you look at a credit card’s Schumer Box.

You’ll usually see two boxes—one detailing the credit card’s APRs (aka its interest rates), and another detailing other fees you need to pay to open and use the card.

Breakdown of a Schumer Box

Detailed breakdown: what’s in the Schumer Box?

Schumer Boxes are supposed to help you quickly and easily figure out what a particular credit card has to offer in terms of interest rates and fees. However, you still need to understand what each of the terms used in the Schumer Box means.

APRs

The annual percentage rate (APR) on a credit card reflects its yearly interest rate. It shows how much you’ll pay if you carry a balance on your card from month to month instead of paying your card off in full.

What many people don’t realize is that credit cards often have multiple APRs that apply in different situations. Here’s a detailed explanation of the APRs listed in a credit card Schumer Box:

- Purchase APR: Also known as the credit card’s “regular APR,” this number represents the interest you’ll pay on all your ordinary purchases.

- Balance transfer APR: This is the interest rate you’ll have to pay when you perform a credit card balance transfer, which involves moving debt from another credit card onto this one.

- Cash advance APR: The interest rate you’ll have to pay when you use your card to withdraw cash from an ATM or make “cash-equivalent transactions,” like using your credit card to buy a gift card. On some cards, interest on cash advances will begin accumulating immediately, in contrast to your purchase APR, which will usually feature an interest-free grace period.

- Penalty APR: If you violate your credit card’s terms (e.g., by missing a payment by 60 days or more), you may have to pay a penalty APR on all of your purchases going forward, which will be higher than your card’s ordinary purchase APR.

Other APR terms to watch out for

There are a few other important terms that have implications for your card’s APR:

- Introductory 0% APR: Some credit cards offer a 0% APR introductory period. During this period, you won’t have to pay any interest on purchases. Sometimes, this also applies to balance transfers. If your card has a period like this, it will be written in the relevant part of the Schumer Box.

- Prime rate: If you see the words “based on the prime rate,” it means your credit card has a variable APR. In other words, its interest rate will change over time according to market conditions—specifically the prime rate, which is a benchmark that banks use for setting credit card APRs.

- Creditworthiness: You may see the card’s APR presented as a range of values followed by the phrase “depending on creditworthiness.” This means that you’re guaranteed to have an APR in the given range, but the exact rate you’ll get depends on factors like your credit score and credit history.

How to avoid paying interest

The Schumer Box will have a row explaining how to avoid paying interest on your purchases.

As mentioned, with most cards, interest doesn’t start accumulating on purchases right away. At the end of each billing cycle, you’ll have a certain number of days (known as your credit card’s grace period) to pay off your balance interest-free.

The Schumer Box will indicate how long the grace period on your card is.

Fees

Credit card fees are payments that you have to make, in contrast to interest, which you can usually get out of paying if you always pay off your debt within your grace period.

Three types of fees will be listed in your card’s Schumer Box.

1. Setup and maintenance fees

Not all credit cards are free. Sometimes you may be charged fees for opening and maintaining your account, such as:

- Annual fee: The annual fee on a credit card is the cost just to keep your account active. This fee may be different for the first year than subsequent years. You may also need to pay monthly rather than in one lump sum, and the first fee may be tacked on to your initial balance.

- Monthly fee: If a credit card features separate annual and monthly fees, then it means you’ll need to pay two different fees to keep the account active.

- Account set-up fee: Some credit cards (especially subprime cards for people with bad credit or no credit score) have a one-time account opening fee. This is generally the card issuer’s way of counteracting the risk in case you don’t pay your bills.

- Authorized user fee: You can usually add someone you trust as an authorized user on your credit card, but some card issuers charge a fee to cover the cost of issuing an additional card for the secondary cardholder.

Transaction fees

There’s no fee for making normal purchases because that’s what credit cards are for. However, there are certain types of transactions that credit card issuers may charge you extra for:

- Balance transfers: Not all companies allow you to move debt from different accounts onto your new credit card account, but those that do often charge a balance transfer fee. You should consider this fee and the balance transfer APR when deciding whether a card is suitable for consolidating credit card debt.

- Cash advances: You may have to pay a cash advance fee any time you use your credit card to borrow cash, either through an ATM withdrawal or a cash-like purchase. This fee will often consist of either a percentage or a set dollar amount (e.g., $10 or 5%)—whichever is higher.

- Foreign transactions: Some credit card companies will charge you a foreign transaction fee any time you make a purchase abroad or in a foreign currency. Similarly, this will often be a set dollar amount or a percentage of the transaction.

Penalty fees

Credit card companies will punish you with various penalty fees if you fail to abide by the terms of your credit card contract.

Below are the main penalty charges to look out for:

- Late fee: You could get hit with a late fee if you send in a credit card payment just a day or two after your payment due date (or you send in a payment that’s lower than your minimum monthly payment). However, you may be charged less than the maximum late fee if it’s your first missed payment. This will be clearly explained in the Schumer Box.

- Returned payment fee: You’ll be charged a fee if your credit card bill payment is returned for some reason, like if you send a bad check. This fee is often the same or similar to the late fee because the effect is the same: your card issuer isn’t getting your payment when it’s due.

- Over-the-limit fee: While you can’t technically overdraft a credit card, your credit card issuer may allow you to spend over your credit limit. In this case, they’re allowed to charge you an over-limit fee, but only if you explicitly agreed to allow over-limit transactions.

- Minimum interest charge: Even if your balance is very low, you’ll be charged at least this minimum interest fee if you allow your balance to accumulate interest (e.g., by not paying your full balance off during your grace period).

How to find the Schumer Box for a credit card

To find the Schumer Box for a credit card you already have, just look through your cardholder agreement, which you should’ve gotten when you first received your card.

If you’ve lost your credit card contract, then you can also contact your card issuer to request a new copy. You may also be able to find the Schumer Box online at one of the links listed below.

How to find the Schumer Box for credit cards you don’t have

You can easily find the Schumer Boxes for every major card issuer using the links below. If you’re shopping around for a card, this is a great way to compare offers.

Just choose a credit card company, select the card you’re interested in, and click the link with the label we’ve indicated:

- American Express: “Rates and Fees”

- Chase: “Pricing & Terms”

- Capital One: Click “Card Details,” then “View important rates and disclosures”

- Bank of America: “Terms & Conditions”

- Discover: “See rates, rewards and other info”

- Citi: “Pricing & Information”

- US Bank: Click the credit card APR or annual fee (both link to the Schumer Box)

- Wells Fargo: “Important Credit Terms”

- Credit One Bank: “Terms, fees & conditions”

- Barclays: Click “Learn More,” then “See Terms and Conditions for a complete listing of rates and fees”

History and purpose of the Schumer Box

The goal of the Schumer Box has always been to bring key credit card fees and rates out of the “fine print” and into plain sight to make it easier to understand and compare them.

Senator Charles (Chuck) Schumer achieved this goal in 2000 by adding a stipulation to the 1988 Truth in Lending Act (TILA) requiring credit card issuers to publish every card’s interest rates and fees in table form and in a large font size. This is how the Schumer Box got its name.

Many credit card companies would rather bury this basic information to make it harder for you to spot hidden charges. However, thanks to this simple little box, you have all the tools you need to find the credit card you want.